Adidas AG reported first-quarter profit decreased 34 percent from the prior year, as revenues declined, hit by adverse currency and weakness in the golf unit. Revenue at TaylorMade slumped 38 percent in the first quarter as a result of increased discounting. On a currency-neutral basis, Adidas brand rose 5.4 percent while Reebok gained 3 percent. The company backed its outlook for the year.

Highlights of the quarter include:

- Retail sales increase 22 percent currency-neutral with comparable store sales up 8 percent

- Strong momentum in European Emerging Markets and Latin America with currency-neutral revenues up 28 percent and 19 percent, respectively

- Currency-neutral Adidas and Reebok sales grow 5 percent and 3 percent, respectively

- Gross margin down 1.0pp to 49.1 percent due to negative currency effects

- Operating margin decreases 3.2pp to 8.6 percent

- Basic and diluted earnings per share decrease 34 percent and 35 percent, respectively

- ADIDAS GROUP CURRENCY-NEUTRAL SALES REMAIN STABLE IN THE FIRST QUARTER OF 2014

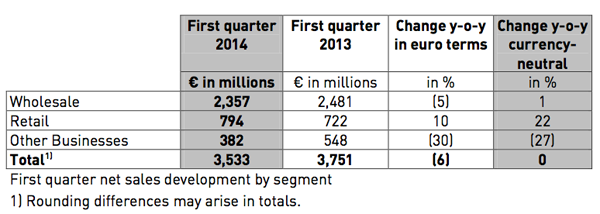

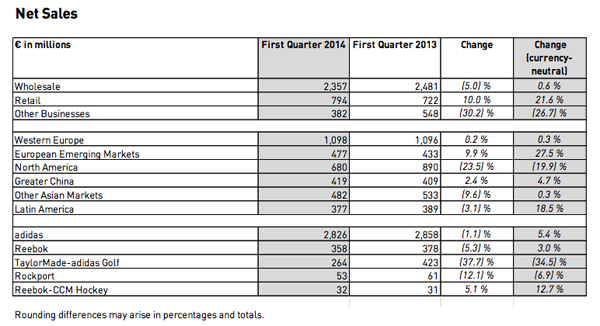

In the first quarter of 2014, Group revenues remained stable on a currency-neutral basis. Currency translation effects had a significant negative impact on sales in euro terms. Group revenues decreased 6 percent to €3.533 billion in the first quarter of 2014 from €3.751 billion in 2013. Currency-neutral Wholesale revenues increased 1 percent due to growth at Adidas. Currency-neutral Retail sales increased 22 percent versus the prior year, as a result of double-digit sales growth at both Adidas and Reebok. Revenues in Other Businesses were down 27 percent on a currency-neutral basis, due to double-digit sales declines at TaylorMade-Adidas Golf. This decline is primarily related to strategic changes the Group is implementing at TaylorMade-Adidas Golf to realign key shipment, product and launch cycles to market demand patterns. Currency-neutral revenues at Rockport also decreased, while sales at Reebok-CCM Hockey grew versus the prior year. Currency translation effects had a negative impact on segmental sales in euro terms. Wholesale revenues decreased 5 percent to €2.357 billion in the first quarter of 2014 from €2.481 billion in 2013. Retail sales rose 10 percent to €794 million versus €722 million in the prior year. Sales in Other Businesses declined 30 percent to €382 million (2013: €548 million).

HERBERT HAINER, ADIDAS GROUP CEO: "Our financial results for the first quarter reflect the challenging start to 2014 which we had expected. Strong performances particularly in the emerging markets and in our own retail were masked by strategic changes to how we go to market at TaylorMade-Adidas Golf as well as adverse currency effects. Looking in depth through our results, however, there are many positive underlying trends. Therefore, we can look forward to an accelerated period of growth and momentum for our Group for the remainder of 2014."

