INVESTORS traded through the political leadership drama in Canberra yesterday with an eye firmly on the federal election in September, encouraged that almost three years of minority government that has contributed to uncertainty on policy would soon end.

Brokers and investors said a change of Labor leadership would have made little difference to investment markets and business because it would be unlikely to result in a change of policy direction in the next six months -- but they despair at the political distraction dominating the nation.

The chief investment officer at Wilson Asset Management, Chris Stott, said the "investor and business community would feel far more confidence if there was more political stability in Canberra".

UBS's Australian head of equities distribution, George Kanaan, said traders largely shrugged off the leadership drama as more of the same. The caucus ballot went to the partyroom at 4.30pm AEDT after the close of the sharemarket.

"The market has made up its mind that with the election coming up in a few months, what happened here didn't really make a difference to what the potential outcome is in a few months," Mr Kanaan said.

"With the polls indicating a Liberal victory, I think that's where the market's expectation is: the Liberals are going to get up and, as a result, today's noise was that -- just noise."

Warren Hogan, ANZ's chief economist, speaking from Singapore, said the leadership spill was widely remarked upon by people interested in the Australian economy. Mr Hogan said the hung parliament, along with tax increases and recent political instability, had temporarily tarnished Australia's reputation overseas.

"Strong stable leadership is always preferable to instability," Mr Hogan said.

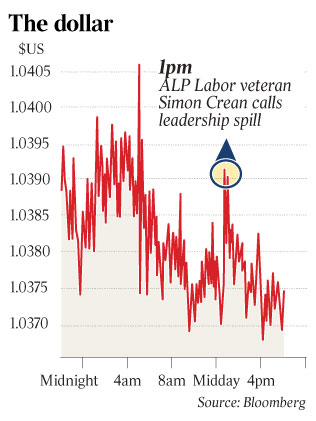

The dollar fell to $US1.0373 from $US1.0391 when now former arts minister Simon Crean called for a leadership spill, and traded around those levels into the evening following the result of the vote, which retained Julia Gillard and Wayne Swan as leader and deputy leader of the Labor Party.

Australian shares swung in a 51-point range, with the S&P/ASX 200 closing 7.9 points lower at 4959.4.

Share prices were buoyed by a stronger reading for China's purchasing managers index, but weakened following the release of local data showing continuing declines in Australian manufacturing orders.

"It's possible the rally (in the afternoon) related to the prospect of a new prime minister, but it's hard to tell," said one analyst.

AMP head of investment strategy Shane Oliver said markets were taking their lead from the international developments and the broader economy, rather than politics.

"The leadership is a bit of a sideshow in the greater scheme of things because whether there was a change to Kevin Rudd or to someone else would not have any bearing on policy between now and the election," he said.

Dr Oliver said the country being run by a minority government had been an "unfortunate period" because it meant policy had not "been formulated as efficiently as possible". But he said international and economic factors had a far greater bearing on the financial markets than local political developments.

Ms Gillard formed a minority government in June 2010 when the dollar was trading at US87c and the S&P/ASX 200 index was at 4479.7. Since then, the currency surged through parity with the US dollar to a "generational high" of $US1.106 on August 1, 2011, and has largely held above parity since, trading at $US1.02-$US1.06 in the past 12 months, hurting export earnings and local manufacturing.

Dr Oliver said the dollar had had a substantial impact on the economy and that had blurred with perceptions of the minority government.

Shares have been more volatile because of concerns about the global economy.