Shoe Carnival Inc. exceeded its net sales, comp store sales and earnings guidance in the third quarter thanks to strong sales of fashion boots, the roll out of national advertising, the addition of new brands in its women's department, and an upgraded e-commerce platform.

Third Quarter Highlights

Net sales increased $18.9 million to $254.7 million, as compared to net sales reported for the third quarter of fiscal 2013, exceeding the company’s guidanceComparable store sales increased 2.3 percent in the third quarter of fiscal 2014, exceeding the company’s guidanceEarnings per diluted share for the third quarter were 54 cents, exceeding the company’s guidancePer-store inventories were down 0.6 percent at the end of the quarter, as compared to the third quarter last year244,000 shares of common stock were repurchased during the quarter under the current share repurchase program“We are pleased to report results that exceeded our expectations for net sales, comparable store sales and earnings per share for the third quarter. These results reflect strong sales in our fashion boot category and progress in key initiatives we announced last year, mainly, national advertising, better brands in our women’s department and a reinvigorated e-commerce presence. I am proud of the entire Shoe Carnival family and believe our strategy will continue to benefit long-term sales and earnings growth,” commented Cliff Sifford, President and CEO.

Third Quarter Financial Results

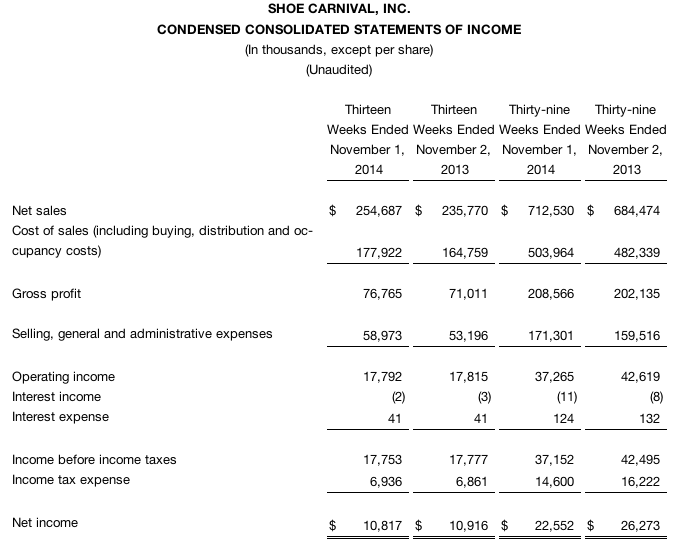

The company reported net sales of $254.7 million for the third quarter of fiscal 2014, an 8.0 percent increase, as compared to net sales of $235.8 million for the third quarter of fiscal 2013. Comparable store sales increased 2.3 percent in the third quarter of fiscal 2014.

The gross profit margin for the third quarter of fiscal 2014 was 30.1 percent which was unchanged compared to the third quarter of fiscal 2013. The merchandise margin increased 0.2 percent. Buying, distribution and occupancy expenses increased 0.2 percent as a percentage of sales.

Selling, general and administrative expenses for the third quarter of fiscal 2014 increased $5.8 million to $59.0 million. As a percentage of sales, these expenses increased to 23.1 percent compared to 22.5 percent in the third quarter of fiscal 2013.

Net earnings for the third quarter of fiscal 2014 were $10.8 million, or $0.54 per diluted share. For the third quarter of fiscal 2013, the company reported net earnings of $10.9 million, or $0.54 per diluted share.

Nine Month Financial Results

Net sales during the first nine months of fiscal 2014 increased $28.1 million to $712.5 million as compared to the same period last year. Comparable store sales for the thirty-nine week period ended November 1, 2014 decreased 0.4 percent. Net earnings for the first nine months of fiscal 2014 were $22.6 million, or $1.12 per diluted share, compared to net earnings of $26.3 million, or $1.29 per diluted share, in the first nine months of last year. The gross profit margin for the first nine months of fiscal 2014 was 29.3 percent compared to 29.5 percent last year. Selling, general and administrative expenses, as a percentage of sales, were 24.1 percent for the first nine months of fiscal 2014 compared to 23.3 percent last year. The company opened 30 stores during the first nine months of fiscal 2014 as compared to opening 29 stores during the first nine months of last year.

Share Repurchase Program

In the third quarter of fiscal 2014, the company repurchased approximately 244,000 shares of its common stock at a total cost of $4.5 million. For the nine months ended November 1, 2014, approximately 405,000 shares were repurchased at an aggregate cost of $7.5 million. The amount that remained available under the share repurchase authorization at November 1, 2014 was $12.8 million.

Fourth Quarter Fiscal 2014 Earnings Outlook

For the 13 weeks ending January 31, 2015, earnings per diluted share are expected to be in the range of $0.06 to $0.10, compared to $0.03 in last year’s fourth quarter. The company’s guidance is based on the expectation that fourth quarter net sales will be in the range of $218 to $222 million. This expectation includes a comparable store sales increase to be in the range of 3 to 5 percent.

Looking ahead, Mr. Sifford stated, “Our customers’ reception to our trend right product assortment combined with a strong fourth quarter marketing presence gives us confidence to expect continued increases in comparable store sales and earnings for the fourth quarter.”

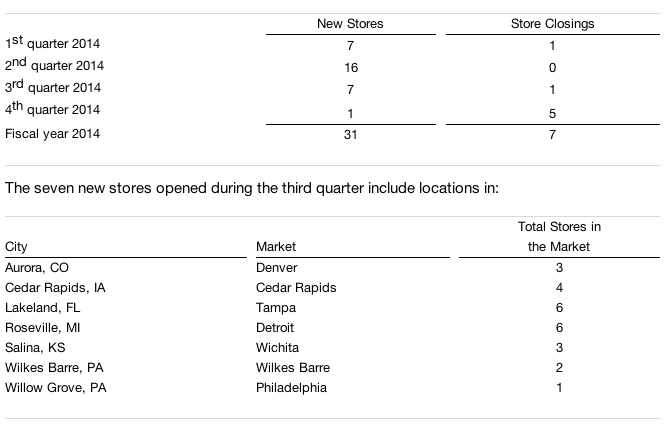

The company expects to open 31 new stores and close seven stores in fiscal 2014. Store openings and closings by quarter for the fiscal year are as follows: