Capacity expansion by Chinese LED chip makers has resulted in a supply glut, with this year's LED chip supply-demand ratio reaching 22%, according to the latest '2015 Global LED Industry Supply and Demand Database Report' by LEDinside (a division of TrendForce).

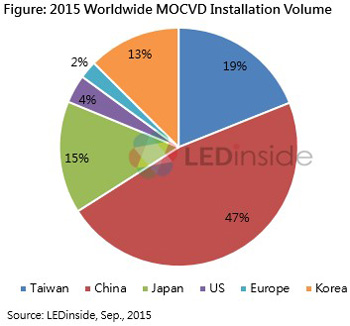

LEDinside also estimates that the global installed volume for metal-organic chemical vapour deposition (MOCVD) in 2015 will grow to 3130 chambers, including 1473 in China accounting for 47% of global capacity (MOCVD systems used in the calculation are of the K465i model).

This year's MOCVD capacity is equivalent to 72.31 million 2-inch LED wafers, up 14% in output volume over 2014, notes research director Roger Chu. Chinese chip makers such as San'an Opto and Changelight in particular are manufacturing using the latest MOCVD systems in their newly built plants in Xiamen. LEDinside projects that monthly wafer capacity during second-half 2015 will increase by as much as 500,000 pieces, creating a huge impact on the entire chip industry's supply and demand situation.

Due to government support and fundraising in the stock market in recent years, Chinese LED chip makers are able to expand their capacities to the point of creating a supply glut, notes LEDinside. Therefore the strength of these enterprises cannot be judged by past records. A prime example is China's largest LED chip maker San'an Opto, which in the past few years has been provided with local government subsidies that have comprisd 10-14% of the firm's annual revenue. Moreover, San'an Opto's market value has been rising sharply since 2014, and this in turn has attracted more numerous and larger-size investments. In the overall competition, Chinese LED firms have fewer patents and a smaller customer base than their global competitors, but they have significant strength as they are backed by a continuing stream of investments, says LEDinside. In contrast, Taiwanese LED companies have seen their market values falling, followed by an exodus of talent together with fundraising challenges. Consequently, the firms have resorted to layoffs and unpaid furloughs as a means to reduce cash outflow.

As the oversupply situation remains unresolved, industry participants in future will have to differentiate themselves by developing distinct products or niche applications in order to overcome highly saturated and competitive markets, reckons LEDinside. From this point onwards, their strategies will change from focusing on market scale and market share to generating stable profits to ensure sustainable development, the report concludes.