Microsoft this week raised prices of its Office suite by as much as 17% and eliminated multi-license packs, all part of a plan to push consumers and small businesses toward new subscription programs, analysts said.

On Monday, Microsoft unveiled pricing for Office 2013, the next version of its suite sold as a perpetual license, and for two new plans in the by-subscription Office 365 lineup.

The numbers revealed an increase of between 10% and 17% in the cost of a perpetual license, which gives the user the right to run the software as long as he or she likes. Microsoft also dispatched several multi-license SKUs, or stock-keeping units, for Office 2010, boosting the price of replicating those offers with Office 2013 by as much as 180%. And it pegged the prices of annual subscriptions to Office 365 Home Premium, aimed at consumers, and Office 365 Small Business, that let customers "lease" the software they've installed on their desktops, notebooks and tablets.

Office Home & Student 2013, a single-license suite that includes Word, Excel, PowerPoint and OneNote, costs $140, or 17% more than its Office 2010 predecessor. The more feature- and application-packed Office Home & Business 2013, priced at $220, and Office Professional 2013, at $400, are 10% and 14% higher than their 2010 counterparts.

It was the first time that Microsoft raised the price of Office since at least 2001, when it debuted Office XP, although changes in 2010 -- when the company dumped "upgrade" pricing -- effectively increased costs for many customers.

More importantly, Microsoft eliminated three multi-license Office 2010 SKUs -- a three-license Home & Student, and a pair of two-license editions, Home & Business and Professional -- that offered major discounts.

Replicating those will be much more expensive with Office 2013, which is only available in single-license forms.

Office Home & Student 2010, for example, was priced at $150 for three licenses, while Home & Business and Professional, each with two licenses, cost $220 and $350, respectively.

To equip three PCs with Office Home & Student 2013, consumers must fork over $420 (3 x $140 per copy), or 180% more than the $150 Office 2010 edition. Buying two licenses of Home & Business, meanwhile, means $440 out of pocket, a 57% increase, while two copies of Office Professional 2013 costs $800, or 60% more than the comparable Office 2010 SKU.

It's clear to analysts why Microsoft has raised prices for perpetual-licensed copies of Office 2013, killed off the multi-license discounts, and made it prohibitively expensive to recreate those editions by selling only single-license software.

"Microsoft is trying to make the price of the subscriptions more attractive by increasing the prices of the [perpetual] licenses," said Al Hilwa, an analyst with IDC. "Microsoft is bracing for a shift to a subscription model because it's so much easier for them on a financial revenue perspective because it's more predictable."

And Microsoft knows how effective -- and lucrative -- subscriptions can be. Most of its Office revenue comes from that model in the form of enterprise agreements.

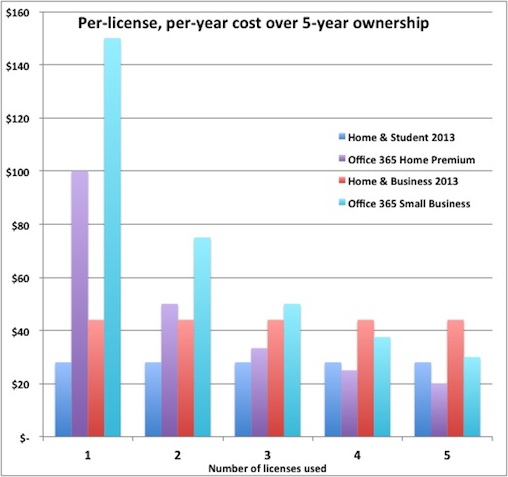

The new Office 365 subscription plans make dollar sense for consumers and small businesses if four or more of the five allowed licenses are used.

Wes Miller of Directions on Microsoft saw the pricing shifts the same way: They are part of what he called a "meticulous plan" to position the Office 365 subscription packages as better deals.

"Microsoft has just put the perpetual license on the higher shelf," said Miller. "You can still reach for it if you want, but they're guiding customers toward the subscriptions."

Those new subscription plans have been priced at $100 per year for Office 365 Home Premium and $150 annually for Small Business Premium. Customers of each receive a full complement of applications, including Word, Excel, PowerPoint, Outlook, OneNote, Access and Publisher -- with Lync only available in Small Business Premium -- as well as extras, notably cloud-basedstorage space.

The selling point of the subscriptions, however, is their multi-license nature.

Home Premium can be installed on up to five Windows PCs, Macs and Windows tablets in a household, while Small Business Premium, although limited to one user, also offers five device licenses.

At first blush the new Office 365 plans look like a deal. Five licenses for $100 annually versus $140 for one copy? It seems like more a steal than a deal.

And that's Microsoft's strategy.

"The packaged products have much larger upfront fees," said Miller, talking about the single-license perpetual licenses such as Office Home & Student 2013. "And only one install."

If customers do the math, the subscriptions appear even more attractive: The $100 Office 365 Home Premium breaks down to $8.33 per month -- again, for five licenses -- while Small Business Premium translates to $12.50 each month.

"If you think about it, if you're willing to pay $100 for Office now, per year, it's always patched, it's always up to date, and you can put it on five machines," said Miller. "That's not a bad deal."

