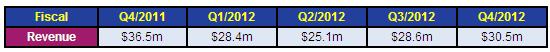

For full-year 2012, GaAs-based broadband wireless and wireline communications component maker Anadigics Inc of Warren, NJ, USA has reported revenue of $112.6m, down 26.3% on 2011’s $152.8m. However, although down 16.5% on $36.5m a year ago, quarterly sales have grown again following the low of $25.1m in Q2/2012, up 6.4% on Q3’s $28.6m to $30.5m in Q4. President & CEO Ron Michels attributes this to “continuing to strengthen our relationship with leading customers and targeting high-growth markets”.

There were again three greater-than-10% customers (Samsung, Huawei and ZTE), plus three at 5-10% (Cisco and distributors Richardson and World Peace).

Revenue for infrastructure (formerly termed broadband) was $5.6m (down 9.6% on $6.2m last quarter). Revenue from legacy WiFi was $1.1m, down slightly from Q3’s $1.3m. Growth was therefore driven by cellular wireless revenue rising by 12.5% from $21.1m last quarter to $23.7m (due mainly to WCDMA, along with some continued sequential growth in LTE). On top of Q3’s 17.4% increase, composite growth of Q4 over Q2 is 32% for cellular wireless.

“We continue to execute to our growth strategy,” says Michels. “Anadigics’ new cellular wireless, WiFi, and infrastructure solutions provide manufacturers with compelling performance and integration advantages,” he adds.

“In cellular wireless, we successfully revitalized the product line throughout 2012 and continued to gain design-win momentum,” says Michels. In early November, Anadigics said that it was shipping production volumes of LTE, CDMA, and WCDMA power amplifiers to Samsung Electronics for the new Galaxy Note II smart-phone. During the quarter, the firm launched four new front-end integrated circuits for 802.11n and 802.11ac WiFi applications (now specified on leading reference designs and ramping up production shipments in Q1/2013).

“Our infrastructure solutions continue to support increasing network build-outs,” he adds. Also during the quarter, Anadigics expanded its family of small-cell power amplifiers (PAs) by launching a model for Band 8 WCDMA and LTE wireless infrastructure. It also launched four hybrid line amplifier module power doubler modules optimized for CATV networks in Asia (with production shipments expected to start in Q2/2013).

R&D expenses shrank again, by 5.2% from $10.8m last quarter to $9.9m, despite the firm continuing to bring more products to market and accelerating new product introductions. Selling & administrative expenses fell just 2%, from $5m last quarter to $4.9m. “We have a plan to continue to control and reduce costs and remain diligent in adding to our efficiencies,” says VP & chief financial officer Terry Gallagher.

Capacity utilization has risen again, from 45% to about 55% (back above 50% a year ago). Non-GAAP gross margin has recovered further, from just above break-even last quarter to 2.5% (though still down on 16.5% a year ago).

On a non-GAAP basis, full-year net loss has grown from $31.7m in 2011 to $62m in 2012. However, although still worse than $9.5m a year ago, quarterly net loss has been cut from $15.3m last quarter to $13.9m. Earnings before interest, taxes, depreciation and amortization (EBITDA) loss was cut from $11.3m to $10.1m (though still almost double the $5.3m a year ago). “Sequential growth and expense control continued to contribute to improvements in our operational metrics,” says Gallagher.

Nevertheless, during the quarter, cash, cash equivalents and short- and long-term marketable securities fell further, from $62.2m to $51.5m. Capital expenditure (CapEx) has risen from just $0.25m last quarter to $0.4m (though still just a quarter of the $1.6m a year ago), while depreciation expense fell slightly to $4m. For the full year, capital spending was $2.8m while depreciation was $16.5m.

“By further strengthening our relationships with leading OEMs and reference design icons, we believe that Anadigics is well positioned for continued success in 2013,” says Michels. “In commenting on the first quarter, we expect revenue growth in WiFi [to 10% of total revenue] to offset some of the seasonal softness in cellular wireless [normally down 10-15%],” adds Gallagher.

“We expect margin headwinds should ease as revenues grow (particularly in WiFi) and we continue our mix of new product to transition,” says Gallagher. “We are receiving positive feedback from customers and are securing design wins in support of revenue growth in 2013.” Anadigics continues to target EBITDA breakeven by year-end, boosted by substantially higher utilization and an expected 80% of Anadigics’ product portfolio being transitioned by then to the firm’s smaller-die (and hence higher-margin) ILD (inter-level dielectric) process.