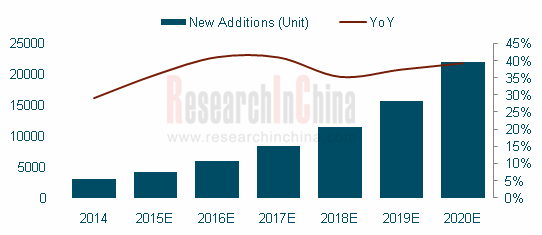

AGV is the most automated modern logistics equipment. Driven by industrial automation, global new demands for AGV were roughly 16,000 units in 2015, up 35% against the previous year. 4,280 units, or 27% of the global total, were added in China, rising by 36% from a year ago, largely due to small factory area, fast task time, and fading demographic dividend. It is expected the country’s new demand will hit 22,000 units in 2020.

Annual New AGVs and YoY in China, 2014-2020E

Source: Information Center of China Logistics Technology Association; ResearchInChina

AGVs are most widely used in automobile and power industries (59% together in 2015). For automobile industry, AGVs are primarily used in automobile assembly, engine, and transmission assembly lines, accounting for 45%. As automation level of automobile production line improves, the new demand for AGV from automobile industry is expected to reach 10,500 units in 2020.

Due to technological constraints, most of core parts including on-board controllers, motors, and laser scanner for AGVs are imported. The new demands for above-mentioned core parts stood at 4,280 sets, 8,560 sets, and 171 sets in 2015 without considering the demand from maintenance/replacement.

Major global AGV players include European and American ATAB, Rocla, Egemin Automation, Swisslog, and JBT Corporation, and Japanese Daifuku, Meidensha, and Aichikikai Techno System.

The Chinese AGV market is dominated by domestic brands with localization rate reaching 77.2% in 2015. Siasun is the largest AGV supplier in China with a share of 19%, followed by KSEC Intelligent Equipment (9%) and Machinery Technology Development (6%).

Propelled by automation development, AGV producers have quickened their financing and M&As from 2014. Producers like Machinery Technology Development, Shanghai Triowin Automation Machinery, and Shenzhen Casun Intelligent Robot finance capacity expansion by transferring equities, and other players like Huaxiao Precision (Suzhou) and Guangdong Jaten Robot & Automation develop at a faster pace by introducing large well-funded companies.

Machinery Technology Development: The company was listed on National Equities Exchange and Quotations for financing via negotiated transfer in Jan 2016.

Shanghai Triowin Automation Machinery: The company went public for financing via equity transfer in July 2014. The new factory under construction in Jinshan District boasts a designed capacity of 2,000 units/a handling robots.

Huaxiao Precision (Suzhou): The company focuses on AGV systems for vehicle and parts. It was fully acquired by Csg Smart Science & Technology in Dec 2015.

Global and China AGV (Automated Guided Vehicle) Industry Report, 2016-2020 by ResearchInChina highlights the followings:

Chinese automated logistics equipment system market (size, product structure, demand structure, competitive landscape, etc.);

Global AGV market (size, demand structure, competitive landscape, and development in Japan, Europe, the United States, etc.);

Chinese AGV market (size, product structure, demand structure, prices, competitive landscape, etc.);

Supply of core parts for AGV, including on-board control system (on-board controller, hand-held controller, operation panel), drive system (motor, speed reducer, etc.), navigation system (magnetic navigation sensor, laser scanner, etc.), charging system, etc.;

Development of main downstream industries (automobile, power, and tobacco) of AGV, and demand for AGV;

Operation of 12 global AGV producers and presence in China;

Operation, development strategy, etc. of 15 major Chinese AGV producers.