According to Computerworld's calculations, however, Office 365 may, in fact, be a bad deal.

The most important variables in comparing the new subscription plans with traditional "sold" software are first, the number of licenses a customer actually uses -- or needs, which may not be the same -- while the second is the time between upgrading a traditional, perpetual license-based edition of Office.

The Office upgrade, on average, say analysts, is five years: Customers have historically skipped an edition to, say, purchase Office 2007 but not Office 2010, and instead waited for the next upgrade, in this example, Office 2013.

Consumers do it, corporations do it, the former because of expense, the latter because even though they may have paid for the right to upgrade with Software Assurance, they're leery of change and the requisite retraining of workers.

At $100 annually, a consumer subscribing to Office 365 Home Premium would pay $500 over a five-year period, or $100 for each of the five allowed copies. That comes out to $20 per license per year.

In comparison, Office Home & Student 2013, which provides one perpetual license, lists for $140. That's $140 over the same five-year stretch. Bottom line: $28 per license per year.

Office 365 is a deal in that scenario, and on a per-license basis is 29% cheaper. But that presupposes that the customer needs and uses all five licenses offered in Office 365.

"Will the average household equip all five seats?" asked Michael Osterman, president of Osterman Research. "Five devices that need Office, even in an average tech household, that's iffy, very iffy."

If a household buys into Office 365 Home Premium, for instance, but actually only uses two of the five licenses, the per-license, per-year cost shoots up to $50, or nearly double that of two copies of Office Home & Student 2013, which revolves to $28 per license per year.

Even at three licenses of the five allowed, the $33.33 per-license, per-year cost of Office 365 is still higher than buying three copies of Office Home & Student, where the per-license, per-year number remains at $28.

The tipping point for Office 365 Home Premium isfour licenses. If a household activates four or more of the five permitted licenses, the subscription is less expensive than the same number of copies of a traditional, buy-it-own-it edition.

Use fewer than four, however, and Office 365 costs more on a per-license, per-year basis than a corresponding number of Home & Student perpetual licenses, even with Microsoft's price hike.

The same holds true for Office 365 Small Business Premium when compared to Office Home & Business 2013: Four is the magic number. Anything less and it's cheaper to equip each device used by a worker with Home & Business 2013.

The comparisons are not apples-to-apples, of course, because the Office 365 subscriptions come with bonuses, including Microsoft's promise to provide frequent upgrades, the additional storage space, Skype calling time (Home Premium), and shared calendars and video conferencing (Small Business Premium). The SKUs are hard to compare head-to-head as well, since Office 365 is a kitchen-sink edition, with applications absent from Home & Student, or even Home & Business.

(Only Office Professional 2013 includes the same set of applications as an Office 365 plan.)

But the numbers made analysts pause.

Osterman, for one. "For the average household, say with someone who does [office] work at home some of the time, this still looks like a premium model," Osterman said of Office 365's pricing. "I think Microsoft's going to be hard-pressed to sell this [to consumers]."

Miller gave Office 365 Small Business Premium a better shot at success, even though, like its consumer cousin, that subscription allows five installs of Office. "The [Office 365] Small Business sounds palatable, and I think many small businesses will adjust to the subscription concept, but for the consumer I'm not quite as convinced," said Miller. "I'm not necessarily convinced that consumers would actually use Office enough to justify the five licenses."

Consumers have also been historically uneasy about software-by-subscription, Miller said.

"Will users grow accustomed to subscriptions?" asked Hilwa of IDC. He wasn't sure.

There's something to their thinking. In mid-2008, Microsoft trotted out Equipt, a subscription bundle of Office Home and Student 2007, Microsoft's now-defunct OneCare antivirus product, and several then-for-free online services, including Hotmail. Microsoft priced an annual Equipt subscription at $70, or about $5.83 per month. Customers were allowed to install Office 2007 on as many as three PCs for that fee, resulting in a per-license, per-year cost over five years of between $23.33 (for all three licenses used) to $70 (for just one license activated).

Microsoft pulled the Equipt plug in April 2009, just nine months after launching the offer.

In July, Rob Helm, a colleague of Miller's at Directions on Microsoft, noted the obvious, that Microsoft failed three years ago at an annual cost 30% less than Office 365 Home Premium.

In fact, Microsoft's now-published prices for Office 365 are higher, 39% higher for Home Premium, 108% higher for Small Business Premium, than a quartet of analysts -- including Helm and Osterman -- said two months ago. Those analysts said the pricing would have to have the must-meet yardstick of just $6 per month if the subscription idea was going to fly.

That was one reason why, even with Microsoft's pricing scheme, which gave a first-glance advantage to Office 365, the experts wondered whether this shift from perpetual licenses to rent-a-suite would work.

Hilwa called it a "blended approach," this mix of old and new. "In the end, Microsoft doesn't care which way people go," he said, as long as they buy into the newest Office.

Only one thing seemed certain. "This is a big gamble," Osterman said. Cloud-based competition, like Google Apps, will only get fiercer. "They're very concerned about losing that premium application business. But Microsoft is still stuck in the old mentality, and trying to defend that turf."