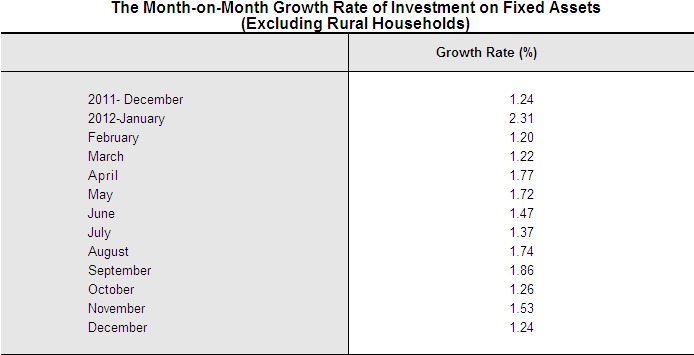

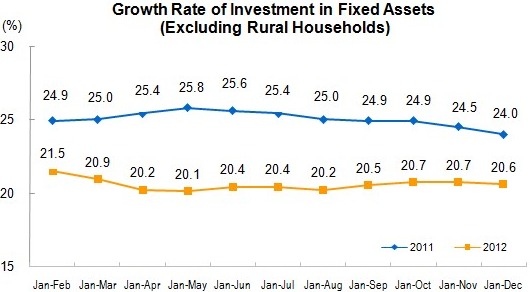

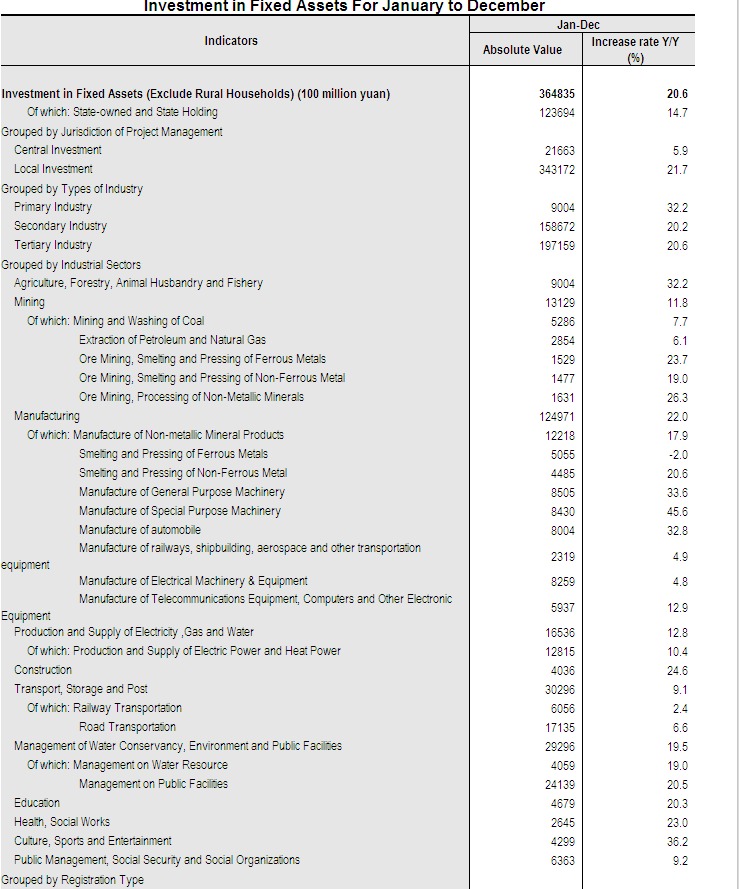

From January to December 2012, the investment in fixed assets (excluding rural households) reached 36,483.5 billion yuan, up by 20.6 percent year-on-year (actual increase was 19.3 percent after deducting price factors), decreased 0.1 percentage points over the first eleven months and decreased 3.4 percentage points over 2011. In December, the investment in fixed assets (excluding rural households) increased 1.53 percent, month-on-month.

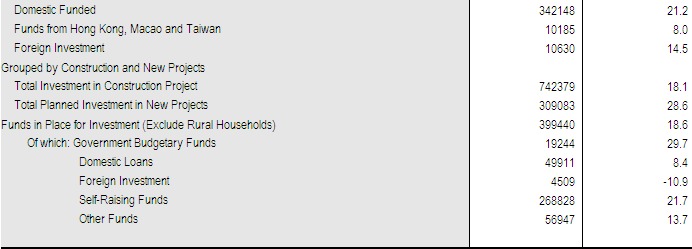

In term of types of registration, from January to December, the investment by domestic enterprises was 34,214.8 billion yuan, up by 21.2 percent year-on-year, and down by 0.2 percentage points over the first eleven month; investment by funds from Hong Kong, Macao and Taiwan was 1,018.5 billion yuan, up by 8.0 percent, 0.8 percentage points lower than that in the first eleven months; and the investment by foreign funds was 1,063.0 billion yuan, up by 14.5 percent, increased 2.7 percentage points over the first eleven months.

In terms of jurisdiction of project management, from January to December, the central investment reached 2,166.3 billion yuan, increased 5.9 percent year-on-year, decreased 0.2 percentage points than that in the first eleven months; while the local investment was 34,317.2 billion yuan, up by 21.7 percent, and the growth rate kept at the same level over the first eleven months.

Analysis on projects under construction or started this year showed that, from January to December, the total planned investment in projects under construction reached 74,237.9 billion yuan, up by 18.1 percent year-on-year, 1.8 percentage points higher over the first eleven months. The total planned investment in newly started projects was 30,908.3 billion yuan, up by 28.6 percent, decreased 0.2 percentage points than that in the first eleven months.

