After years of development, it has gradually formed five districts of Chinese furniture industry: the Pearl River delta (Guangdong province is the center, which includes Guangzhou, Shenzhen, Dongguan, Shunde, Foshan, etc.), the Yangtze River delta (its center contains Jiangsu, Zhejiang and Shanghai area, where furniture industry grows fastest), the Bohai Rim, the Northeast industrial district and the Northwest industrial district. The Pearl River delta and the Yangtze River delta are the main districts with biggest output and highest export value, shaping the distribution situation from south to north together with the Bohai Rim and the Northeast industrial district for eastern coastal areas. Export production enterprises and large-scale production enterprises distribute densely in the four districts and they are the main suppliers of domestic market and major regions for Chinese furniture export. The west industrial district focuses on the domestic market. Guangdong province takes a half of Chinese furniture industry total output, while Zhejiang takes 15%, the Bohai Rim takes 8%-10%, and the Northeast takes less than 15% and Sichuan takes nearly 10%.

Content

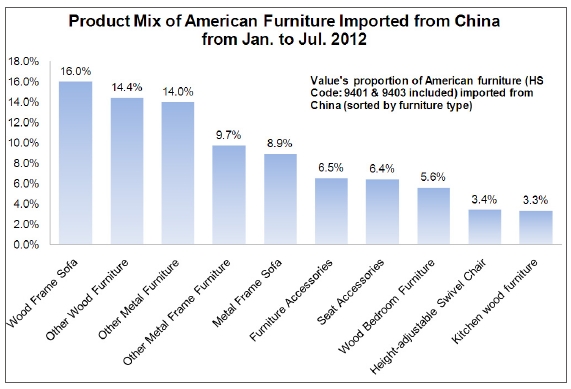

1. Product Mix of American Furniture Imported from China

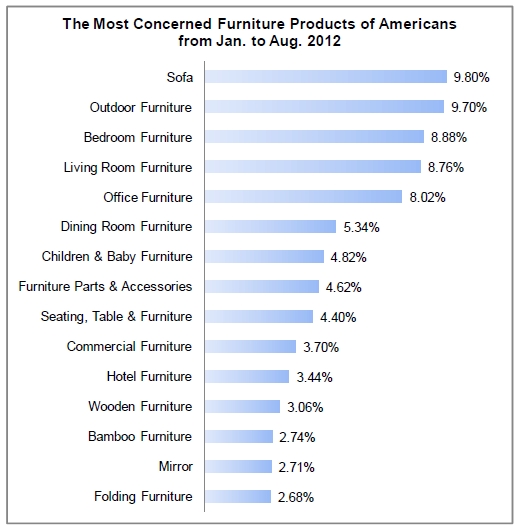

2. The Most Concerned Furniture Products of Americans, from Jan. to Aug. 2012 (ranked by attention)

3. Sofa Products Analysis

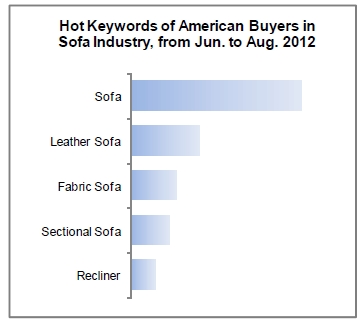

3.1 Hot Keywords

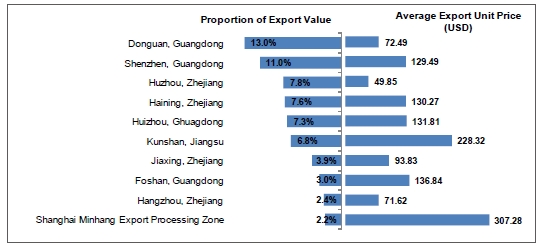

3.2 Major Cities for Chinese Wood Frame Sofa (HS Code: 940161) Export and Their Average Export Unit Price

3.3 Major Cities of Chinese Metal Frame Sofa (HS Code: 940171) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

3.4 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

4. Outdoor Furniture Products Analysis

4.1 Hot Keywords

4.2 Major Cities for Chinese Other Wood Furniture (HS Code: 940360) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

4.3 Major Cities for Chinese Other Metal Furniture (HS Code: 940320) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

4.4 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

5. Bedroom Furniture Analysis

5.1 Hot Keywords

5.2 Major cities for Chinese Wood Bedroom Furniture (HS Code: 940350) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

5.3 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

6. Living Room Furniture Products Analysis

6.1 Hot Keywords

6.2 Major Cities for Chinese Furniture Made by Other Material (HS Code: 940389) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

6.3 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

7. Office Furniture Products Analysis

7.1 Hot Keywords

7.2 Major Cities for Chinese Adjustable Chair (HS Code: 940130) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

7.3 Major Cities for Chinese Metal Office Furniture (HS Code: 940310) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

7.4 Major Cities for Chinese Wood Office Furniture (HS Code: 940330) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

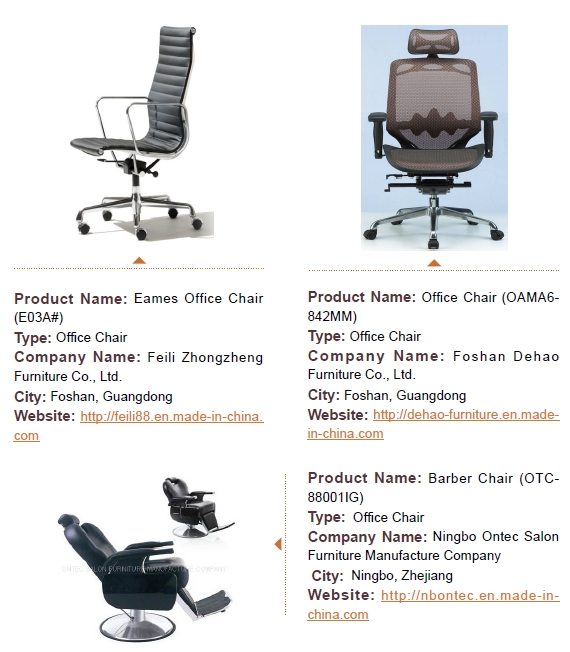

7.5 Star Products (According to The Statistics of Made-in-China.com, from Jun.

to Aug. 2012)

Abstract:

After years of development, it has gradually formed five districts of Chinese furniture industry: the Pearl River delta (Guangdong province is the center, which includes Guangzhou, Shenzhen, Dongguan, Shunde, Foshan, etc.), the Yangtze River delta (its center contains Jiangsu, Zhejiang and Shanghai area, where furniture industry grows fastest), the Bohai Rim, the Northeast industrial district and the Northwest industrial district. The Pearl River delta and the Yangtze River delta are the main districts with biggest output and highest export value, shaping the distribution situation from south to north together with the Bohai Rim and the Northeast industrial district for eastern coastal areas. Export production enterprises and large-scale production enterprises distribute densely in the four districts and they are the main suppliers of domestic market and major regions for Chinese furniture export. The west industrial district focuses on the domestic market. Guangdong province takes a half of Chinese furniture industry total output, while Zhejiang takes 15%, the Bohai Rim takes 8%-10%, and the Northeast takes less than 15% and Sichuan takes nearly 10%.

In 2005, China took Italy's place as the largest exporter of furniture, with an export value of 13.5 billion US dollars. Chinese furniture exports account for a proportion of 22% of the world and the major importers were the US, the European Union and the ASEAN, among which the US was the top importer. From January to July, 2012, the cumulative export value was 8 billion US dollars, accounting for 30% of total export amount in the same period of Chinese furniture exports.

