With Christmas and an end to 2012 fast approaching, the overdrive of recent months appears to be dissipating somewhat as new deals slow, deliveries / beachings wind down and cash buyers, owners and end buyers alike continue to count their losses.

A record 55 vessels were beached in India last month with over 100 for both October and November combined, and a period of cool down is now perhaps needed as steel prices and the currency show few material signs of a prompt recovery.

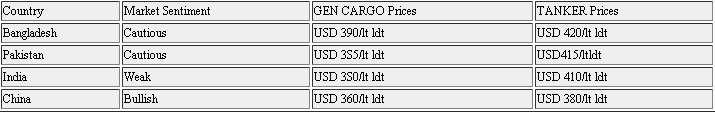

With that in mind, prices remain firmly rooted below USD 400/LT LDT for standard dry vessels and slightly above for wet units. Pakistan was echoing the sentiment of their Indian neighbours with buyers only realty emerging at firm levels for select units while a whole swathe of average units continuing to seek market levels remaining unsold.

The same approach was true of Bangladesh for the right vessels (usually large LDT with decent specs and tankers strictly gas free for hot works), there were buyers emerging, but at far more underwhelming levels than had been anticipated for a market expected to return to form aggressively.

Indeed, even the recently recovered Chinese market settled back into their comfort zone this week, dropping back down to the mid-300s/LT LDT on both wet and dry candidates.

This all round apathy to acquire will perhaps characterize the end of the year with still plenty of vessels stocking local yards and a concerted period of digestion and stability in steel prices / currency needed in order for aggressive buying to resume.

Whether the New Year will bring with it a renewed energy and rejuvenated sentiment remains to be seen, but the markets at this stage could perhaps be forgiven for appearing a touch weary!

For week 49 of 2012, GMS demo rankings for the week are as below: