Iconix Brand Group Inc. reported a loss of $263 million, or $5.44 a share, after charges of $402.4 million to writeoff the company's trademarks and goodwill. Over 90 percent of the impairment is related to the company's men's business including Rocawear, Ecko and Ed Hardy, with the balance primarily related to its Royal Velvet brand.

Highlights of the full year ended December 31 include:

2015 free cash flow of $189 million 2015 licensing revenue of $379 million Non-cash impairment charge of $438 million, primarily related to men's brands $220 million of cash at 2015 year end New term loan expected to be funded next week, addressing upcoming convertible debt maturity Plan to file 10-K for the year ended December 31, 2015 on March 30, 2016Peter Cuneo, Chairman and Interim CEO of Iconix commented, "Despite a challenging year in 2015, I believe our ability to continue to generate significant free cash flow speaks to the overall resilience of our business model and the ongoing strength of a diversified portfolio of global brands." Cuneo continued, "When I took over as Interim CEO about eight months ago, there were three key areas of concern. These were the need to refinance the $300 million convertible notes due in June, the continuing dialog with the Staff of the SEC regarding certain historical accounting, and finally to bring a new CEO into the company with the right experience and leadership qualities to take us into the future. I am pleased to say we have met each of these challenges. We signed a new $300 million term loan in order to address the upcoming maturity of our convertible notes. The company has reached conclusions on the matters that were the subject of our comment letter process with the Staff of the SEC, and we brought John Haugh to the company. Looking forward, 2016 will be a year of restaging the business, but I believe with the right investments in our brands and our organization, as well as increased support to our licensing partners, we can strengthen our revenue and continue to generate strong free cash flow in the future, driving long term value for our company and our shareholders."

The results that the company reported today reflect the historical restatement that the company previously announced on February 18, 2016, and relates to consolidation of certain joint ventures that were previously accounted for as equity method investments, the elimination of the gains associated with those joint venture transactions, the recalculation of the cost basis of trademarks contributed to other joint ventures that continue to be accounted for on the equity method, and certain other non-cash adjustments primarily to historical licensing revenue. With this restatement, the company believes that all significant historical transactions have been reviewed and will be properly accounted for. As previously disclosed, the company has responded to the Staff of the SEC with a Confirming Letter on all of the questions the Staff has raised.

The financial results for the fourth quarter and full year 2015 include certain items that the company has excluded from its non-GAAP net income, non-GAAP EPS and Adjusted EBITDA, which are detailed in the reconciliation tables at the end of this press release. These items include;

A non-cash impairment charge of approximately $437.5 million in the fourth quarter of 2015 related to certain of the company's trademarks and goodwill. Over 90 percent of the impairment is related to the company's men's business including Rocawear, Ecko and Ed Hardy, with the balance primarily related to the company's Royal Velvet brand. Special charges of approximately $11.1 million for the full year of 2015 and $1.6 million for the fourth quarter of 2015 related to professional fees associated with the previously disclosed correspondence with the Staff of the SEC and the Special Committee review, as well as costs related to the transition of Iconix management.Consistent with the company's historical reporting, non-GAAP metrics also exclude non-cash interest related to the company's convertible notes, non-cash gains related to the acquisition and re-measurement of the company's initial investment in certain joint ventures, and non-cash foreign currency losses or gains.

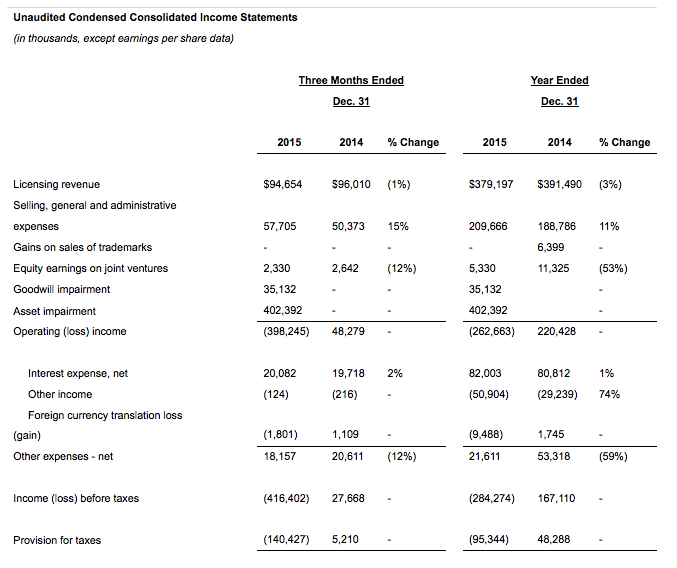

Results for the Fourth Quarter Ended December 31, 2015

For the fourth quarter of 2015, licensing revenue was approximately $94.7 million, a 1 percent decline as compared to approximately $96.0 million in the fourth quarter of 2014. Licensing revenue included approximately $2.0 million of revenue related to acquisitions made in 2015 including the Strawberry Shortcake and PONY brands, and was negatively impacted by approximately $1.4 million due to foreign currency exchange rates. Excluding the effect of acquisitions and foreign currency exchange rates, licensing revenue declined approximately 2 percent in the quarter.

