CITI has ended rival UBS's 11-year streak at the top of the stockbroking heap, as brokers warn that an imminent uptick in market activity is unlikely after the worst year since 2005.

"I would say next year will be similar to this year in terms of volumes," said UBS co-head of equities Gary Head, adding that the year's hottest trade -- investors buying defensive, high-yielding stocks -- would continue.

Citi head of equities David Haldane added that while the market rally of more than 14 per cent this year would inject confidence, and volumes had improved, "this does feel more than cyclical".

"We could see these lower volumes continuing for a while," he said. "There are times when equities are in vogue and there are times when they're not. We may still be at a point where they're not in vogue."

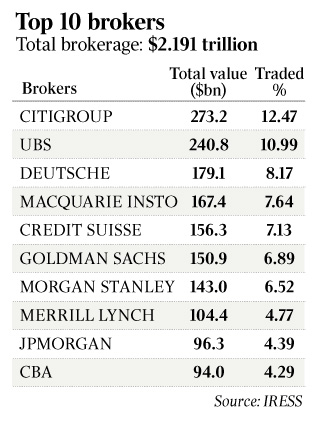

The comments come after stockmarket turnover sank 18.5 per cent to $2.2 trillion this year, the softest year since 2005, according to data from the IRESS trading platform, as investors shy away from risk in favour of term deposits and high-yielding stocks such as banks and property trusts.

Indeed, these are tough times for investment banks, which house the largest broking units, as they have also suffered a sharp fall in fees for advice on capital raisings and takeovers.

Retail brokers Wilson HTM, Patersons, Bell Financial and Shaw Stockbroking posted losses this year, a trend that is expected to drive consolidation after BBY this year bought Cameron Stockbrokers and EL & C Baillieu acquired FW Holst.

"If you wanted to do a tier-two bank raising or some sort of hybrid with a reasonable yield and terms, you can easily raise hundreds of millions to a billion dollars, but if you tried to do an initial public offering for $200m, it was hard work," UBS's Mr Head said.

"Term deposits have been the best risk-return trade probably in the world for retail investors."

Citi handled the most secondary trade on the Australian Securities Exchange and alternate venue Chi-X this year, with 12.5 per cent market share, ahead of UBS at 11 per cent, Deutsche Bank, Macquarie and Credit Suisse, according to the IRESS data. Citi's win marks the first time UBS has not topped the table since 2000, when Merrill Lynch was crowned.

While there is debate over the relevance of the data following the rise in high-frequency trading, investment banks spruik market share to win other deals from fund managers and companies.

Mr Head said the firm had moved away from looking at the headline market share data and was "sifting down" to assess the stock it crossed for clients and "the commission we're capturing".

Brendan Lyons, co-head of equities at Goldman Sachs, agreed that the relevance of headline market had decreased and said he was more focused on its rankings on fund managers' panels, which ultimately determined how much trade brokers were awarded.

The rise of high-frequency trading -- ultra-fast trades by computer programs that some brokers estimate has grown to 30 per cent of market turnover -- at a time when volumes are weak and compliance and IT costs are going up is raising tensions.

Rivals say UBS's and Citi's market shares are boosted by electronic trading firms using their broker codes.

The corporate regulator is reviewing an array of regulation around HFT and alternate trading venues known as dark pools amid concerns of fund managers.

But Mr Haldane said the market share rankings would be the same even if HFT was stripped out.

Mr Haldane added that the global investment banks would continue to invest in equities in Australia for strategic reasons and because of the potential strong return on risk-weighted assets, signalling that an easing in competition is unlikely.

"It's still a market where the commissions that come from the local funds are worth chasing," he said. "That said, it has become a much more cost-conscious business. People are drilling down much more on commission rates, how many people they need to run a business and doing things as efficiently and as well as they can."

Wilson HTM boss Andrew Coppin, who has been streamlining the firm since taking the reins a year ago, was more upbeat after a recent lift in activity. "I'm not saying we're printing money, but it's more buoyant than it has been and the outlook is better," he said.

Mr Haldane said yield stocks "can't rally forever" and investors may start to "question whether they should start moving into equities" given interest rates on bonds are low.

Mr Lyons said "it wouldn't surprise us if volumes have bottomed".

Goldman expects the stockmarket to rise next year, which would bode well for equities.

UBS's December 2013 target for the S&P/ASX 200 is 4800. But Nomura and JPMorgan are more bearish, expecting it to be at 4200 and 4250, respectively, versus yesterday's close of 4671.

"Most of the returns in 2013 will be generated by dividends, although the index could end the year around 4700 if further RBA rate cuts and a weaker Australian dollar generate optimism," said Russell Investments.