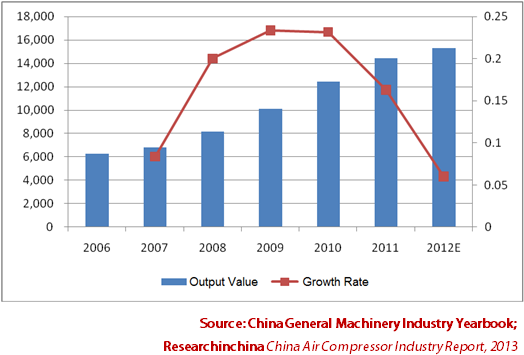

With the growth of Chinese economy, the demand for air compressors keeps rising, fueling the spring-up of China air compressor manufacturing industry. According to the statistics from China General Machinery Industry Association Compressor Sub-Association, the output value of compressors increased by 16.3% to RMB14.454 billion in 2011, while that in 2012 grew by roughy 6% to RMB15.321 billion.

Output Value of Air Compressors, 2006-2012 (RMB mln)

The most popular air compressors in China are screw compressors and piston air compressors. The former has such merits of energy conservation and cost effectiveness that gain wide acceptance in the market, so the market growth is well above the industrial average and it may well be that the screw compressor will replace piston air compressor. In 2006-2012, the market occupancy of screw compressor soared to 74% from 52% in China air compressor market, while the output value in 2012 hit RMB11.34 billion. By contrast, the output value of piston air compressor posted RMB3.33 billion, while the sales percentage dived to 21.7% of China's total.

As of 2013, China's top air compressor enterprises include Kaishan Group, Zhejiang Hongwuhuan, JCEP, Shanghai Feihe Industrial Group, and Wuxi Compressor. In particular, Kaishan Group holds an advantage in the R&D of new products. In 2012, the sales from screw compressor business of Kaishan accounted for 71.92%, while that from piston air compressor business made up 11.98%. In 2013, Kaishan is scheduled to highlight the R&D of high-pressure screw air compressors. As long as high-pressure screw air compressors are industrialized, Kaishan will seize some market shares from Atlas Copco and Sullair.

The report sheds light on the followings:

overview of China air compressor market: industrial evolution, laws and regulations, market scale, status quo and prediction;

overview of China air compressor market: industrial evolution, laws and regulations, market scale, status quo and prediction;

China air compressor market breakdown: market scale, competition pattern and development trend of screw compressor, piston air compressor, centrifugal compressor , axial-flow compressor, etc.

China air compressor market breakdown: market scale, competition pattern and development trend of screw compressor, piston air compressor, centrifugal compressor , axial-flow compressor, etc.

Profile, financial data, capacity layout, development in China and the latest strategy of 9 domestic air compressors, including Kaishan, HanBell Precise Machinery, Xi'an Shaangu Power, Jingtongling, Wuxi Compressor, as well as 7 well-known foreign peers like Ingersoll Rand, Atlas Copco, Fusheng, GE, Siemens, and Cameron.

Profile, financial data, capacity layout, development in China and the latest strategy of 9 domestic air compressors, including Kaishan, HanBell Precise Machinery, Xi'an Shaangu Power, Jingtongling, Wuxi Compressor, as well as 7 well-known foreign peers like Ingersoll Rand, Atlas Copco, Fusheng, GE, Siemens, and Cameron.