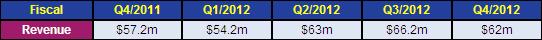

For fourth-quarter 2012, NeoPhotonics Corp of San Jose, CA, a vertically integrated designer and manufacturer of both indium phosphide (InP) and silica-on-silicon photonic integrated circuit (PIC)-based modules and subsystems for bandwidth-intensive, high-speed communications networks, has reported revenue of $62m, down 6% on $66.2m last quarter but up 8% on $57.2m a year ago.

"NeoPhotonics has grown 40/100G product sales to approximately one third of our quarterly revenue as of the fourth quarter of 2012, helping to meet rapidly growing demand for high-speed PIC-based products," says chairman, president & CEO Tim Jenks. For full-year 2012, annual revenue was a record $245.4m, up 22% on 2011's $201m.

On a non-GAAP basis, gross margin was 24.5%, up from 23.5% a year ago but down from 32.9% last quarter. Gross margin was adversely impacted by about 700 basis points due to higher yield loss and inventory-related expense relating to one of the firm's high-speed products plus lower wafer fab utilization.However, full-year gross margin was 27%, up from 2011's 25.7%.

Loss from continuing operations was $0.1m, down from income of $2.7m last quarter but still a big improvement on a loss of $6.4m a year ago. Full-year loss has been more than halved, from $9.6m in 2011 to $4.7m for 2012.

Adjusted EBITDA was $3.5m, down from $6.4m last quarter but an improvement from an adjusted EBITDA loss of $3m a year ago. Full-year adjusted EBITDA has more than tripled, from $2.7m in 2011 to $9.3m for 2012.

Although up from $86.4m at the end of 2011, total cash, cash equivalents and short-term investments fell during the quarter from $105.9m to $101.2m. This was due mainly to capital expenditure, scheduled repayment of bank debt, and expenses relating to the pending $36.8m acquisition (announced on 22 January) of the semiconductor optical components business unit (OCU) of LAPIS Semiconductor Co Ltd (a subsidiary of Japan's ROHM Co Ltd).

For first-quarter 2013, NeoPhotonics expects revenue of $50-55m, primarily reflecting seasonally lower business activity and a full quarter impact of changes in product prices negotiated in the fourth quarter. Gross margin should be 22-24%, reflecting the impact of seasonality and pricing changes, related lower wafer fab utilization, and continued higher manufacturing costs relating to the high-speed product.

The outlook for Q1/2013 excludes operating results of LAPIS OCU as the transaction is not yet closed. The Non-GAAP outlook excludes expected amortization of intangibles and other assets of about $1.3m, the anticipated impact of stock-based compensation of about $1.2m, and transaction expenses related to the LAPIS acquisition of about $1.2m (including $1m relate to cost of goods sold).

For full-year 2013, NeoPhotonics expects revenue growth of 8-10% over 2012, and hence profitability on a non-GAAP basis.

Based on preliminary unaudited pro forma financial information provided by LAPIS Semiconductor's management, OCU had revenue of about $45m for the first nine months of 2012. OCU is hence expected to be accretive to NeoPhotonics' adjusted EBITDA within the first year following the transaction. The transaction is expected to close in Q2/2013 or sooner (subject to various customary conditions).