Icahn Enterprises has announced its plans to acquire automotive service provider Pep Boys-Manny Moe & Jack for $1bn.

The deal was announced after Japanese tire maker Bridgestone quit the race to acquire the company by announcing that it will not raise its latest cash bid of $17 per share to counter Icahn's raised offer of $18.50 per share in cash.

Icahn previously bought an auto spare parts company named Auto Plus from Canada's Uni-Select, and according to Icahn founder Carl Icahn Pep Boys' retail auto parts business will complement Auto Plus, reported Reuters.

Due to the fall in crude prices and slows growth in its energy business Icahn Enterprises sifted its focus on auto business, which has accounted for nearly half of its revenue in 2014.

The company also owns 82% stake in auto parts maker Federal-Mogul Holdings.

Icahn is likely to close the Pep Boys acquisition in the first quarter of 2016, and it is expected to pay $39.5m termination fee to Bridgestone.

Carl Icahn said: "This was a terrific opportunity to leverage the financial resources and industry knowledge of Icahn Enterprises to the benefit of Pep Boys' customers, manufacturer partners and employees and further bolster our U.S. automotive footprint.

"Since our acquisition of Auto Plus, our wholly-owned automotive aftermarket company, in June, we have been actively looking for an excellent synergistic acquisition opportunity like Pep Boys, which has enormous growth potential, strong brand recognition, and well-known, best-in-class customer service."

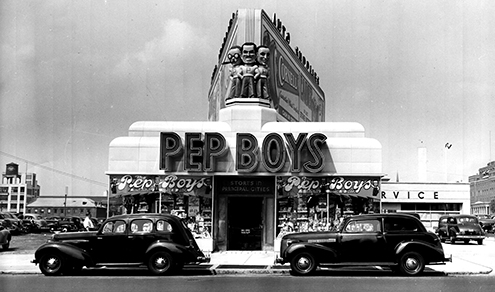

Image: Icahn Enterprises to buy Pep Boys for $1bn. Photo: courtesy of: Pep Boys.