Australian Securities & Investments Commission chairman Greg Medcraft has declared dark and high-frequency trading "the new normal" of financial markets after two inquiries found no evidence of systemic abuse of the practices.

ASIC found that concerns about high-frequency trading were overstated and proposed regulatory changes to drive share trading volumes back towards the public market, away from broker-owned private networks that have sprung up in recent years.

But the regulator also warned that some investment banks needed to improve practices in the internal markets that they operated to avoid conflicts of interest, keep investors better informed and allow them to opt out of dark trading.

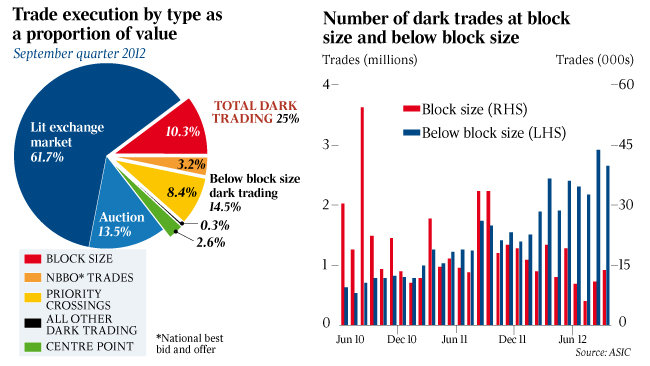

ASIC estimates that as much as 15 per cent of the market is turned over in dark pools without the knowledge or permission of clients and Mr Medcraft said he was concerned that investors needed to at least know that their shares could be traded away from the public market.