1. Product Mix of American Furniture Imported from China

Proportion of American furniture import value (HS Code: 9401 & 9403 included)[1] imported from China (sorted by furniture type)

(Data Source:China Customs)

The US is the largest importer of Chinese furniture. China Customs statistics show that from January to July 2012, China's furniture exports to the U.S. (including HS Code: 9401 and 9403, in the following text, "furniture" refers to product contained in HS Code: 9401 and 9403) cumulated to a total of nearly 8 billion U.S. dollars, accounting for 30% of the total furniture exports over the same period.

From the view of material, the Chinese-made wooden furniture and metal furniture are very popular in the U.S. market. In the first seven months of 2012, the amount of imported wooden furniture from China accounted for 43.1% of the United States' total imports of furniture, while metal furniture accounted for 33.1%.

From the view of product category, sofa is one of the America's most important imported furniture. In the first seven months of 2012, the value of sofa imported from China amounted to 1.98 billion U.S. dollars, taking nearly 1/4 of the total import value of furniture. Wood frame sofa import value accounted for 64% of the total sofa import value, while the metal frame sofa accounted for 36%.

2. The Most Concerned Furniture Products of Americans, from Jan. to Aug. 2012 (ranked by attention)

(Data Source: Made-in-China.com)

According to the statistics of Made-in-China.com, in the first eight months of 2012, U.S. buyers concerned about sofa most, accounting for 10% of total attention. Outdoor furniture ranked two, accounting for 9.7%, followed by bedroom furniture, living room furniture and office furniture respectively.

3. Sofa Products Analysis

3.1 Hot Keywords

Hot Keywords of American Buyers Searching in Sofa Industry, from Jun. to Aug. 2012

(Data Source: Made-in-China.com)

The statistics of Made-in-China.com indicate that from June to August 2012, American buyers concerned leather sofa, fabric sofa, combination sofa and loungers most among all sofa products.

3.2 Major Cities for Chinese Wood Frame Sofa (HS Code: 940161) Export and Their Average Export Unit Price

(Data Source: China Customs)

China customs figures show that in the first seven months of 2012, Chinese wood frame sofa export source distributed densely in Guangdong, Zhejiang, Jiangsu and Shanghai, among which Guangdong wood frame sofa export value accounted for 44.6% of total export amount (Dongguan, Shenzhen, Huizhou and Foshan accounted for 13%, 11%, 7.3% and 3% respectively), Zhejiang, Jiangsu and Shanghai accounted for 26.3%, 11.7% and 9.1% respectively. From the point of average export unit price, Jiangsu had the highest price among the above four provinces, Shanghai exceeded Guangdong slightly while Zhejiang had the minimum. Buyers may choose the supply of goods according to their own needs of product grades.

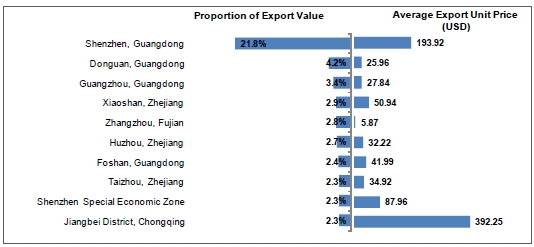

3.3 Major Cities of Chinese Metal Frame Sofa (HS Code: 940171) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

It is indicated by China customs statistics that in the first seven months of 2012, major cities of Chinese metal frame sofa export concentrated in Guangdong, Zhejiang, Chongqing and Fujian, among which Guangdong metal frame sofa export value accounted for 48.1% of total export amount (Shenzhen, Dongguan, Guangzhou and Foshan accounted for 21.8%, 4.2%, 3.4% and2.4% respectively), Zhejiang, Chongqing and Fujian accounted for 15.7%, 8.9% and 6.5% respectively. Seen from the average export unit price, Chongqing had higher price than other three among the above four provinces, the second was Guangdong, followed by Zhejiang and Fujian. In combination with the proportion of export value, metal frame sofa made in Shenzhen was the most popular in overseas market, taking the biggest share of the export market with its upper-middle price.

