Applications of CCMs in the mobile phone and automotive sectors are fueling camera module revenues.

Driven by the mobile phone and automotive sectors, the sales value of the Compact Camera Module (CCM) industry will grow by a factor of by 2.5 over the next five years, reaching a total revenue of $51 billion by 2020. This is the headline conclusion of a new market report from Yole Développement (Yole), Lyon, France.

Entitled Camera Module Industry, the report states that the largest contributing market segment, mobile phones, will continue to grow from 72% to 74% of all revenues due to improving specifications and average selling prices. “Therefore mobile phone manufacturers will meet the increased market demand for higher quality photos and propose innovative products with more and more efficient camera modules,” the document states.

Yole also highlights the CCM price increase. Pierre Cambou, Activity Leader at Yole, commented, “This trend is a real surprise. At Yole, we have followed the electronic components market for the mobile phone industry for a long time and we know the strategic importance of pricing in this sector.”

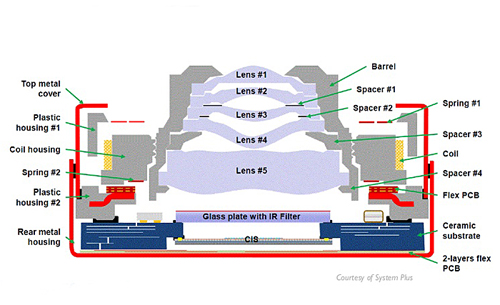

Market demand is partly explained by the penetration of technologies auto focus (AF) and optical image stabilization (OIS) applications, which are together forecast to reach $5.5bn in 2020, with 21% CAGR expected between 2015 and 2020. Such figures highlight the strategic importance of the AF and OIS applications in the mobile phone sector and the implication of those technologies in likely future sensing applications, Yole commented.

Technology trends

Yole’s Camera Module Industry report is said to be the first technology and market analysis focused on the camera module market and technologies, performed by Yole’s analysts. It has been performed in collaboration with Jean-Luc Jaffard, formerly of STMicroelectronics and part of Red Belt Conseil.

In the report, both experts also present a comprehensive overview of the CCM applications (including mobile, Digital Single Lens Reflex (DSLR), automotive, medical, security, and machine vision) and the key market players. The report includes revenue forecasts, as well as volume shipment numbers and sub-component breakdowns by application.

Pierre Cambou added, “There is a different market trajectory for the lens and sensor markets, which are now maturing at approximately 14% CAGR with the emergence of giant billion-dollar companies. CCM and auto-focus manufacturing markets, which are still very fragmented and growing at roughly 20% CAGR, should experience consolidation over the next five years.”

The report comments that the stakes in the CCM market are high, “since the mobile phones market is maturing and micro-cameras are key differentiators. The consumer appetite for slimmer mobile devices is forcing CCM players into a major technological race while at the same time demanding massive investment to keep up with volume.

Imaging to sensing transition

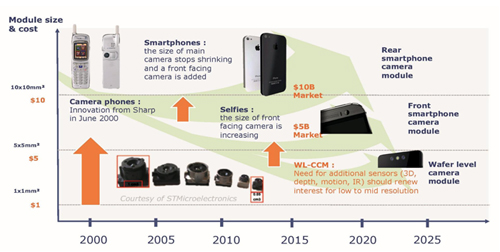

“The CCM industry greatly benefited from the adoption of high-resolution cameras in mobile phones, since doubled by the adoption of front-facing ones. Current revenues are mainly driven by the increasing resolution of both rear and front-facing mobile cameras. But new applications, especially in the automotive area, are starting to play an important role.

“Automotive has a long way to go: technologies are just good enough to enter the current market as they reach consumer expectation”, added Cambou. “The technology will quickly evolve and serve the autonomous vehicle trend. Automotive has had a significant impact on the CCM ecosystem. Automotive cameras have shifted from an add-on feature to must-have standard equipment, and regulations in the European Union and the United States are encouraging this transition.”

Automotive module revenue reached US$1.2 billion in 2014, and growing at a CAGR of 36% should reach US$7.9 billion by 2020. This exceptional growth has mainly benefited the CCM industry’s second-tier players, but the response of market leaders will be worth watching.

As the camera module application moves from imaging to sensing, the automotive Advanced Driver Assistance System (ADAS) application is the perfect barometer of what’s to come for the entire camera module industry.

The computing sector is also an area analyzed by the market research and strategy consulting firm, Yole. This market is important in value but its growth is stable. According to Yole’s analysts, the computing sector could expect a large growth with the addition of innovative sensors (3D, depth, motion, IR). New applications in video interaction are to revolutionize computing camera usages.