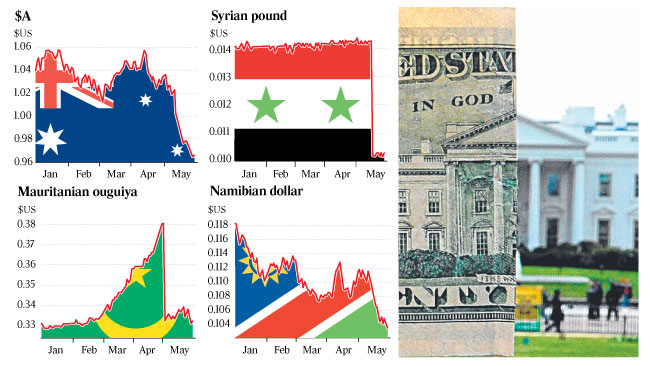

The Australian dollar is slugging it out with the Syrian pound for the title of world's worst-performing currency.

Once the darling of foreign-exchange traders, the Aussie has been out of favour since April 12. According to National Australia Bank, the only global currency that has been more unloved since is from Syria, where a civil war is raging. Even the currencies of Mauritania, Myanmar, Swaziland and Namibia have more friends.

For Aussie dollar bears, the fall has been a vindication.

Record foreign demand for the nation's AAA-rated securities in recent years as Europe's debt crisis raged has propelled the Aussie dollar to historic highs against its rivals.

Surging direct investments also pushed the Aussie higher, prompting some investors to call it a safe-haven currency.

Not everyone was convinced. Some analysts were quick to point out the Aussie was only a minor reserve currency, backed by a country with a gaping current account deficit. In their view, the delinking of the currency's historic correlation to commodity prices and global growth was only temporary.

The truth is probably somewhere in between. For sure, the Aussie is not a safe haven in the classic mould. But it has held up despite volatile commodity prices, record low domestic interest rates and slower growth in China, the nation's biggest trading partner. Traders say there are few signs that the big global reserve managers are cutting their Aussie holdings.

Instead, the sell-off has been driven by leveraged accounts and the collapse of key technical support levels, forcing the liquidation of bullish bets.

Support is expected from the relatively high yields on offer in Australia, and the government's AAA stamp is unlikely to be lost anytime soon.

Australia also continues to enjoy some of the world's most benign economic conditions, even as the mining boom slows. Unemployment remains low at 5.5 per cent and the economy, while patchy, is expected to grow at 2.5 per cent this calendar year.

Still, analysts now feel the currency has entered a new, lower range against the greenback and is unlikely to test new highs. UBS, Goldman Sachs and Commonwealth Bank of Australia were among those downgrading their outlook in recent weeks.

While domestic developments would count, the real driver for fresh selling would be events offshore, especially in the US, said Nick Parsons, global co-head of foreign exchange strategy at National Australia Bank.

"While we already have pencilled in a $US1 to US94c range until end-2014, we warn that the risks around this are asymmetrical and at great risk from stronger economic data in the United States and a resultant stronger US dollar," Mr Parsons said.

For those betting on another Aussie-US dollar parity party, the wait could prove a long one.