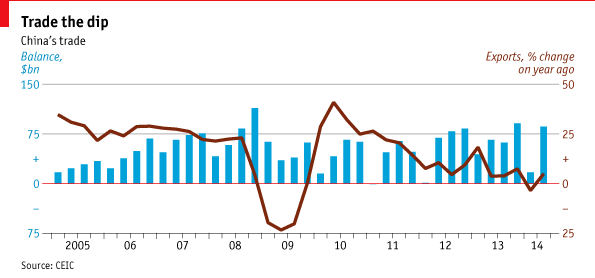

China just notched up its third-largest quarterly trade surplus on record: a whopping $86 billion, equivalent to roughly the entire output of the Danish economy over the same time. But if you look a little bit closer at the seemingly impressive performance, the view is unsettling. China's exports grew 4.9% in the year to the second quarter; that was only the 29th-fastest pace of the past decade and not the source of the big trade gains. For that, turn to imports. They rose 1.3% in the year to the second quarter, the fifth-slowest of the past decade. Put simply, this was a trade surplus from a position of weakness – a reflection of the sluggish domestic economy rather than voracious global demand.

Here's a chart showing how unusual it is for large Chinese trade surpluses to coincide with such middling export growth:

China's massive trade surpluses used to inspire equal parts admiration and anger about its export juggernaut. This past quarter is more likely to add to concerns about its slowing economy. But in the world of GDP accounting, a trade surplus is still a trade surplus. Regardless of the root cause, net exports add to growth. In the first quarter, China's trade surplus was 62% smaller than a year earlier, lopping about 1.5 percentage points off first-quarter growth (GDP grew 7.4% year-on-year in the first quarter). But the trade surplus widened by 31% in the second quarter from a year ago, promising to give a little lift to the overall GDP growth rate, which is due to be reported on July 16th. This helps explain why Li Keqiang, China's prime minister, said this week that although growth had sped up in the second quarter, more policy measures were needed to support the economy. The trade surplus is a nice cushion but not a substitute for domestic strength.