Global Toy (HS: 9503) Import and Export Trend Analysis

2011-2013 Global Toy Import Trend Analysis

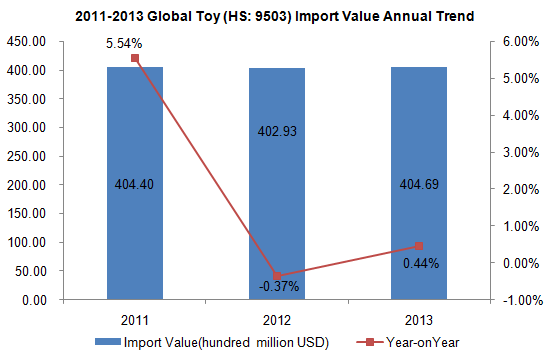

2011-2013 Global Toy Import Value Trend

Global import value of toys showed a V-shaped trend from 2011 to 2013, the import value for these three years amounted to 40.44 billion US dollars, 40.293 billion US dollars and 40.469 billion US dollars, while the import value of 2013 increased slightly by 0.44% compared with the same period of 2012.

2011-2013 Global Toy Major Import Countries/Regions

| No. | Import Countries/Regions | Import Value (Thousand USD) | Import Value Growth Compared 2013 with 2011 | ||

|

|

| 2011 | 2012 | 2013 |

|

| 1 | USA | 11,527,881 | 11,545,197 | 11,747,167 | 1.90% |

| 2 | Germany | 2,669,542 | 2,517,016 | 2,648,984 | -0.77% |

| 3 | United Kingdom | 2,765,139 | 2,387,736 | 2,492,680 | -9.85% |

| 4 | Japan | 1,905,208 | 2,089,156 | 1,980,887 | 3.97% |

| 5 | France | 2,015,203 | 1,877,735 | 1,970,999 | -2.19% |

| 6 | Russian Federation | 990,491 | 1,232,337 | 1,427,575 | 44.13% |

| 7 | Canada | 1,209,874 | 1,316,966 | 1,349,981 | 11.58% |

| 8 | Hong Kong | 2,228,510 | 2,284,463 | 1,070,921 | -51.94% |

| 9 | Belgium | 998,403 | 906,080 | 1,069,460 | 7.12% |

| 10 | Italy | 1,130,944 | 996,336 | 995,191 | -12.00% |

| 11 | Australia | 853,514 | 928,429 | 932,375 | 9.24% |

| 12 | Czech Republic | 762,582 | 794,967 | 903,540 | 18.48% |

| 13 | Netherlands | 885,496 | 805,544 | 856,108 | -3.32% |

| 14 | Spain | 911,713 | 793,257 | 841,620 | -7.69% |

| 15 | Mexico | 810,379 | 825,465 | 838,658 | 3.49% |

| 16 | Poland | 502,840 | 498,958 | 591,451 | 17.62% |

| 17 | Republic of Korea | 407,499 | 475,297 | 561,873 | 37.88% |

| 18 | Austria | 396,793 | 384,470 | 409,111 | 3.10% |

| 19 | Brazil | 396,993 | 401,966 | 390,607 | -1.61% |

| 20 | Turkey | 419,339 | 369,286 | 373,989 | -10.81% |

From 2011 to 2013, the United States, Germany and the United Kingdom were the first three importing countries of global toys. Among the global top twenty toys import markets in 2013, the Russian Federation's import value of toys increased by 44.13% compared with that of 2011, for the largest increase in value.

According to the data of Russian children's toys market analysis, the scale of Russian children's toy market increased by nearly 40% from 2008 to 2012, from 664 million to 928.3 million units. During the period, Russian children's toy market was increasing year by year except 2009, the period of economic crisis, the product supply of which decreased by 17% compared with 2008. In the next few years, product supply increased by 20% equally per year. Steady growth of product supply is due to the growing demand for the products.

Children's toys launched in the Russian market are mostly imported products. From 2008 to 2012, products that foreign companies supplied to Russian market accounted for an average of 80% of total supply, while the Russian domestic products accounted for an average of 7.2%.

According to the analysis, from 2013 to 2017, imported products will continue to occupy the Russian children's toys market supplies. And in this period, the proportion of imported products will achieve an average of 77.1%. However, the proportion of domestic products will increase, for the government of the Russian Federation approved Children commodity industrial development strategy before 2020, aiming at renovating Russian children commodity market and improving the competence of Russian children products. The main goal of Russian children commodity industrial development strategy is to increase the proportion of Russian children commodity in domestic market, expand the proportion of innovative products in total exports and reduce the consumption costs of children commodity.

