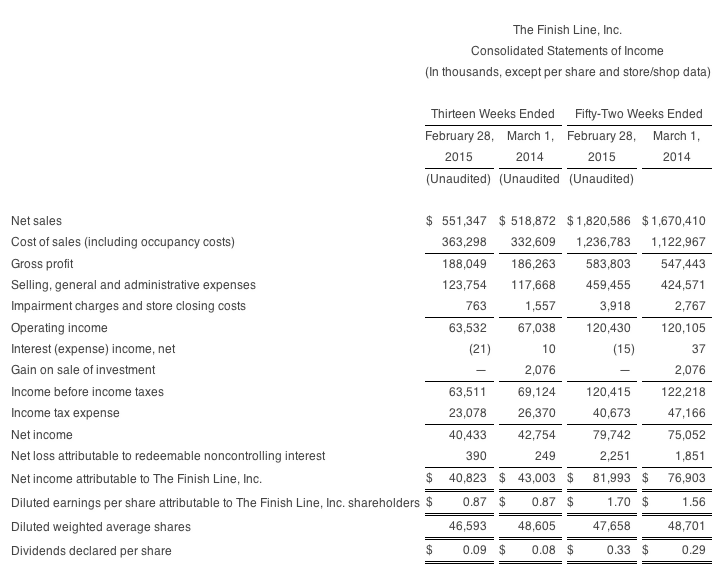

The Finish Line reported earnings declined 5.4 percent to $40.4 million, or 87 cents in its fourth quarter ended Feb. 28, but adjusted earnings topped Wall Street's consensus target. Sales improved 6.3 percent to $551.3 million with comps ahead 2.6 percent.

For the thirteen weeks ended Feb. 28, 2015:

- Consolidated net sales were $551.3 million, an increase of 6.3 percent over the prior year period

- Finish Line comparable store sales increased 2.6 percent.

- On a GAAP basis, diluted earnings per share were $0.87.

- Non-GAAP diluted earnings per share, which excludes the impact of impairment charges and store closing costs were 88 cents .

For the fifty-two weeks ended Feb. 28, 2015:

- Consolidated net sales were a record $1.82 billion, an increase of 9.0 percent over the prior year.

- Finish Line comparable store sales increased 3.2 percent.

- On a GAAP basis, diluted earnings per share increased 9.0 percent over the prior year to $1.70.

- Non-GAAP diluted earnings per share, which excludes the impact of impairment charges and store closing costs, employee resignation costs, and the recognition of a one-time tax benefit were $1.67.

“Our fourth quarter results, especially for our core business, represent a solid finish to a disappointing year,” said Glenn Lyon, chairman and chief executive officer of Finish Line. “We quickly reduced expenses and gained better leverage to deliver earnings ahead of plan. At the same time, we made progress rebalancing our inventory to better align with customer demand. While there is still work to be done to achieve operational excellence throughout the company, we have a sound plan in place to improve profitability and continue our long track record of returning increased value to our shareholders.”

As of Feb. 28, 2015, consolidated merchandise inventories increased 13.2 percent to $344.4 million compared to $304.2 million as of March 1, 2014.

The company repurchased 0.7 million shares of common stock in the fourth quarter, totaling $15.9 million. For the full year, Finish Line repurchased 2.7 million shares totaling $68.1 million. The Board has authorized a new 5 million share repurchase plan. The new plan will commence upon completion of the current plan which has 1.2 million shares remaining.

As of Feb. 28, 2015, the company had no interest-bearing debt and $148.2 million in cash and cash equivalents, compared to $229.1 million as of March 1, 2014.

Outlook

For the fiscal year ending Feb. 27, 2016, Finish Line expects comparable store sales to be up in the low single to mid single digit range and earnings per share to increase in the low single to mid single digit range over fiscal year 2015 non-GAAP diluted earnings per share of $1.67.

Annual Meeting July 16, 2015

The company’s Board of Directors has established July 16, 2015 as the date of the 2015 annual meeting of shareholders, with May 15, 2015 as the record date for this meeting.