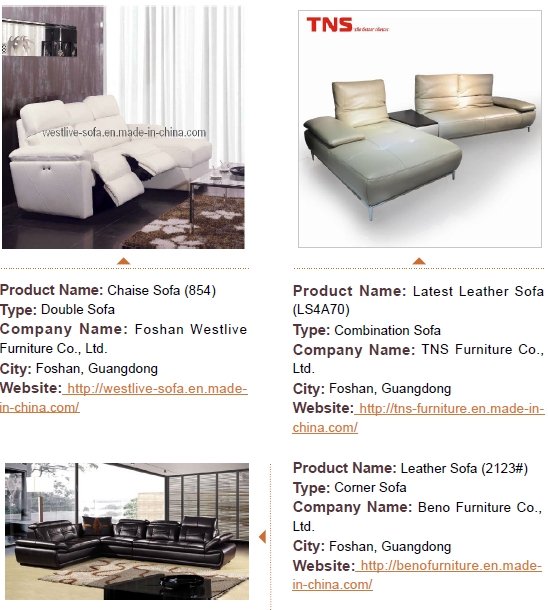

3.4 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

According to the attention rank of Made-In-China.com, the above three sets of leather sofas obtained the highest attention, and they had the same place of origin, Foshan. Located in the Pearl River delta, China's largest furniture industry area, Foshan is one of the major export cities in China. The region has both complete production system and developed sales market, together with improved supporting industry, including raw materials production such as woodworking machinery, hardware accessories, paint coating and wood & leather cloth art. There has been a complete industrial chain and meanwhile, the quality products cover a wide range.

4. Outdoor Furniture Products Analysis

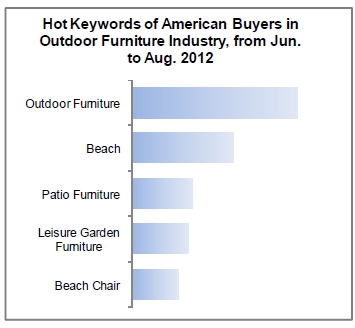

4.1 Hot Keywords

(Data Source: Made-in-China.com)

The statistics of Made-in-China.com indicate that from June to August 2012, American buyers concerned beach chair, patio furniture and leisure garden furniture most among all outdoor furniture products.

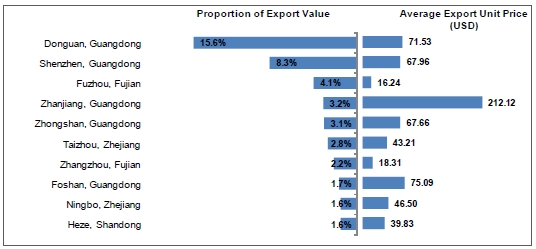

4.2 Major Cities for Chinese Other Wood Furniture (HS Code: 940360) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

It is confirmed by China customs statistics that in the first seven months of 2012, major cities of Chinese other wood furniture export are Guangdong, Zhejiang and Fujian, among which Guangdong's other wood furniture export value accounted for 44.8% of total export amount (Dongguan, Shenzhen, Zhanjiang and Zhongshan accounted for 15.6%, 8.3%, 3.2% and 3.1% respectively), Zhejiang accounted for 11.7% (Taizhou accounted for 2.8%), Fujian accounted for 11.2%(in which Fuzhou and Zhangzhou accounted for 4.1% and 2.2% respectively). From the point of average export unit price, Chongqing had lower price than other two among the above three provinces while Zhejiang and Guangdong were twice and triple that of Fujian.

