Strong Chinese manufacturing data was not enough to shake the Australian dollar from its slumber yesterday, with traders glued to any news from Washington as talks over the so-called fiscal cliff went down to the wire.

The Aussie dollar was slightly higher over the session, but still contained within the range that has held it tightly over recent weeks.

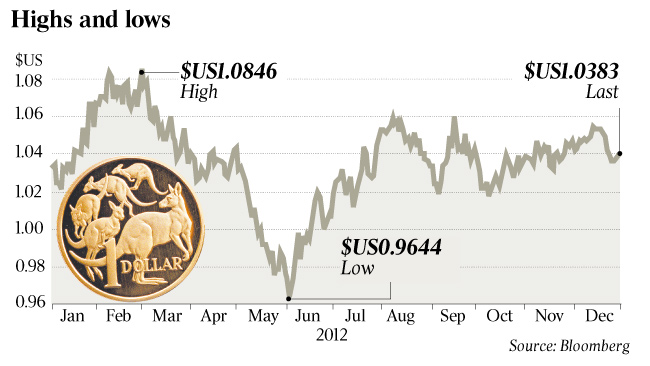

At 5pm AEDT, the dollar was trading at $US1.0383, up US0.09c.

The Washington negotiations to end the deadlock over the looming tax increases and spending cuts, due to come into force on New Year's Day in the US, were continuing overnight.

"Even if the Senate endorses an agreement, safe passage through the Republican-led House of Representatives is by no means guaranteed," UBS economist Gareth Berry said yesterday.

"Time is clearly running out, and so it would be wise to allow for the possibility of a risk sell-off."

The fiscal cliff is a mix of legislated spending cuts and tax hikes that will come into effect today in the US, potentially delivering a jolt to the nation's economic growth.

Andrew Salter, currency strategist at ANZ Bank, said the US budget problems could result in 1.5 percentage points being shaved off economic growth in the first half of this year.

"We think there will only be partial resolution to the talks," he said.

Locally, data on credit growth in November showed business credit had contracted at its fastest monthly pace since the middle of the year.

Economists said the Reserve Bank of Australia could build a case to cut interest rates again this year, because lending remained muted.