The French consulting company Yole Développement releases this month its Sapphire Applications and Market: From LED to Consumer Electronics report. This technology & market report provides a detailed analysis of the status and prospect of the sapphire industry including recent trends and market drivers in established and emerging applications. Itdescribes and analyses why Apple and GTAT are investing more than US$1 billion in sapphire manufacturing…

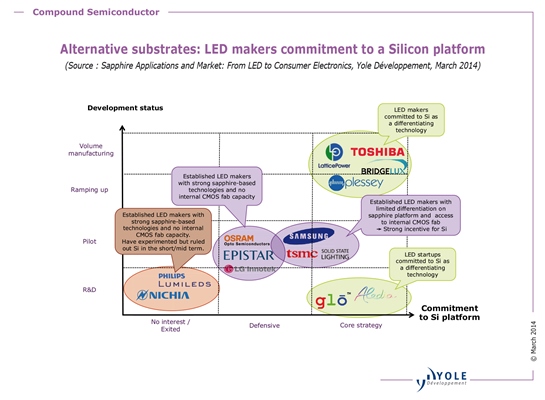

Moreover, Yole Développement's analysis includes drivers for adoption of alternative LED substrates (GaN and Si), sapphire supply and demand trends. In this report, Yole Développement identifies key players (established and emerging companies), with geographic trends and specificities.

After almost 2 years of losses, core prices increased by more than 50% in 2013; tier-1 sapphire vendors are finally selling at prices close to breakeven costs. After a short pause, Yole Développement expects the uptrend to resume through Q2 and Q3. But leading vendors' interests are not to increase prices above levels that would allow tier-2 competitors to generate a profit as well." We therefore expect prices to stabilize by the end of the year. Due to strong competition, finishing companies didn't pass the higher material costs on to their customers. Wafer prices remained stable in 2013 but will go up slightly in Q2-2014. For PSS, which now dominates with 85% penetration rate, prices could increase faster as supply currently falls short of demand in Taiwan", says Eric Virey, Yole Développement. This will continue until leading suppliers increase capacity and emerging players in China ramp up and enter the supply chain later in 2014. Overall, sapphire prices should stabilize by the end of 2014 and start decreasing again in late 2015 as the industry keeps improving its cost structure.

The report provides historical price trends and forecasts for cores and wafers, detailed capacity and revenue analysis, rankings and market share, as well as a thorough supply vs. demand analysis.

… And Apple could completely transform the industry in 2014

Sapphire has been used for years in various luxury cell phones. In 2013 Yole Développement indicated that adoption in more accessible models could start in 2014. This just happened with the introduction by Gionee of the first "non-luxury" (<$1000) smartphone to feature a sapphire display cover. If adopted by leading cell phone OEMs for their flagship models, total sapphire demand could increase by up to 2x by the end of 2014 and 20x by the end of the decade.

On November 4th 2013, GTAT and Apple announced a partnership to set up a large sapphire manufacturing plant in Mesa, Arizona. Yole Développement thoroughly analyzed the deal and reached the conclusion that exiting 2014, the plant could reach a capacity equivalent of more than twice the current worldwide capacity. What for? Demand for home buttons and camera lens covers are expected to increase in 2014 and 2015, but even with aggressive forecasts for smart watches (and assuming that Apple uses sapphire for its own model which Yole Développement's analysts don't believe it will), the company could still tap into the existing supply chain to procure the sapphire it needs. It's therefore difficult to justify this US$1 billion investment unless new applications requiring a lot of sapphire are coming to market. From our analysis, Yole Développement considers cell phone display covers to be the most likely outlet for this capacity.

Yole Développement modeled the Mesa operations and believe that the plant will make sapphire slabs that will then be sliced and polished by Apple subcontractors in China. The simulated slab cost of $6.40 per part would enable a US$17 cost per finished display cover,with a path for <$13 ASP in the midterm. The plant could deliver an equivalent of 42 million display covers in 2014 and more than 85 million in 2015.

The report includes a thorough analysis of the GTAT/Apple deal with everything Yole Développement knows and the remaining grey areas. It explains the rationale behind all key hypothesis of our cost model.