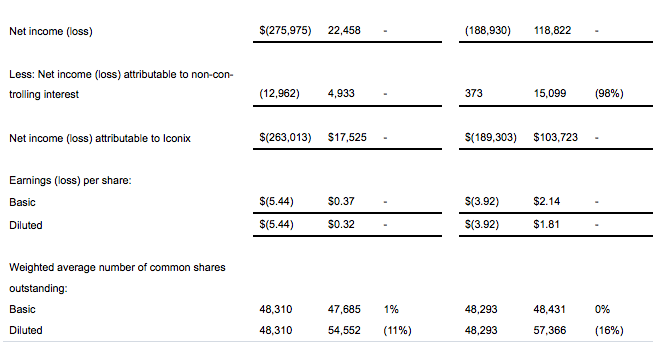

Adjusted EBITDA attributable to Iconix for the fourth quarter of 2015 was approximately $38.0 million, a 14 percent decline as compared to approximately $44.3 million in the prior year quarter. On a non-GAAP basis, as set forth in the tables below, net income attributable to Iconix was approximately $12.3 million, a 46 percent decrease as compared to the prior year quarter of approximately $22.7 million. Non-GAAP diluted EPS for the fourth quarter of 2015 was $0.25, a 45 percent decrease as compared to $0.45 in the prior year quarter. GAAP net income attributable to Iconix for the fourth quarter of 2015 reflects a loss of approximately $263.0 million, as compared to income of $17.5 million in the prior year quarter, and GAAP diluted EPS for the fourth quarter of 2015 reflects a loss of $5.44 as compared to earnings of $0.32 in the prior year quarter.

Results for the Full Year Ended December 31, 2015

Licensing revenue for the full year ended December 31, 2015 was approximately $379.2 million, a 3 percent decline as compared to approximately $391.5 million for 2014. Licensing revenue included approximately $11.9 million of revenue from acquisitions made in 2015 including the Strawberry Shortcake and PONY brands, and was negatively impacted by approximately $10.1 million due to foreign currency exchange rates. In addition, licensing revenue in the comparable 2014 period included $17.1 million of revenue related to the five-year renewal of the Peanuts specials with ABC. Excluding the effect of acquisitions, foreign currency exchange rates and the ABC renewal, licensing revenue increased approximately 1 percent for the year.

The company reported no Gains on Sales of Trademarks in 2015 as compared to approximately $6.4 million in 2014, which was related to the sale of the Sharper Image e-commerce and US catalog rights.

Adjusted EBITDA attributable to Iconix for the full year 2015 was approximately $172.7 million, an 18 percent decline as compared to approximately $211.1 million in the prior year. The company's results for 2015 include an incremental expense of approximately $16 million of accounts receivable reserves and write-offs related to a comprehensive review of the company's license agreements and relationships with its licensees, which have not been excluded from the company's non-GAAP metrics.

On a non-GAAP basis, as set forth in the tables below, net income attributable to Iconix for 2015 was approximately $66.4 million, a 36 percent decline as compared to approximately $103.6 million in the prior year, and non-GAAP diluted earnings per share was approximately $1.33, a 33 percent decline versus $1.98 for the prior year. GAAP net income attributable to Iconix for 2015 reflects a loss of approximately $189.3 million, as compared to income of $103.7 million in 2014, and GAAP diluted EPS for 2015 reflects a loss of $3.92, as compared to earnings of $1.81 in 2014.

Free cash flow attributable to Iconix for 2015 was approximately $188.9 million, a 14 percent increase over the prior year period of approximately $165.4 million. In 2015 the company received a tax refund of approximately $15.5 million.

Adjusted EBITDA, free cash flow, non-GAAP net income and non-GAAP diluted EPS are non-GAAP metrics, and reconciliation tables for each are attached to this press release.

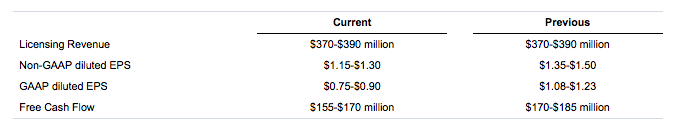

2016 Guidance for Iconix Brand Group, Inc.:

As anticipated, the company is updating its 2016 guidance to reflect higher expenses associated with the new term loan, the impact of the sale of the Badgley Mischka brand, adjustments related to the financial restatement, transition costs relating to the hiring of the company's new Chief Executive Officer, and current trends in our portfolio.