Iron ore levels remained ascendant for the 3rd consecutive day. It has touching levels last seen in July. Primarily driven by expected economic recovery in Q1 supported by strong critical parameters has set speculative fear in the market. Fear that if the mills do not buy now, the price could run away from them has become prevalent.

All this is based on the expectation that next year the fragile economy will gain further traction, and that demand for steel will increase. But the recent demand could also be because the New Year in China is at the beginning of February, when tradition has it most industries in China are at a near standstill for the celebrations. Hence mills are in a hurry to stock material before price take runaway course in January.

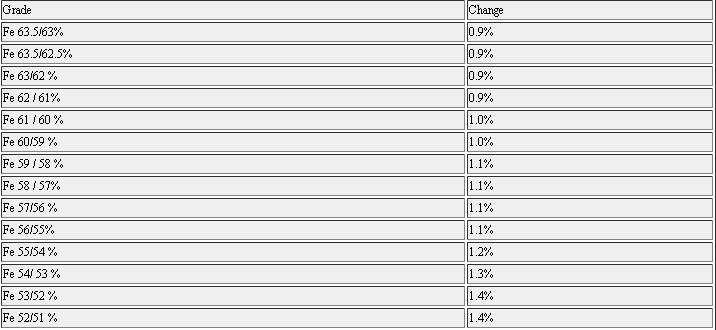

Iron ore fines

Change on 12th December as compared to 11th December 2012