4.3 Major Cities for Chinese Other Metal Furniture (HS Code: 940320) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

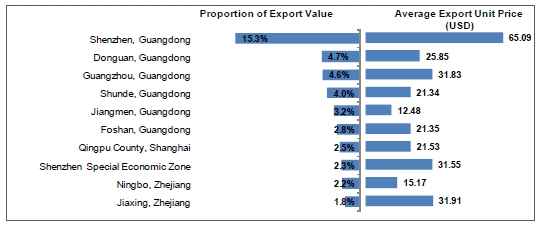

It's shown by China customs statistics that in the first seven months of 2012, major cities of Chinese other metal furniture export were Guangdong, Zhejiang, Jiangsu Fujian and Shanghai. Guangdong's other metal furniture export value accounted for 46.1% of total export amount (in which Shenzhen, Dongguan, Guangzhou, Shunde Jiangmen and Foshan accounted for 15.3%, 4.7%, 4.6%, 4%, 3.2% and 2.8% respectively), Zhejiang took 16.1% (in which Ningbo accounted for 2.2%), Jiangsu, Fujian and Shanghai took a proportion of 8.2%, 7% and 5.7% separately. From the point of average export unit price, Guangdong had highest one among the above five provinces, Zhejiang, Jiangsu, Fujian and Shanghai phased almost, about 3/5 that of Guangdong.

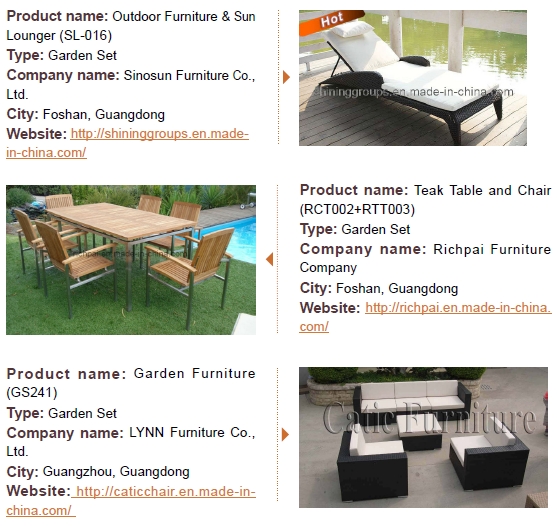

4.4 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

The attention rank of Made-In-China.com reveals that consumers pay most attention to lounge chair, Courtyard teak chairs and Garden sofa set, which are produced in Foshan and Guangzhou city in Guangdong province.

5. Bedroom Furniture Analysis

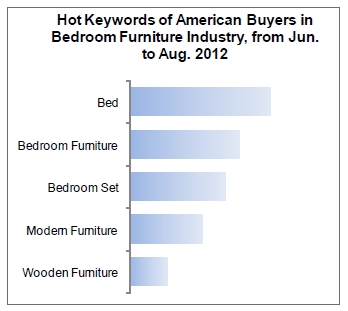

5.1 Hot Keywords

(Data Source: Made-in-China.com)

It's shown by the statistics of Made-in-China.com that from June to August 2012, American buyers pay most attention to bedroom set, modern furniture and wooden furniture among all bedroom furniture products.

5.2 Major cities for Chinese Wood Bedroom Furniture (HS Code: 940350) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

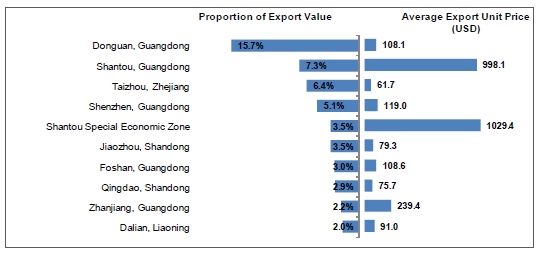

From the figures of China Customs, we can see that in the first seven months of 2012, Guangdong, Zhejiang and Shandong were the main export source of Chinese wood bedroom furniture. Guangdong's wood bedroom furniture export value accounted for nearly a half of total export amount (Dongguan, Shantou, Shenzhen, Foshan and Zhanjiang took a proportion of 15.7%, 7.3%, 5.1%, 3% and 2.2% respectively. In the case of average export unit price, it was highest in Guangdong, nearly as much again as that of Zhejiang and Shandong.

