Microsoft makes more than$300 on each Surface RT tablet it sells,showing that the company has adopted the business model of its rival,Apple,analysts said yesterday.

According to IHS iSuppli,which disassembled a 32GB Surface to estimate a"bill of materials"(BOM),Microsoft's component costs were$271,with another$13 to account for manufacturing.The total of$284,however,does not include other costs,such as research and development or marketing.

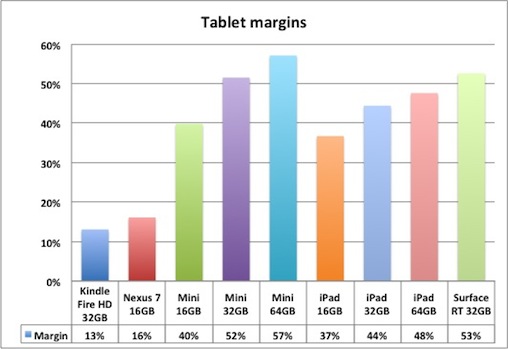

With the Surface RT's retail price of$599--iSuppli examined the model that comes with a Touch Cover,Microsoft's least-expensive keyboard-cum-cover--the$315 difference represented a margin of almost 53%,higher than any of Apple's W-Fi equipped full-sized iPads.

"Microsoft can make money on the hardware alone,"said Andrew Rassweiler,iSuppli's senior principal analyst for teardowns,in a Monday interview."The numbers speak for themselves."

Microsoft has taken the same approach as Apple,which prices its hardware at a premium to generate profit on the devices themselves.

Other tablet makers,notably Google and Amazon,have taken a different tack,pricing their wares at or near cost,expecting to make money on software,other digital content,and services.

For example,Amazon's Kindle Fire HD,a 7-in.tablet that launched in September,is priced at$199,just$26 above its materials and manufacturing costs,iSuppli noted Monday.The Fire HD's margin,then,is a minuscule 13%.

Google's Nexus 7,which was just upgraded to 16GB for the entry-level configuration,carries a BOM and assembly cost of$167,giving the search giant only$32 in profit on the$199 list price.It's margin:a slightly-higher-than-Amazon 16%.

When Microsoft unveiled the Surface RT last June--months before it disclosed prices--many experts speculated that the company would discount the tablet and try to make good on app sales from its Windows Store,from fees for beefed up services like its SkyDrive cloud storage,and from other software.Microsoft was,after all,a software company,the pundits noted.

That wasn't the road the Redmond,Wash.developer took.

It may not have had any other option,said Sameer Singh,an analyst who covers mobile technology on his Tech-Thoughts website.

"I don't think making money on the hardware was as much of a choice as it seems,even though it fits in well with their long-term strategy,"said Singh in an email reply to questions."While I think the Surface would have more success at$299,coming in at that price point would have forced their major OEM partners to immediately drop all Windows RT-based products.OEMs have to make money off of hardware and have to pay a license fee,so they could never have cost or price parity."

Both Rassweiler and Singh saw the pricing and margins of the Surface RT as indicative of a sea change at Microsoft,one that CEO Steve Ballmer announced last month.

"It truly is a new era at Microsoft,"Ballmer wrote in his annual letter to shareholders about the U-turn from software to selling hardware and focusing on cloud services."This is a significant shift,both in what we do and how we see ourselves as a devices and services company,"Ballmer said.

Tablet margins illustrate the business strategies of the major players,ranging from Amazon and Apple to Google and Microsoft.(Data:IHS iSuppli.)

"The Surface represents a key element in Microsoft's strategy to transform itself from a software maker into a devices and services provider,"said Rassweiler in a post to the iSuppli blog yesterday."Key to this strategy is offering hardware products that generate high profits on their own,similar to what Apple has achieved with its iPad line."

Singh echoed that."I think Ballmer's been pretty clear that he wants Microsoft to focus on devices and services going forward,"Singh said."[But]I'm not sure how smart that strategy is.OEMs are clearly unhappy about the move and Acer's been pretty vocal about it.It's one thing if you're moving into hardware and your software's free.It's a whole different story if you're selling your software to OEMs and then competing with them."

After conducting a Surface teardown and producing a BOM estimate,Rassweiler said the tablet's most interesting component was the Touch Cover,the flat and flexible cover-slash-keyboard that comes with the$599 and$699 models,and is available separately at$119.99 for the$499 tablet.

"The Touch cover actually has quite a bit of its own electronics,"said Rassweiler."There's a motherboard and at least two ICs[integrated circuits].It's pretty cool."

And it's a money maker for Microsoft.

Rassweiler pegged the Touch Cover's cost at between$16 and$18,making the margin a whopping 85%when purchased separately,and contributing almost a fourth of the profit from the sale of each$599 32GB Surface RT.

He applauded Microsoft's business acumen,noting that the addition of the Touch Cover lets the company charge an extra$100--what he called"a very healthy upgrade"--and gives it an additional upsell tactic beyond the usual memory upgrades that Apple popularized in tablets.

The Surface's large margin also gives Microsoft plenty of maneuvering room down the road,just as the high margins on the iPad Mini provide Apple pricing alternatives.

"They came to the conclusion that they didn't have to give away the Surface,but if[the current pricing]doesn't work,they have room to drop it,or even subsidize it,"said Rassweiler.

Singh again disagreed,reiterating his take that there was less room than the numbers indicated because of pressure on Microsoft from its OEM partners to give them ways to meet or even beat the Surface RT's price.

"I think this is a test of sorts,"countered Rassweiler,echoing what others have said of Surface RT pricing."They'll see how this works.Only time will tell."