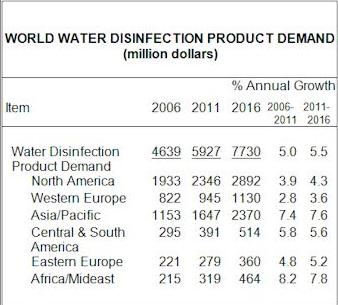

World demand for water disinfection products is projected to increase 5.5 percent per year to $7.7 billion in 2016. Significant changes are occurring around the world for a number of reasons.

There is continued concern about disinfection byproducts (DBPs), many of which are known or suspected carcinogens. Outbreaks of waterborne illness continue to occur even in developed countries as pathogens such as Cryptosporidium and Giardia lamblia are resistant to chlorine. Heightened security and anti-terrorism measures have led to increased regulatory costs. Finally, standards for water quality and wastewater treatment around the world are tightening -- including pressure to treat wastewater so that it is suitable for reuse or resupply of source waters. These and other trends are presented in World Water Disinfection Products, a new study from The Freedonia Group, Inc., a Cleveland-based industry market research firm.

The net result of these factors has been a switch from elemental chlorine in favor of higher value chemicals and advanced treatment technologies. While there is considerable regional variation in the degree to which chlorine alternatives are favored, sodium hypochlorite and hypochlorite generators, UV equipment, and ozone equipment will be the main beneficiaries of these changes. In addition to environmental advantages, growth in the use of equipment will be spurred by technological improvements and reduced costs, both of which have made these alternatives more attractive options. However, chlorine will remain important -- especially in the developing world.

The most dramatic changes in product mix are occurring in the municipal market. This trend is led by the US, which is pushing to replace chlorine gas. Around the world, municipal water treatment systems are reviewing their disinfection choices to determine the best technology. Growth in the industrial market will accelerate due to improving levels of manufacturing activity. Industrial users favor high-end chemicals and nonchemical disinfection techniques, but chlorine and other commodities have a large presence in industrial markets in developing countries. The recreational market is dominated by a handful of countries -- namely the US, Brazil, Spain, France, Germany, Italy, Australia, South Africa, and Mexico.