2011-2013 Global Toy Major Import Countries/Regions Market Share

| No. | Import Countries/Regions | Import Value Percentage | ||

|

|

| 2011 | 2012 | 2013 |

| 1 | USA↑ | 28.51% | 28.65% | 29.03% |

| 2 | Germany | 6.60% | 6.25% | 6.55% |

| 3 | United Kingdom | 6.84% | 5.93% | 6.16% |

| 4 | Japan | 4.71% | 5.18% | 4.89% |

| 5 | France | 4.98% | 4.66% | 4.87% |

| 6 | Russian Federation↑ | 2.45% | 3.06% | 3.53% |

| 7 | Canada↑ | 2.99% | 3.27% | 3.34% |

| 8 | Hong Kong | 5.51% | 5.67% | 2.65% |

| 9 | Belgium | 2.47% | 2.25% | 2.64% |

| 10 | Italy↓ | 2.80% | 2.47% | 2.46% |

| 11 | Australia | 2.11% | 2.30% | 2.30% |

| 12 | Czech Republic↑ | 1.89% | 1.97% | 2.23% |

| 13 | Netherlands | 2.19% | 2.00% | 2.12% |

| 14 | Spain | 2.25% | 1.97% | 2.08% |

| 15 | Mexico↑ | 2.00% | 2.05% | 2.07% |

| 16 | Poland | 1.24% | 1.24% | 1.46% |

| 17 | Republic of Korea↑ | 1.01% | 1.18% | 1.39% |

| 18 | Austria | 0.98% | 0.95% | 1.01% |

| 19 | Brazil | 0.98% | 1.00% | 0.97% |

| 20 | Turkey | 1.04% | 0.92% | 0.92% |

Note: “↑”represents that the indicators listed continued to increase from 2011 to 2013, “↓”represents that the indicators listed continued to decrease from 2011 to 2013.

Judging from the market share between 2011 and 2013, the proportion of import value for the United States, the Russian Federation, Canada, the Czech Republic, Mexico and the Republic of Korea continued to rise, while that of Italy continued to decline.

2011-2013 Global Toy Export Trend Analysis

2011-2013 Global Toy Major Export Countries/Regions

| No. | Export Countries/Regions | Export Value (Thousand USD) | Export Value Growth Compared 2013 with 2011 | ||

|

|

| 2011 | 2012 | 2013 |

|

| 1 | China | 10,827,046 | 11,450,207 | 12,386,706 | 14.41% |

| 2 | Czech Republic | 1,777,796 | 2,006,343 | 2,351,566 | 32.27% |

| 3 | Germany | 1,733,397 | 1,733,747 | 1,926,674 | 11.15% |

| 4 | USA | 822,639 | 962,836 | 989,206 | 20.25% |

| 5 | Netherlands | 790,577 | 729,106 | 799,641 | 1.15% |

| 6 | Belgium | 712,575 | 644,345 | 796,477 | 11.77% |

| 7 | Mexico | 638,143 | 769,370 | 745,113 | 16.76% |

| 8 | France | 522,353 | 543,613 | 617,572 | 18.23% |

| 9 | United Kingdom | 507,390 | 480,603 | 549,832 | 8.36% |

| 10 | Hong Kong | 4,228,405 | 4,379,160 | 469,511 | -88.90% |

| 11 | Spain | 413,662 | 390,000 | 466,266 | 12.72% |

| 12 | Indonesia | 273,259 | 347,068 | 428,967 | 56.98% |

| 13 | Italy | 455,349 | 403,431 | 423,924 | -6.90% |

| 14 | Taiwan | 428,162 | 467,057 | 391,964 | -8.45% |

| 15 | Viet Nam | 193,712 | 212,346 | 384,006 | 98.24% |

| 16 | Hungary | 281,769 | 268,171 | 326,254 | 15.79% |

| 17 | Poland | 141,902 | 174,075 | 271,822 | 91.56% |

| 18 | Thailand | 202,981 | 203,024 | 241,027 | 18.74% |

| 19 | Denmark | 139,396 | 188,647 | 224,670 | 61.17% |

| 20 | Canada | 232,370 | 241,828 | 224,345 | -3.45% |

In 2013, China, the Czech Republic and Germany were the top three largest export markets of global toys. Among the top twenty toys export markets, the export value of Vietnam toys increased by 98.24% compared with that of 2011, which had the largest increase, followed by Poland, the export value increased by 91.56% compared with that of 2011.

2011-2013 Global Toy Major Export Countries/Regions Market Share

| No. | Export Countries/Regions | Export Value Percentage | ||

|

|

| 2011 | 2012 | 2013 |

| 1 | China↑ | 39.70% | 40.14% | 45.77% |

| 2 | Czech Republic↑ | 6.52% | 7.03% | 8.69% |

| 3 | Germany | 6.36% | 6.08% | 7.12% |

| 4 | USA↑ | 3.02% | 3.38% | 3.66% |

| 5 | Netherlands | 2.90% | 2.56% | 2.95% |

| 6 | Belgium | 2.61% | 2.26% | 2.94% |

| 7 | Mexico↑ | 2.34% | 2.70% | 2.75% |

| 8 | France | 1.92% | 1.91% | 2.28% |

| 9 | United Kingdom | 1.86% | 1.68% | 2.03% |

| 10 | Hong Kong↓ | 15.50% | 15.35% | 1.73% |

| 11 | Spain | 1.52% | 1.37% | 1.72% |

| 12 | Indonesia↑ | 1.00% | 1.22% | 1.59% |

| 13 | Italy | 1.67% | 1.41% | 1.57% |

| 14 | Taiwan | 1.57% | 1.64% | 1.45% |

| 15 | Viet Nam↑ | 0.71% | 0.74% | 1.42% |

| 16 | Hungary | 1.03% | 0.94% | 1.21% |

| 17 | Poland↑ | 0.52% | 0.61% | 1.00% |

| 18 | Thailand | 0.74% | 0.71% | 0.89% |

| 19 | Denmark↑ | 0.51% | 0.66% | 0.83% |

| 20 | Canada | 0.85% | 0.85% | 0.83% |

Note: “↑”represents that the indicators listed continued to increase from 2011 to 2013, “↓”represents that the indicators listed continued to decrease from 2011 to 2013.

Judging from the market share between 2011 and 2013, the proportion of import value for China, the Czech Republic, the United States, Mexico, Indonesia, Vietnam, Poland and Denmark continued to rise, while that of Hong Kong continued to decline.