An unhealthy cash flow cycle exists among Australian businesses, with 62 per cent of accounts settled late and firms taking on average, 52 days to pay their bills, according to the latest Trade Payments Analysis by Dun & Bradstreet.

The lengthy wait explains the cash flow concerns being reported by business executives, and reveals the day-to-day operational challenge for firms looking to stimulate growth in an environment affected by soft sales activity and conservative consumer sentiment.

More than 68 per cent of business executives expect cash flow will be an issue for their business’s operations in the coming months, according to D&B’s National Business Expectations Survey, which also found that more than 28 per cent of executives view outstanding accounts-receivable as their biggest barrier to growth.

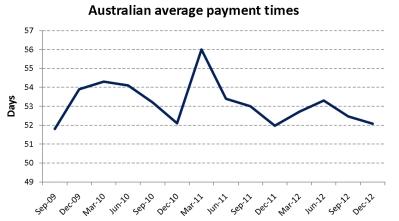

The Trade Payments Analysis, which examines the millions of accounts-receivable records contained on the D&B database, has shown the national average for business-to-business payment times is flat compared to the same time last year, and it remained stubbornly above the 52-day mark for the December 2012 quarter.

The national average for payment times has declined since the height of the global financial crisis, however it has not been less than 52-days since the third quarter of 2009. The relative consolidation at this payment range is reflective of other indicators showing the economy in a period of subdued growth. It also suggests the nation’s businesses will continue to struggle with cash flow at a time when they are already facing challenging trading conditions and higher input costs.

In comparison, average payment times in New Zealand during the final quarter of 2012 were 40 days, and have only been above the 50-day mark during one quarter in the past 10 years.

According to Dun & Bradstreet’s CEO, Gareth Jones, late payments produce a negative knock-on effect for the broader economy.

“Trade credit is an essential form of non-bank finance, and when bills are paid late it withholds essential operating money that businesses need day-to-day, but also to invest and grow,” he said. “If businesses are waiting 52 days to be paid it impacts their ability to pay their own bills, creating an unhealthy cash flow cycle in the economy that removes millions of dollars from the system.

“While the long-term picture shows payment times in Australia coming down since the GFC, they have stalled at more than three weeks past standard terms (30 days) and have remained at this level for the past seven quarters.

“Given we typically see bills paid more slowly after the Christmas period, we expect there will be an increase in average trade payment times for the March 2013 quarter”, he added.

At a state level, average payment times remain highest in the ACT, at 56 days, an increase of two days compared to the same time last year. Businesses in New South Wales are the second-slowest payers, at 53 days, while Tasmanian companies are settling their accounts in the shortest time, at 51 days.

The forestry and mining industries are the nation’s slowest to pay their bills, with a national average of 55 days. This is despite both sectors reducing their payment times by three days, and half-a-day respectively compared to the same time last year. In comparison, businesses operating in the transportation sector are paying their bills nearly one week faster, at an average of 49 days.

Across industries it is the larger companies that continue to take the longest amount of time to make their payments. Companies employing more than 500 workers are taking an average of 55 days to pay their bills, and have been the slowest payers throughout 2012. Companies with between 50 and 199 staff made their payments the most promptly, at an average of 47 days, an improvement of two days compared to a year earlier.

Trade payments analysis provides a financial pulse-check on Australian businesses and the general economy. When the economy is strong, businesses have more cash and pay their bills more promptly, while in times of economic difficulty businesses suffer cash flow constraints which lead to more delayed payments.

According to Stephen Koukoulas, Economic Advisor to D&B, the mixed signals of the economy continue to show up in trade payments data. “Firms, on average, are still tardy in paying their bills. This is another sign, along with the findings from the recent Business Expectations Survey, that the economy remained soft through the course of 2012,” he said.

“While there are clearly positive signals coming through in the recent sharp gains in the stock market, and better news in the global economy, this is yet to flow on to much of the business sector in Australia, with many firms yet to break the shackles of the GFC,” he added. (116)