As per latest market information from Europe, the steel market continues to face southward headwinds

While the buyers are extremely reluctant to place orders as 2012 is coming to an end, steel mills are pushing up prices, hoping to get at the reopening in January better results.

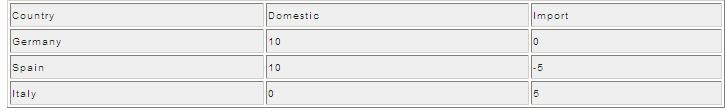

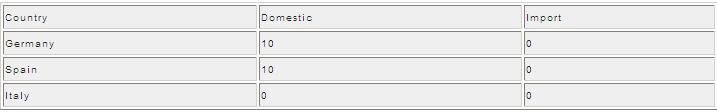

In Germany, local producers are also trying to increase prices but with very limited success.

In Italy everybody is waiting for the release of the almost 150,000 tonnes of Ilva material that should happen next week, as a result of the new government Decree. If this is really happening, believe we can consider the year definitely closed, at least as far as Italian market is concerned.

On the other hand, Russian Mills are increasing HRC prices up to EUR 440 per tonne base Fob Black Sea which is equivalent to a minimum of EUR 460 per tonne to EUR 465 per tonne base CFRFO at sight. This is for Jan production, February shipment but so far no buyers.

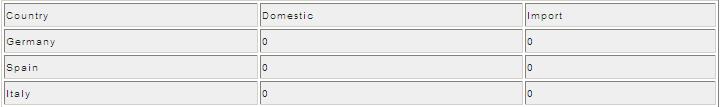

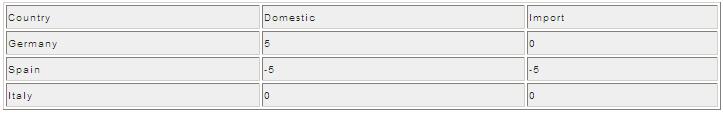

1. Plates

HRP

S 235 / S275JR

5-20x2000

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

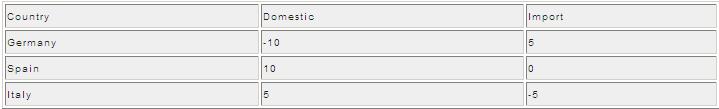

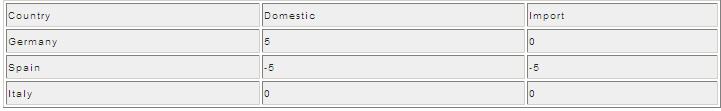

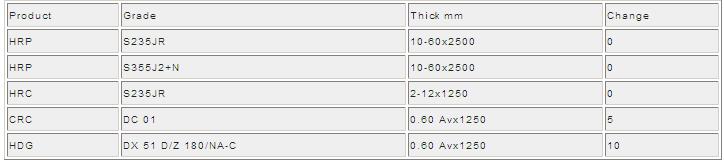

2. Hot Rolled Coils

HRC

S235JR

2-12x1000-1500

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

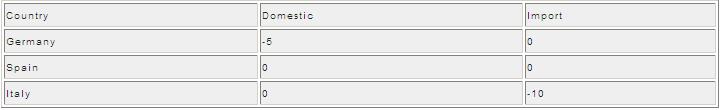

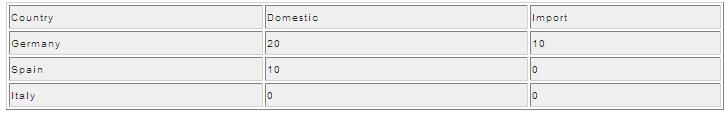

3. Cold Rolled coils

CRC

DC 01

0.60 Avx1250

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

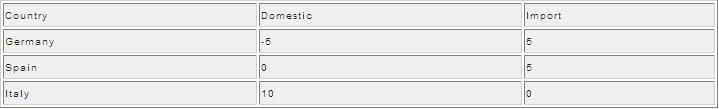

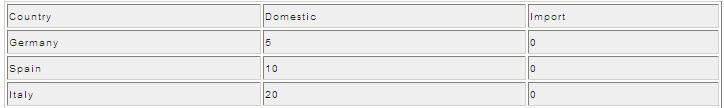

4. Hot Dipped Galvanized

HDG

DX 51 D / Z100-120 / AS

0.55 - 0.57x AW

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

5. Merchant bars

Merchant bars (B)

S235JR

5 to 150 mm

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

6. IPN / UPN

IPN / UPN (B)

S235JR

50 to 400 mm

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

7. HEA/B/M

HEA/B/M (E)

S235JR

100 to 600 mm

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

8. De-Bars

De-Bars (E)

FE500

6 to 40 mm

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

9. WRC Mesh

WR Mesh (E)

S235JR

5.5 to 16 mm

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

10. WRC Drawing

WR Drawing (E)

SAE 1006/8

5.5 to 16 mm

Change is on 14th December as compared to 7th December 2012

In EUR per tonne

(E) - Effective

(B) - Base

CFR Antwerp

Change is on 14th December as compared to 7th December 2012

In EUR per tonne