Well-healed Australian investors, battered by political uncertainty and the ongoing aftershocks of the global financial crisis, are maintaining their faith in local shares, according to an exclusive survey of individuals with at least $500,000 to invest.

Of the high-net-worth individuals surveyed, 59 per cent directly own shares, although 51 per cent of them are "concerned about" the direction of Australia.

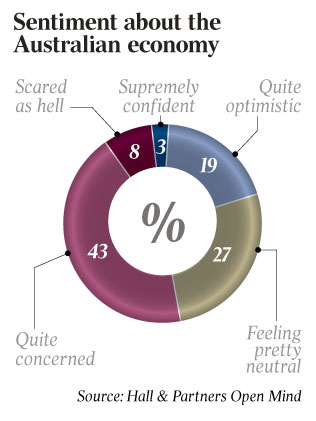

Of these, 8 per cent class themselves as "scared as hell" and many are worried they will not have enough to retire on.

The survey was carried out amid jitters ahead of the September 14 federal poll, weak consumer sentiment and concern over the future of Australia's resources boom.

Given that, the HNWIs are unwilling to flee the safe harbour of cash altogether, with 70 per cent of the respondents maintaining at least some funds in an ordinary bank account.

The findings are part of an inaugural in-depth survey of 202 respondents conducted exclusively for The Australian's Wealth Intelligence series by research house Hall & Partners/Open Mind. The full results of the survey are published in print and online today.

While the interviews were conducted before last fortnight's market rout that has seen 5 per cent wiped off the value of the local bourse, the results clearly indicate that the desire among Australians, particularly the wealthy, to invest directly in the stockmarket remains strong.

The high level of ownership among the wealthy indicates a bias towards the stockmarket, compared with the average investor. The Australian Securities Exchange's recent biannual share ownership study found that 38 per cent of adult Australians directly owned shares.

This was well down on 46 per cent just before the global financial crisis began in 2007, but was still high by global standards.

But, as with the broader population, bricks and mortar continue to be alluring for the HNWIs, with more than half the sample (54 per cent) owning an investment property.

When it comes to their own local share portfolio there's more comfort, with 43 per cent feeling neutral about prospects and a further 35 per cent confident or "supremely confident".

Sentiment towards their overall portfolios is mixed, with one-third concerned, one-third optimistic and one-third "feeling pretty neutral".

Alex Moffat, director of broker Joseph Palmer & Sons, said the trends accorded with the behaviour of his own wealthier clients, who continued to seek attractive high-yielding shares while maintaining an unusually large cash buffer.

"No one I can think of is over-confident," he said. "They are cautiously positive. We have seen a fair bit of money come out of deposits in October and go back into the sharemarket.

"It's not overexuberance, it's just a realisation that cash returns are not working at current levels."

Mr Moffat added that there had been noticeable rising interest in local shares from foreign HNWIs since the Australian dollar began abating.

Veteran Melbourne broker Richard Morrow said the even spread of bullish and bearish clients showed a "market in equilibrium". In his experience, high-net-worth clients were disinclined to make rash investment decisions and the survey results bore this out.

"People who have accumulated these investments are fairly experienced and are not likely to have panicked over the last few years," he said. "After all, they lived through and survived the GFC."

The survey indicated that respondents were evenly divided between losing money from their investments, suffering low capital growth and not achieving adequate income or yields.

Ahead of Tuesday's Reserve Bank meeting on interest rates, HNWIs are also ambivalent about whether the cash rate, currently at 2.75 per cent, will be cut to further record lows.

One-third of respondents believe the official cash rate will be higher within 12 months, 28 per cent think it will stay the same and the remainder expect it to be lower.

On alternative assets, 8 per cent are invested in precious metals.

Art and ethical investments are also favoured on 7 per cent, with wine, antiques and hedge funds on 6 per cent.

Only 3 per cent have invested in carbon credits and, despite the tax advantages, only 1 per cent are attracted to film as an investment.

While one in four have a self-managed super fund, two-thirds of those who don't have no plans to have one in future, citing "too much work and hassle".

Just over half the respondents expected they would be affected by the government's proposed 15 per cent "super tax" on annual retirement income above $100,000.

Geoff Lloyd, the chief executive of fund manager Perpetual, said the survey showed that Australians were worried about the future, but needed to do more to ensure their long-term financial security.

"A majority of the respondents to the survey said that being able to live well in retirement and generating enough income from their assets to live comfortably in retirement were their key investment drivers," Mr Lloyd said. "But they're not confident they will get there."