5.3 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

In the attention rank list of Made-In-China.com, the three most concerned products had common characteristic that they were all made of wood and fiber and produced in the same place, Foshan. Two of them used leather as their headboard surface material.

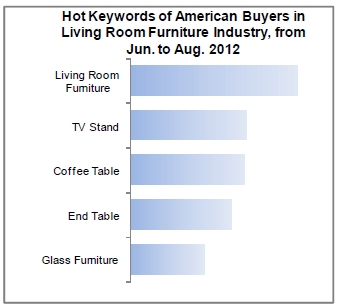

6. Living Room Furniture Products Analysis

6.1 Hot Keywords

(Data Source: Made-in-China.com)

It's revealed by the statistics of Made-in-China.com that from Jun. to Aug. 2012, in all living room furniture products, American buyers concern TV stand, coffee table, end table and glass furniture most.

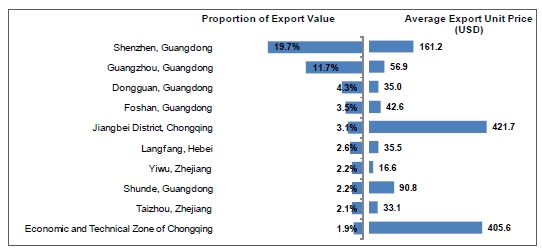

6.2 Major Cities for Chinese Furniture Made by Other Material (HS Code: 940389) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

Figures of China Customs indicate that in the first seven months of 2012, Chinese main export source of furniture made by other material were Guangdong, Chongqing, Zhejiang and Hebei. Export value of furniture made by other material in Guangdong accounted for 52.7% of total export amount (Shenzhen, Guangzhou, Dongguan and Foshan separately accounted for 19.7%, 11.7%, 4.3% and 3.5%), Chongqing, Zhejiang and Hebei accounted for 11.3%, 9.5% and 6.4% respectively. From the view of average export unit price, there were wide price margins among the above four provinces. The average export price of Chongqing was far higher than other three provinces, Guangdong, Hebei and Zhejiang. In combination with export's market share, Guangdong took larger part than other areas with its middle price.

6.3 Star Products (According to Statistics of Made-in-China.com, from Jun. to Aug. 2012)

According to the attention rank of Made-in-China.com, two of the three most concerned products were living room furniture set, which were made in leather and cloth, and the other was leisure chair. The origin place of these three products was Guangdong province.

7. Office Furniture Products Analysis

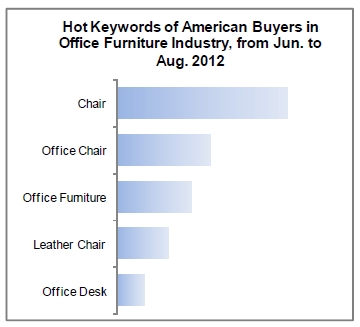

7.1 Hot Keywords

(Data Source: Made-in-China.com)

According to the statistics of Made-In-China.com, American buyers paid most attention to office chair and office desk in office furniture from Jun. to Aug. 2012.

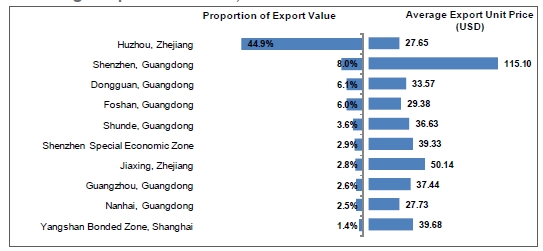

7.2 Major Cities for Chinese Adjustable Chair (HS Code: 940130) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

Data of China Customs indicate that in the first seven months of 2012, major cities of Chinese adjustable chair were Zhejiang and Guangdong. Zhejiang accounted for 52.7% of total export amount of Chinese adjustable chair (Huzhou took 44.9% of Zhejiang), while Guangdong took a proportion of 37.5%. As regard to average export unit price, it was higher of Guangdong than that of Zhejiang.

