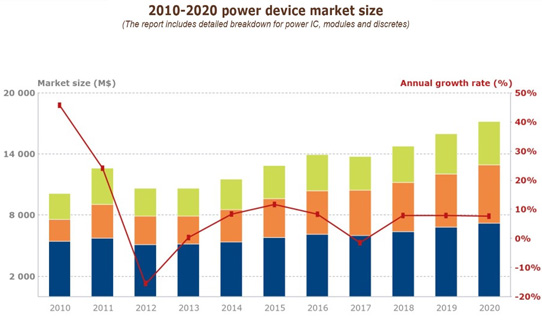

After two tough years of stagnation, in 2014 the power semiconductor device market returned to growth, rising by 8.4% to $11.5bn, according to the report 'Status of the Power Electronics Industry (February 2015 edition)' from Yole Développement, which presents data for applications such as photovoltaics (PV), wind turbines, transmission and distribution, EV/HEV, rail traction, uninterruptible power supplies (UPS) and motor drives, as well as from different value chain levels spanning wafers, devices, and inverters.

The outlook for the years ahead is also optimistic, says the market research firm. Driven by a significant increase in electric and hybrid-electric vehicle (EV/HEV) sales, as well as the ramp-up of renewable energy and more smart-grid technology implementation, the market will rise at a compound annual growth rate (CAGR) of 6.9% from 2014 to more than $17bn in 2020.

"Power modules, and more precisely IGBTs [insulated-gate bipolar transistors], will lead this growth," says technology & market analyst Mattin Grao Txapartegi. "Modules are expected to reach a CAGR 2014-2020 of 10.3%, compared to 5.1% growth for discrete components. This growth in the demand of IGBT modules is due to their improved overall performance in terms of efficiency and thermal conductivity management," he adds.

"The new wide-bandgap (WBG) device market will also drive growth," says Dr Pierric Gueguen, business unit manager for Power Electronics & Compound Semiconductor activities at Yole. A lot of industrial firms have been focusing their development on WBG technologies, notes the report. Today, both silicon carbide (SiC) and gallium nitride (GaN) have proved to be powerful solutions, ready to be implemented in numerous applications. They should represent about 5% of the overall market by 2020, recons Yole, even though their presence will still be limited in terms of units. Gueguen and his team are working to identify and analyze the current bottlenecks to implementing WBG technologies in the power electronics industry.

Chinese companies' vertical integration challenging diverse historical market leaders, while Europe & US firms push horizontal integration

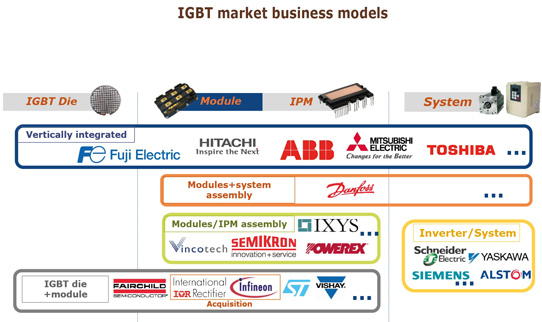

In this context the supply chain is evolving. The power electronics supply chain is very diverse and mostly dependent on applications and local markets, says Yole. European and American players will prioritize horizontal integration, maintaining proven expertise in a specific level of the value chain. Partnerships and joint ventures will therefore be preferred, Yole reckons. The report hence analyzes the major mergers and acquisitions of 2014 (e.g. International Rectifier's acquisition by Infineon) in order to understand their context and purpose.

Some system manufacturers, such as Tesla or BYD, have understood the importance of developing their own power electronics and energy management systems for traction, chargers and batteries in order to offer extended added-value.

Asian companies will prefer to expand vertically in order to be fully integrated and optimize the costs. Japanese players are already vertically integrated and involved in multiple applications simultaneously to benefit from their technologies across different markets. Chinese players are developing this vertical integration in order to create major market leaders in each application segment, such as SunGrow in PV, GoldWind in wind and BYD in EV/HEV. Yole's report focuses especially on the details of the Chinese market, which is driven by Chinese Government policies. In this changing environment, western and Japanese players need to bring high-added-value solutions to be able to compete with Chinese companies, says Yole. The report therefore includes a complete section on the strategies of the main players.

Existing technological disruptions now generating revenue, becoming a challenge for firms that are not involved

Demand for compact products is increasing. Players are therefore obliged to create partnerships between different industries so that they can coordinate and use the synergies of integrated products in order to offer a smaller and higher-performance solution. In the report, Yole describes several partnerships influenced by this trend. In this direction, the concept of the power stack has recently appeared, and ever more companies will be involved in their development, forecasts Yole.

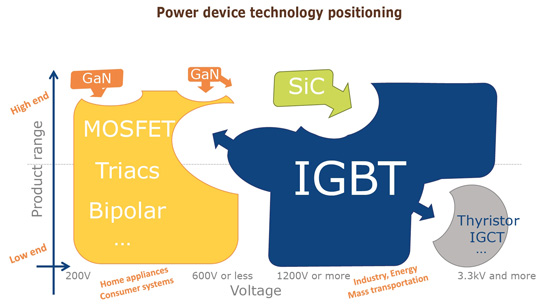

Technologically, MOSFETs and IGBTs will continue to be the devices in greatest demand, covering low- and medium- to high-voltage applications respectively. Also, the last decade has seen the appearance of new technologies, such as Super Junction MOSFETs, which have raised the MOSFET family into higher-voltage segments (up to 900V), with better performance. In terms of power packaging, ongoing evolution is driven particularly by the EV/HEV industry.

The advance of new wide-bandgap materials is also reshaping the power electronics industry. Compared with silicon devices, SiC- and GaN-based devices are intended for high-voltage (especially SiC), high-frequency and high-temperature applications due to their advanced performance. SiC technology is more mature than GaN, so industry segments such as rail traction and PV inverters have already adopted systems based on WBG devices.

The introduction of SiC into other high-voltage segments - such as wind and high-voltage direct current grids - is also inevitable, says Yole. But the big boost for these new markets should arrive with the implementation of SiC devices in the traction systems of electric cars.

GaN systems are still less prevalent on the market. Some consumer applications, such as laptop chargers, and just-announced PV inverters will be the first market segments to incorporate GaN, says Yole.

Several system manufacturers are also developing further SiC- and/or GaN-based prototypes, so the next five years are going to be decisive for the introduction of WBG devices into different markets, concludes Yole.