Australian businesses have pulled back their profit expectations for the coming months as they anticipate modest sales activity, difficult trading conditions and subdued consumer activity.

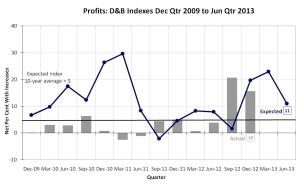

After showing signs of optimism leading into the New Year, businesses have lowered their profit outlook for the June 2013 quarter, while also reporting lower-than-expected actual profits for the December 2012 quarter. Findings from Dun & Bradstreet’s National Business Expectations Survey have also revealed a new low for selling price expectations and deep concerns from businesses about their operating cash flow.

The D&B profit expectations index has fallen sharply to 11 for the quarter ahead, a drop of 12 points from the Q1 outlook. This movement comes in the wake of declining expectations for sales and selling prices, and a persistent, conservative approach to spending from consumers.

The outlook for sales has declined for a second consecutive quarter, dipping below the index’s 10-year average level, to a score of 10. The decrease suggests businesses are adjusting their expectations to a continued period of restrained consumer spending and sentiment. The Consumer Credit Expectations Survey, released by D&B in January, revealed this ongoing mood of caution from consumers, with fewer Australians taking on debt and soft demand for credit as part of a shift in priorities towards more conservative spending.

In apparent efforts to stimulate activity, businesses have again lowered expectations for their selling prices. Retailers and wholesalers are leading the downward trend with negative indexes, suggesting that the high Australian dollar continues to support low prices.

For two consecutive quarters, the selling price index has reached its lowest point since the survey was first conducted in 1988, underlining recent commentary that discounting by businesses is the new normal.

With the selling price index falling to one, the number of businesses expecting to decrease their prices is almost equal to the number expecting to increase prices.

Expectations for sales, capital investment and inventories all decreased from the previous quarter, while the survey also found significant cash flow concerns among business executives. More than 68 per cent of executives have indicated that cash flow will be an issue for their business’s operations for the June 2013 quarter, while more than 28 per cent rate outstanding accounts receivables as their biggest barrier to growth.

According to Dun & Bradstreet’s Director of Corporate Affairs, Danielle Woods, the subdued profit expectations reflect a business outlook where sales activity is soft and consumers are applying a greater degree of consideration to their spending decisions.

“After previously demonstrating some buoyancy, the outlook for profits has taken a fall, which is consistent with movements in the other indices we’ve been tracking,” said Ms Woods.

“With forecasts for sales and prices being lowered, in tandem with a more conservative attitude to spending from Australian consumers, it appears that businesses are anticipating their profits will be squeezed.

“Actual levels of capital investment and employment for the December 2012 quarter were in negative territory, suggesting businesses are themselves taking a conservative approach and looking at their core operations in response to these sales pressures.

“Such caution is not unexpected given the high number of businesses anticipating cash flow will be an issue for their operations,” she added.

The survey’s employment expectations index was the only measure to register a positive movement for the June 2013 quarter, edging up marginally to an index of two from a level of one in the previous quarter.

In further signs of a conservative approach, D&B’s survey has found 33 per cent of businesses plan to take advantage of interest rate levels to pay off more debt, compared to the 10 per cent that will use the low rate to increase their borrowings.

The findings suggest that the effects of past interest rate cuts are still to flow through and stimulate growth activity from businesses, or increased spending by consumers.

According to Stephen Koukoulas, Economic Advisor to Dun & Bradstreet, the Business Expectations Survey presents a disconcerting view of the economy in the early months of 2013.

“The softer outlook for the bulk of indicators suggests the cooling of economic activity through 2012 has continued into the New Year,” he said. “The record low reading for selling prices suggests that the official inflation rate could fall further during the first half of 2013. If this shows up with the release of the March quarter inflation data in April, it will leave the Reserve Bank with scope to cut interest rates, if required.

“While a further interest rate cut is unlikely given the improving global economy and strength in financial markets, the Business Expectations Survey results suggests the risks ahead are for a slowing in sales and capital investment in the next few months,” he added.