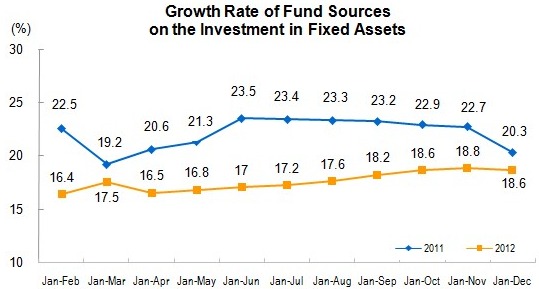

In terms of paid-in funds, from January to December, 39,944.0 billion yuan had been invested, rose 18.6 percent year-on-year, 0.2 percentage points lower than that in the first eleven months. Of this total, the growth of government budgetary funds went up by 29.7 percent, 1.6 percentage points lower over the first eleven months; investment from domestic loans went up by 8.4 percent, 1.4 percentage points lower than that in the first eleven months; that from self-raising funds went up by 21.7 percent, 0.1 percentage points higher than that in the first eleven months, that from foreign investment dropped 10.9 percent, 0.5 percentage points higher than that in the first eleven months, and other investment rose by 13.7 percent, with the growth rate keeping at the same level over the first eleven months.

Note:

For parts of data, the total is not equal to the total of sub-items due to round-off.

Annotations:

1. Explanatory Notes on Indicators

Investment in fixed assets (excluding rural households): refers to the total workload on construction and purchase for fixed assets during a certain period in the form of currency, as well as the concerning expenses.

Paid-in fund: refers to all funds received by investment units used for fixed assets during the reference period, including state budgetary fund, domestic loans, foreign investment, self-raised funds, and others.

Newly started project: refers to all newly started construction projects during the reference period.

State-owned and Stat-holding Enterprises: including absolutely state-holding enterprises, relatively state-holding enterprises and consultatively state-holding enterprises. Absolutely state-holding enterprises refer to those enterprises that the proportion of state investment capital to the total actual capital (or capital stock) is larger than 50 percent.

Relatively state-holding enterprises refer to those enterprises that the proportion of state investment capital to the total actual capital (or capital stock) is less than 50 percent, but larger than any other single share holders. Consultatively state-holding enterprises refer to those enterprises that the proportion of state investment capital to the total actual capital (or capital stock) is less than other share holders, but owning the real control power regulated by agreement.

The enterprises which the proportion of investment capital of the two investors is 50 percent, and the share holding control power is not clearly stated by either side, if one of them is state-owned, are all classified as the state-holding enterprises without exception.

The investment projects invested by the administrative and institutional units are all classified as state-holding.

Types of Registration: the types of registration on the enterprises are based on the Provisions for the Classification of Types of Enterprise Registration jointly issued by NBS and State Administration of Industry and Commerce. And that on the individual operation is based on Note on the Code & Classification of Types of Individual Operation Registration.

According to the provision of statistical reporting system, all grassroots units shall fill in registration types. The registration types shall be filled in by the enterprises or individual operation units engaged in investment in fixed assets. Those who have already registered in the industrial and commercial administrative units, shall fill in based on the registration types, if unregistered, shall be filled in based on the registration types of investors or that on the provisions of related papers.

Domestic enterprise includes state-owned enterprise, collective enterprise, joint enterprise, limited liability enterprise, share-holding enterprise, private enterprise and others.

Enterprises with funds from Hong Kong, Macao and Taiwan includes joint-venture and cooperation by Hong Kong, Macao and Taiwan, Hong Kong, Macao and Taiwan Sole Investment, Hong Kong, Macao and Taiwan Funded Share-holding Corporations Ltd., and other investment enterprises by Hong Kong, Macao and Taiwan.

Foreign investment enterprise includes joint-venture and cooperation enterprises, foreign funded enterprise, foreign funded share-holding corporations Ltd., and other foreign investment enterprises.

2. Statistical Coverage

Refers to construction projects on fixed assets and real estates involving a total planned investment of 5 million yuan and over.

3. Data Collection

The report of investment on fixed assets is collected monthly with complete enumeration (no report in January).

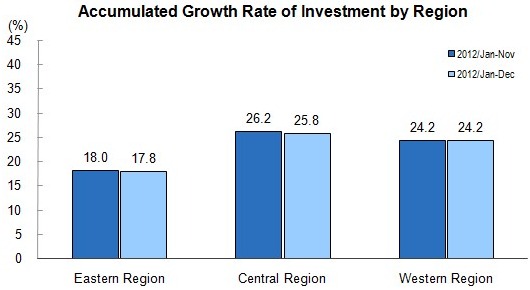

4. Classification on East, Central and West Region

Eastern region: including Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Hainan. Central region: including Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan. Western region: including Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang.

5. Standard Industrial Classification

Since 2012, NBS performed the new standard on industrial classification for national economic activities (GB/T 4754-2011).

6. Explanatory Notes on Growth Rate

The growth rate of investment in fixed assets are calculated in nominal except that in Jan.- Mar., Jan.-Jun., Jan-Sep. and Jan.-Dec. in case of the price indices of investment in fixed assets are calculated on quarterly.

According to the survey program, the annual report data was used instead of fast report data at the end of 2011, the related growth rates have been adjusted accordingly.

7. Revision on Month-on-Month Data

According to the auto-revision function of the seasonal adjustment model, the month-on-month growth rate of investment on fixed assets from December 2011 to December 2012 has been revised as follows: