The results from Dun & Bradstreet’s March Business Expectations Survey have highlighted a second consecutive decline in expectations, with businesses issuing subdued forecasts for the three-month period to June 2016, despite reporting an improved actual performance over the previous quarter.

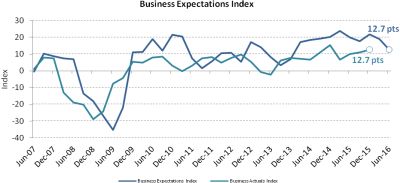

Dun & Bradstreet’s Business Expectations Index, the average of the survey’s measure of Sales, Profits, Employment and Capital Investment, has fallen to 12.7 points for the second quarter of 2016, down 6.2 points from 18.9 points for Q1 2016, and a fall of 7.4 points from 20.1 points for Q2 2015. Nonetheless, it is significantly higher than the 10-year average of 7.0 points.

All expectations indices – Sales, Employment, Profit, Capital Investment and Selling Prices – declined over the period. In contrast, the Actuals Index, which measures results from Q4 2015, has improved from 11.0 points to 12.7 points. As the final index for the quarter, the report draws data from surveys undertaken over January, February and March 2016.

The Business Expectations Index is an aggregate of the survey’s measures of sales, profits employment and investment expectations.

Head of group development for Dun & Bradstreet Adam Siddique said the credit data bureau’s view is that the downward trend in expectations was cause for concern rather than alarm. “While two consecutive quarters of declining survey results clearly shows that businesses are realigning their trading expectations down from the highs of 2015, we aren’t observing widespread evidence that supports an overly gloomy outlook,” he said.

“Upcoming leading-indicator releases from the ABS, such as building approvals, will be pivotal in adding weight to any strong change in economic sentiment,” Mr Siddique added.

According to Stephen Koukoulas, economic advisor to Dun & Bradstreet: “The latest business expectations data has cast a shadow over what had been a period of stronger economic performance. There has been a fall in each of the components of the Index, with the overall Business Expectations Index slipping to its lowest level in over two years.

“The BEI is consistent with GDP growth of around 2.5 per cent, which is a little weaker than the 3 per cent growth rate recorded in the year to the end of 2015,” Mr Koukoulas noted.

He added: “It is difficult to pinpoint why businesses are reporting a souring in the business expectations climate, other than perhaps the issues that may be thrown up in the looming federal election and ongoing uncertainty surrounding global economic conditions, especially in China.”

The survey revealed particularly pessimistic forecasts from the Retail and Services sectors, both of which reported sharp declines in expectations for the upcoming quarter. Based on the latest data, the Retail sector reported a 47.1% decline in expectations for Q2 2016, compared with Q1 2016, while the Services sector’s expectations more than halved. The only sector that did not report a decline over the month was the Construction sector, with expectations remaining unchanged compared with the previous quarter.

Despite the pessimistic Expectations data, however, businesses reported a stronger actual performance over the previous quarter (Q4 2015), with the result marking the Actuals Index’s third consecutive increase. The Wholesale, Retail, Construction and Services sectors all reported strong increases in their Actuals Indices. In particular, the Retail sector saw strong sales growth over the quarter, with the Actual Sales Index more than doubling from 12.7 in Q3 2015 to 29.4 in Q4. This marks a sharp contrast with data from the latest Expected Sales Index in the sector, which nearly halved from 20.6 points to 10.9 points.

Despite these improvements, some negative sentiments were seen in the Manufacturing sector, as well as the Transport, Communication and Utilities sector, both of which saw slight declines in their Actuals Indices, while the Finance, Insurance and Real Estate sector’s Actuals Index fell significantly, from 23.8 points to 16.7 points.

“While it is not yet time to be too concerned about the slide in expectations, any further deterioration in the months ahead would present challenges for the economy and would result in the need to recast our assessment of the state of the business landscape,” Mr Koukoulas noted.