Demand for real-time data, including personal health information, is driving the market for wearable, wireless devices that will grow from 14 million items this year to as many as 171 million in 2016.

In four years, the market for wearable wireless devices is expected to achieve minimum revenues of $6 billion, according to new research from IMS Research, a subsidiary of IHS.

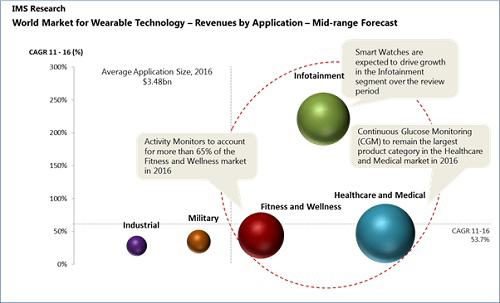

Worldwide market for wearable wireless technology

"A $6 billion market in 2016 is our most conservative forecast which assumes that the adoption of wearable technology will be limited by factors including lack of suitable technology, poor user compliance and lack of an overall enhanced experience from devices that are wearable as compared to non-wearable products," said Theo Ahadome, senior analyst at IMS Research.

The majority of wearable devices are concentrated around a few products mainly for healthcare and wellness applications, such as glucose and heart rate monitors. In the future, devices for personal entertainment and military use will increase dramatically. For example, the introduction of Google's Smart Glasses and the rumored Apple Smart Watch" will be part of a new wave of wireless wearable devices. Sleep sensors, hand-worn terminals, and industrial and military head's up displays -- transparent screens that provide data and are attached to helmets -- will provide users with actionable data, leading to even more rapid expansion in the market for wearable technology.

Most wearable, wireless devices today are used to transmit vital signs or to track user exercise performance or fitness metrics. Dominating the market are continuous glucose monitors, such as devices from Abbott and Medtronic, and activity monitors, such as those from Fitbit, Adidas miCoach and Nike Fuelband. Fitness and heart-rate monitors from Garmin, Polar and Suunto are also market leaders, Ahadome said.

The Federal Communications Commission recently approved a Medical Body Area Network (MBAN) radio spectrum for use in hospitals. The MBAN spectrum first is expected to be used in hospitals, but over time, medical instrument vendors say MBAN devices could be used at home, where 80% of health care services are delivered.

Unlike traditional medical telemetry systems, which require separate links for each function being monitored, wireless MBAN systems could monitor all required functions and then aggregate the results and transmit them to a remote location for evaluation. The data could be uploaded to private clouds within hospital data centers and also to public cloud providers, such as Microsoft's HealthVault.

While medical wireless devices and their data will be regulated under HIPAA (the Health Insurance Portability and Accountability Act), one problem with consumer-grade wearable devices is that the information will likely be sent over unsecured networks to public cloud service providers.

For example, consumers may upload workout and sleep monitoring data into online personal health records.

"You don't necessarily want many applications in different places, but in one centralized place," Ahadome said. "Personal fitness records will be cloud based. It becomes a free-for-all in terms of where your data goes."

Last year, the amount of information created and replicated surpassed 1.8 zettabytes (1.8 trillion gigabytes), growing by a factor of nine in just five years, according to IDC's Digital Universe study.

While 75% of the information in the digital universe is generated by individuals, less than one-third of all stored data today has even minimal security or protection. Only about half the information that should be protected is protected at all, IDC stated.