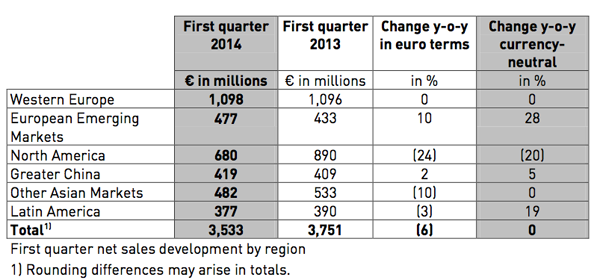

CURRENCY-NEUTRAL SALES INCREASE IN NEARLY ALL REGIONS

In the first quarter of 2014, currency-neutral Adidas Group sales grew in all regions except North America. Revenues in Western Europe remained stable on a currency-neutral basis, as double-digit increases in Germany and Poland were offset by sales declines in Italy and the UK. In European Emerging Markets, Group sales were up 28 percent on a currency-neutral basis, with double-digit sales increases in nearly all markets. Currency-neutral sales for the Adidas Group in North America decreased 20 percent, mainly due to double-digit sales declines in the USA. Sales in Greater China increased 5 percent on a currency-neutral basis. Currency-neutral revenues in Other Asian Markets remained stable, as sales increases in India and South Korea were offset by declines in Japan and Australia. In Latin America, sales grew 19 percent on a currency-neutral basis, with double-digit increases in nearly all markets, in particular Argentina, Brazil, Mexico and Colombia. Currency translation effects had a negative impact on regional sales in euro terms.

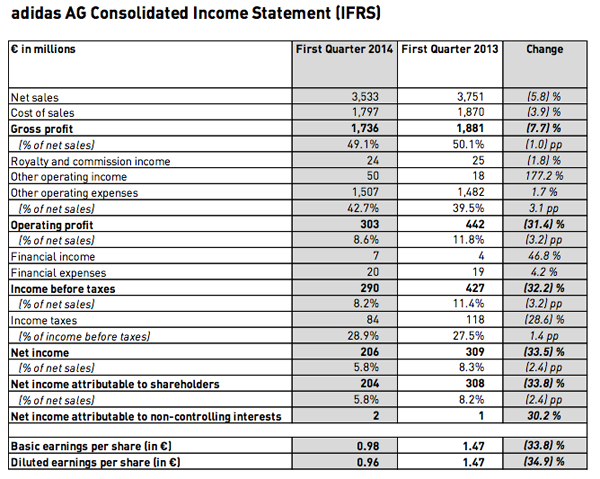

GROUP GROSS MARGIN DECLINES 1.0 PERCENTAGE POINTS

The gross margin of the Adidas Group decreased 1.0 percentage points to 49.1 percent in the first quarter of 2014 (2013: 50.1 percent). This development was mainly due to less favourable hedging rates, lower margins at TaylorMade-Adidas Golf resulting from strategic changes in the product and launch cycles, negative effects resulting from foreign currency devaluation as well as higher input costs. Currency devaluation effects were mainly related to Russia/CIS, where sales and gross profit were negatively impacted by the significant devaluation of the Russian rouble against the euro and the US dollar. Gross profit for the Adidas Group decreased 8 percent in the first quarter of 2014 to €1.736 billion versus €1.881 billion in the prior year.

OPERATING MARGIN DECREASES TO 8.6 percent

Group operating profit declined 31 percent to €303 million in the first quarter of 2014 versus €442 million in 2013. The operating margin of the Adidas Group decreased 3.2 percentage points to 8.6 percent (2013: 11.8 percent). The majority of the decline in operating profit is related to a lower contribution from TaylorMade-Adidas Golf as well as the adverse impacts from negative currency movements. These items amounted to around €80 million and €50 million, respectively. In euro terms, other operating expenses increased 2 percent to €1.507 billion (2013: €1.482 billion), as a result of higher expenditure related to the expansion of the Group’s own-retail activities as well as an increase in sales working budget expenditure. Thereof, sales and marketing working budget expenditure amounted to €444 million, which represents an increase of 2 percent versus the prior year level (2013: €437 million).

FINANCIAL INCOME UP 47 PERCENT

Financial income rose 47 percent to €7 million in the first quarter of 2014 from €4 million in the prior year, mainly due to an increase in interest income.

FINANCIAL EXPENSES INCREASE 4 PERCENT

Financial expenses increased 4 percent to €20 million in the first quarter of 2014 (2013: €19 million). Negative exchange rate variances were the main contributor to the increase.

INCOME BEFORE TAXES DECLINES 32 PERCENT

In the first quarter of 2014, income before taxes (IBT) for the Adidas Group decreased 32 percent to €290 million from €427 million in 2013. IBT as a percentage of sales declined 3.2 percentage points to 8.2 percent in the first quarter of 2014 (2013: 11.4 percent), as a result of the Group’s lower operating margin.

NET INCOME ATTRIBUTABLE TO SHAREHOLDERS DOWN 34 PERCENT

The Group’s net income attributable to shareholders decreased to €204 million in the first quarter of 2014 from €308 million in 2013. This represents a decline of 34 percent versus the prior year level. The Group’s tax rate increased 1.4 percentage points to 28.9 percent in the first quarter of 2014 (2013: 27.5 percent), mainly due to a less favourable earnings mix.

