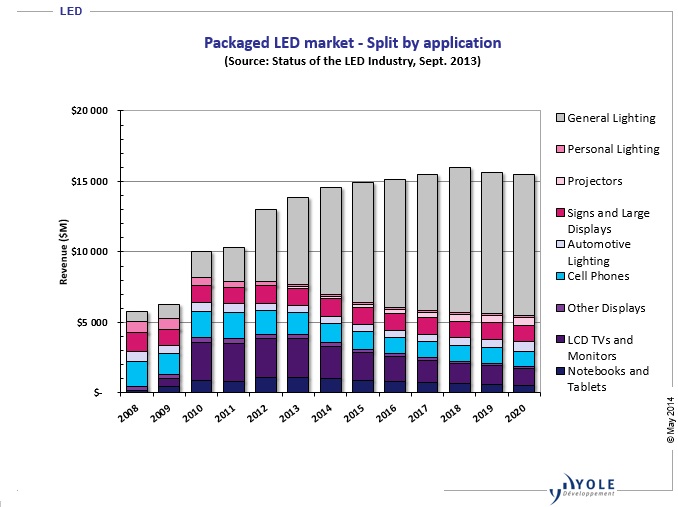

Driven by the fanfare over (and overestimation of) the LCD display market, the LED front-end equipment market experienced an unprecedented investment cycle in 2010-2011. The market surge was driven mostly by MOCVD reactor shipments to new Chinese entrants: these players benefited from the generous subsidies of the Chinese central and local governments in a bid to stimulate domestic chip production. However LED market was overestimated at that moment, creating an overcapacity just recovering in 2014, driven by increased LED penetration rate for general lighting applications. Yole Développement expects more than $2.2B to be spent in the next 6 years in LED front-end equipment, which is far from the annual $1.7B invested in 2010 and 2011. How could we explain this result, even though the LED device market should growth by a factor of nearly x1.25 (e.g.: packaged LED market) in the next 3 years?!

LED front-end equipment market is becoming more and more competitive is some areas, with new players entry pushing down average selling price. Additionally, typologies and structures of the different equipment markets emphasized such trend.

For example, the LED epitaxy equipment market (MOCVD reactor) is very concentrated under the control of the Big 3: Aixtron, Veeco and Taiyo Nippon Sanso. They represented nearly 97% of market share in 2013.

New entrants have missed the first two LED growth cycles (small display and large display applications) that have allowed leaders to build their expertise and know-how as well as their networks (sales office, training center…). Even big names, such as the company, Applied Materials, did not achieve their access to these markets. Finally, revenue collected during the 2010 - 2011 investment cycle (a total of more than $2B for MOCVD reactors, with > 90% going to Aixtron and Veeco) have allowed Veeco and Aixtron to slash average selling price and initiate a price war to lever further market entry barriers.

Following the disappointment in 2012, LED companies are more and more reluctant to invest in new equipment and so develop their capacity. Moreover, in a context of overcapacity, consolidation is favored with strategic mergers and acquisitions to fulfill market demands. Indeed, to successfully convert the general lighting opportunity into bottom line cash, the industry has to undergo some major transformations, and many challenges await. First of all is the highly fragmented LED industry - with more than a hundred chip makers and thousands of packaging companies - that needs some serious consolidations.

Finally, the current LED front-end industry is largely driven by cost reduction (as technological evolutions are reaching their saturation point). The main strategy developed by a new equipment supplier is to focus on decreasing cost of ownership through new design, increased batch size, automation (…). However such evolution (mostly incremental) does not allow this company for strong differentiation (compared to technological innovation) toward competition, and does not justify strong increase of average selling price.

“If the overall environment is quite pessimistic toward LED front-equipment market, we are not immune to good surprises”, comments Pars Mukish, Activity Leader at Yole Développement. “The LED front-end equipment market is continuously evolving since its inception and could radically change orientation based on new developments, if they are successfully industrialized (e.g: new substrates, photonic crystal…)”, he adds.