The nation's largest sporting goods retailer reported net sales for the first quarter of 2014 ended May 3, 2014 increased 7.9 percent to $1.4 billion. Consolidated same store sales increased 1.5 percent, compared to the company's guidance of an approximate 3 to 4 percent increase. First quarter 2013 consolidated same store sales decreased 3.8 percent, adjusted for the shifted retail calendar due to the 53rd week in 2012. Same store sales in the first quarter of 2014 for Dick's Sporting Goods increased 2.3 percent, while Golf Galaxy decreased 10.4 percent.

"Our difficulties this quarter were isolated to two categories: golf and hunting," said Edward W. Stack, Chairman and CEO. "After a very challenging first quarter in golf last year, we expected some further headwinds and only modest improvement, but instead we saw a continued significant decline. In the case of hunting, we planned the business down based on last year's catalysts, but it was even weaker than expected."

Stack continued, "Despite these challenges, our e-commerce business continued to show exceptional growth and we saw significant strength in several categories in the first quarter, including womens and youth athletic apparel, footwear and team sports."

DKS reported consolidated non-GAAP net income for the quarter reached $61.3 million, or $0.50 per diluted share, excluding a gain on the sale of an asset, compared to the company's expectations provided on March 11, 2014 of $0.51 to 0.53 per diluted share. For the first quarter ended May 4, 2013, the company reported consolidated non-GAAP net income of $60.5 million, or $0.48 per diluted share.

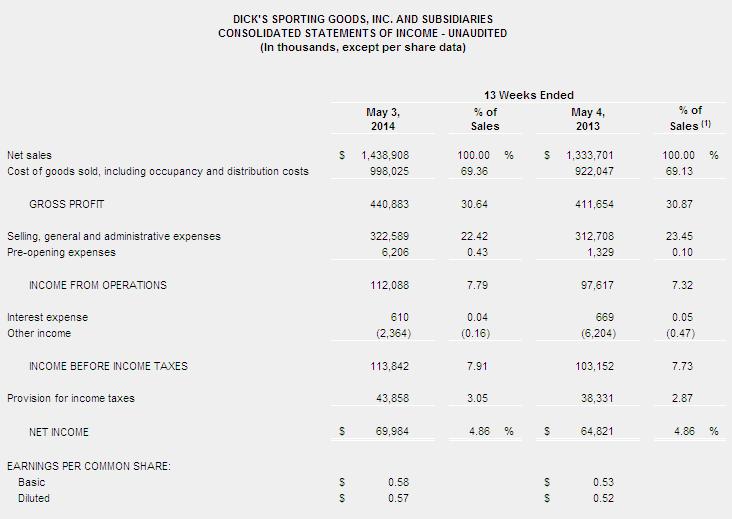

On a GAAP basis, the company reported consolidated net income for the first quarter ended May 3, 2014 of $70.0 million, or $0.57 per diluted share. For the first quarter ended May 4, 2013, the company reported consolidated net income of $64.8 million, or $0.52 per diluted share. The GAAP to non-GAAP reconciliations are included in a table later in the release under the heading "Non-GAAP Net Income and Earnings Per Share Reconciliations."

Omni-channel development

E-commerce penetration for the quarter was 7.0 percent of total sales, compared to 5.8 percent in the first quarter last year.

In the first quarter, the company also opened eight new DICK'S Sporting Goods stores. These stores are listed in a table later in the release under the heading "Store Count and Square Footage." The company also relocated one DICK'S Sporting Goods store and one Golf Galaxy store during the first quarter. As of May 3, 2014, the company operated 566 Dick's Sporting Goods stores in 46 states, with approximately 30.6 million square feet and 79 Golf Galaxy stores in 29 states, with approximately 1.4 million square feet.

Balance sheet

The company ended the first quarter of 2014 with approximately $139 million in cash and cash equivalents as compared to approximately $114 million at the end of the first quarter of 2013. The company did not have any outstanding borrowings under its $500 million revolving credit facility. Over the course of the past twelve months, the company utilized capital to invest in omni-channel growth, repurchase shares and pay quarterly dividends.

Total inventory was 12.8 percent higher at the end of the first quarter of 2014 as compared to the end of the first quarter of 2013. The increase in inventory reflects investments in strategic growth categories, new concepts and excess inventory in golf and hunting.

Capital allocation

In the first quarter of 2014, the company repurchased approximately 0.5 million shares of its common stock at an average cost of $55.44 per share, for a total cost of $25.0 million. To date, the company has repurchased $280.6 million of common stock under its $1 billion share repurchase authorization.

On May 15, 2014, the company's Board of Directors authorized and declared a quarterly dividend in the amount of $0.125 per share on the company's Common Stock and Class B Common Stock. The dividend is payable in cash on June 27, 2014 to stockholders of record at the close of business on June 6, 2014.

Current 2014 outlook

The company expects the challenges in golf to continue throughout the year, while hunting sales are anticipated to stabilize and begin returning to normalized levels by the end of the year. As a result, the company has revised its full year outlook. Given the importance of golf and hunting to the company's second quarter, the company expects a disproportionate impact to sales and earnings in the second quarter.

Full year 2014

Based on an estimated 124 million diluted shares outstanding, the company currently anticipates reporting consolidated non-GAAP earnings per diluted share of approximately $2.70 to 2.85, excluding a gain on the sale of an asset. This compares to the previous expectation, provided on March 11, 2014, of $3.03 to 3.08 per diluted share. For the 52 weeks ended February 1, 2014, the company reported consolidated earnings per diluted share of $2.69. Consolidated same store sales are currently expected to increase approximately 1 to 3 percent, compared to a 1.9 percent increase in fiscal 2013. This compares to the previous expectation, provided on March 11, 2014, of an approximate 3 to 4 percent increase. The company expects to open approximately 50 new DICK'S Sporting Goods stores, relocate five DICK'S Sporting Goods stores and remodel five DICK'S Sporting Goods stores in 2014. The company also expects to open approximately eight new Field & Stream stores, relocate two Golf Galaxy stores and open one new Golf Galaxy store in 2014

Second quarter 2014

Based on an estimated 124 million diluted shares outstanding, the company currently anticipates reporting consolidated earnings per diluted share of approximately $0.62 to 0.67 in the second quarter of 2014, compared to second quarter 2013 non-GAAP consolidated earnings per diluted share of $0.71, excluding an asset impairment charge. On a GAAP basis, the company reported consolidated earnings per diluted share of $0.67 in the second quarter of 2013. Consolidated same store sales are currently expected to increase approximately 1 to 3 percent in the second quarter of 2014, as compared to a 0.4 percent decrease in the second quarter of 2013, adjusted for the shifted retail calendar due to the 53rd week in 2012. The company expects to open approximately eight new DICK'S Sporting Goods stores, one new Field & Stream store and relocate three DICK'S Sporting Goods stores in the second quarter of 2014

Capital expenditures

In 2014, the company anticipates capital expenditures to be approximately $360 million on a gross basis and approximately $265 million on a net basis.