BASIC AND DILUTED EARNINGS PER SHARE DECREASE 34 PERCENT AND 35 PERCENT, RESPECTIVELY

In the first quarter of 2014, basic earnings per share decreased 34 percent to €0.98 versus €1.47 in the prior year. The weighted average number of shares used in the calculation of basic earnings per share was 209,216,186 (2013 average: 209,216,186). Diluted earnings per share decreased 35 percent to €0.96 from €1.47 in the prior year. The weighted average number of shares used in the calculation of diluted earnings per share was 215,233,140 (2013 average: 209,216,186). The dilutive effect results from additional potential shares that could be created in relation to the Group’s outstanding convertible bond.

GROUP INVENTORIES INCREASE 18 PERCENT CURRENCY-NEUTRAL

Group inventories increased 7 percent to €2.505 billion at the end of March 2014 versus €2.346 billion in 2013. On a currency-neutral basis, inventories were up 18 percent, as a result of the Group’s expectations for growth in the coming quarters as well as higher inventories in Russia/CIS.

ACCOUNTS RECEIVABLE UP 2 PERCENT CURRENCY-NEUTRAL

Group receivables decreased 7 percent to €2.176 billion at the end of March 2014 (2013: €2.328 billion). On a currency-neutral basis, receivables were up 2 percent.

NET BORROWINGS INCREASE €74 MILLION

Net borrowings at March 31, 2014 amounted to €254 million, compared to net borrowings of €180 million in 2013, representing an increase of €74 million. This increase is mainly a result of higher capital expenditure during the first quarter of 2014. In addition, currency translation had a negative effect of €12 million. The Group’s ratio of net borrowings over EBITDA amounted to 0.2 at the end of March 2014 (2013: 0.1).

ADIDAS GROUP CONFIRMS GUIDANCE FOR THE FULL YEAR 2014

Adidas Group sales are forecasted to increase at a high-single-digit rate on a currency-neutral basis in 2014. In particular, this year’s major sporting events will provide positive stimulus to Group sales. As the Official Partner of the 2014 FIFA World Cup in Brazil, the Adidas brand will be the most visible brand during the event and will benefit from record sales in the football category. Group sales development will also be favourably impacted by the Group’s high exposure to fast-growing emerging markets as well as the further expansion of Retail. Currency translation is expected to have a significant negative impact on the Group’s top-line development in euro terms.

In 2014, the Adidas Group gross margin is forecasted to increase to a level between 49.5 percent and 49.8 percent (2013: 49.3 percent). Improvements are expected in most segments. Group gross margin will benefit from a positive pricing, product and regional sales mix, as growth rates in high-margin emerging markets are projected to be above growth rates in more mature markets. In addition, the Reebok brand will positively influence Group gross margin development. However, these positive effects will be partly offset by less favourable hedging terms compared to the prior year, negative exchange rate variances in emerging markets such as Russia and Argentina, as well as increasing labour costs in our cost of sales.

In 2014, the Group’s other operating expenses as a percentage of sales are expected to be around the prior year level (2013: 42.3 percent). Sales and marketing working budget expenses as a percentage of sales are projected to increase modestly compared to the prior year. Marketing investments will be centred on major sporting events such as the 2014 FIFA World Cup and highly innovative product launches, particularly in the running category. Further, the Group will support Reebok’s growth strategy in key fitness categories, leveraging partnership assets such as CrossFit, Spartan Race and Les Mills. Operating overhead expenditure as a percentage of sales is forecasted to decrease modestly in 2014. Higher expenses in the Retail segment due to the planned expansion of the Group’s store base will be offset by leverage in other areas.

In 2014, the operating margin for the Adidas Group is forecasted to be at a level between 8.5 percent and 9.0 percent (2013 excluding goodwill impairment losses: 8.7 percent). The Group tax rate is expected to be at a level of around 28.5 percent and thus more favourable compared to the 2013 tax rate excluding goodwill impairment losses of 29.0 percent. As a result of these developments, net income attributable to shareholders is expected to be at a level between €830 million and €930 million compared to the 2013 net income attributable to shareholders, excluding goodwill impairment losses, of €839 million. This represents basic earnings per share of between €3.97 and €4.45.

While we still have to be wary of currencies and their effects on our financials, I expect a strong second quarter to point the way forward to a sustained period of growth and momentum for our Group. Later this month, we will unleash our largest football offensive ever ahead of the 2014 FIFA World Cup. The energy and intensity of our campaign and product concepts will be a clear statement and sign of things to come from our Group as we drive towards the realisation of our strategic goals and our 2014 financial guidance.