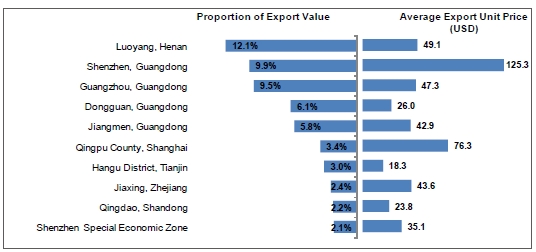

7.3 Major Cities for Chinese Metal Office Furniture (HS Code: 940310) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

It is revealed by data of China Customs that in the first seven months of 2012, major regions of Chinese office furniture densely distributed in Guangdong, Henan, Shanghai, Jiangsu and Zhejiang. Among the above four provinces, Guangdong accounted for 42.3% of total export amount of Chinese metal office furniture ( Shenzhen, Guangzhou, Dongguan and Jiangmen took a proportion of 9.9%, 9.5%, 6.1%, and 5.8% respectively ), Henan, shanghai, Jiangsu and Zhejiang accounted for 12.2%, 11.6%, 7.3% and 6.8% respectively. As regard to average export unit price, Guangdong, Henan and Shanghai were at the same level, higher than that of Jiangsu, and Zhejiang kept the lowest price.

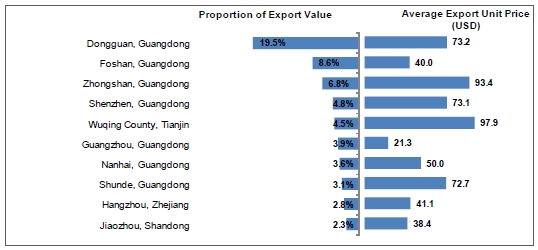

7.4 Major Cities for Chinese Wood Office Furniture (HS Code: 940330) Export and Their Average Export Unit Price, from Jan. to Jul. 2012

(Data Source: China Customs)

Figures of China Customs show that in the first seven months of 2012, Chinese main export source of wood office furniture concentrated in Guangdong, Jiangsu, Shanghai and Shandong, among which Guangdong held the largest share, 60% of total export value (Dongguan, Foshan, Zhongshan, Shenzhen, Guangzhou, Nanhai and Shunde accounted for 19.5%, 8.6%, 6.8%, 4.8%, 3.9%, 3.6% and 3.1% separately). Jiangsu, shanghai, Shandong and Zhejiang took the share of 6.9%, 6.8%, 6.4% and 6.2% respectively. In the above five provinces, Guangdong, Shandong and Zhejiang differentiated little that all of them kept highest from the point of average export unit price, shanghai followed and Jiangsu was at the bottom. Generally, Dongguan, Zhongshan, Shenzhen and Shunde in Guangdong province keeping upper-middle price occupied the biggest part of wood office furniture's market share. Meanwhile, products with relatively lower price made in Foshan, Guangzhou, Nanhai, Hangzhou and Jiaozhou region in Shandong province were also popular.

7.5 Star Products (According to The Statistics of Made-in-China.com, from Jun. to Aug. 2012)

In the attention rank list of Made-in-China.com, the three most concerned products were all office chairs and made in Foshan and Ningbo.

In addition, according to the figures of China Customs, export amount of height-adjustable swivel seats produced in Huzhou, Zhejiang province, accounted for nearly 45% of the total. Price level of Huzhou was slightly lower than that of Guangdong and buyers may pay more attention to this area.

The IAR Team of Made-in-China.com dedicates to surveying, excavating and collating industry information for supplying the service of timely and exact information analysis, providing necessary information and dates for clients'decision.

Thanks for reading the report, if you have any questions,opinions or advices, please contact us.

Name: Ms. Zhang Li

E-mail: [email protected]

Web: http://www.made-in-china.com/communication/market-analysis.html