After years of development, it has gradually formed five districts of Chinese furniture industry: the Pearl River delta (Guangdong province is the center, which includes Guangzhou, Shenzhen, Dongguan, Shunde, Foshan, etc.), the Yangtze River delta (its center contains Jiangsu, Zhejiang and Shanghai area, where furniture industry grows fastest), the Bohai Rim, the Northeast industrial district and the Northwest industrial district. The Pearl River delta and the Yangtze River delta are the main districts with biggest output and highest export value, shaping the distribution situation from south to north together with the Bohai Rim and the Northeast industrial district for eastern coastal areas. Export production enterprises and large-scale production enterprises distribute densely in the four districts and they are the main suppliers of domestic market and major regions for Chinese furniture export. The west industrial district focuses on the domestic market. Guangdong province takes a half of Chinese furniture industry total output, while Zhejiang takes 15%, the Bohai Rim takes 8%-10%, and the Northeast takes less than 15% and Sichuan takes nearly 10%.

In 2005, China took Italy's place as the largest exporter of furniture, with an export value of 13.5 billion US dollars. Chinese furniture exports account for a proportion of 22% of the world and the major importers were the US, the European Union and the ASEAN, among which the US was the top importer. From January to July, 2012, the cumulative export value was 8 billion US dollars, accounting for 30% of total export amount in the same period of Chinese furniture exports.

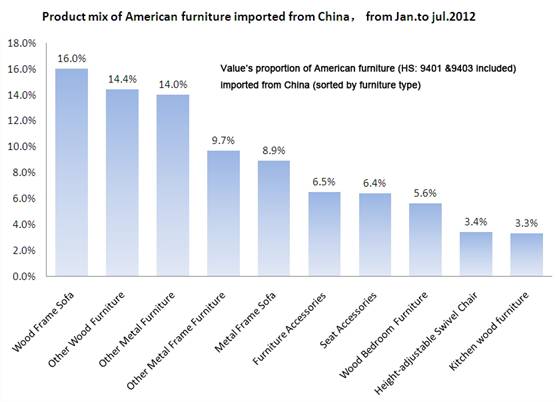

I.Product mix of American furniture imported from China

Proportion of American furniture import value (HS: 9401 &9403 included) imported from China (sorted by furniture type)

(Data Source:China Customs)

The US is the largest importer of Chinese furniture. China Customs statistics show that from January to July 2012, China's furniture exports to the U.S. (including HS: 9401 and 9403, in the following text, "furniture" refers to product contained in HS: 9401 and 9403) cumulated to a total of nearly 80 billion U.S. dollars, accounting for 30% of the total furniture exports over the same period.

From the view of material, the Chinese-made wooden furniture and metal furniture are very popular in the U.S. market. In the first seven months of 2012, the amount of imported wooden furniture from China accounted for 43.1% of the United States’ total imports of furniture, while metal furniture accounted for 33.1%.

From the view of product category, sofa is one of America's most important imported furniture. In the first seven months of 2012, the value of sofa imported from China amounted to 1.98 billion U.S. dollars, taking nearly 1/4 of the total imports of furniture. Wood frame sofa imports accounted for 64% of the total sofa imports, while the metal frame sofa accounted for 36%.

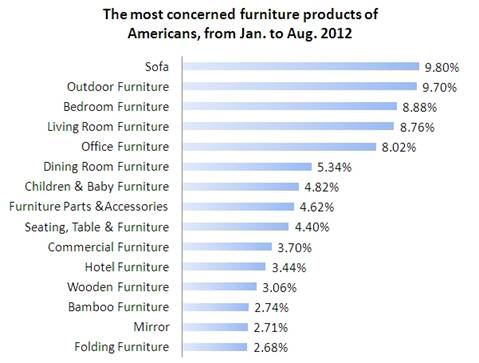

II. The most concerned furniture products of Americans, from Jan. to Aug. 2012 (ranked by attention)

(Data source: Made-in-China.com)

According to the statistics of Made-in-China.com, in the first eight months of 2012, U.S. buyers concerned about sofa most, accounting for 10% of total attention. Outdoor furniture ranked two, accounting for 9.7%, followed by bedroom furniture, living room furniture and office furniture respectively.