GfK Retail and Technology has released its quarterly report on the state of the electrical retailing industry in what it calls “Technical Consumer Goods (TCG), painting a mixed picture across varying segments in both the consumer electronics and appliance categories.

The GfK Temax Report showed that, while the fourth quarter of the 2013 calendar year accounted for more than a quarter of full year revenue (28 per cent of $17.6 billion for the year), overall revenue for Q4 was down 3.2 per cent year-on-year. This followed the reasonably strong consumer sentiment tracked in Q3, driven largely by rate cuts and a change in Federal Government.

Click here to sign up for our free daily newsletter

In the appliance space, Small Domestic Appliances (SDA) carried growth, driven largely by food prep and floorcare categories, while Major Domestic Appliances (MDA) experienced revenue declines.

Commenting on the SDA category, GfK Retail and Technology analyst Gwenno Hopkin said it was one of only two sectors to experience sales value growth, up 1.4 per cent for Q4 2013, compared to 2012:

Vacuum cleaners, which accounted for more than a quarter of the sector’s sales revenue, recorded its fourth successive quarter of double-digit value growth. Robot vacuums, which proved a popular Christmas gift, and hand stick vacuums, continued their recent share growth and now collectively account for almost a third of vacuum cleaner spend. Juicers was another segment to benefit from gift purchasing, with higher-priced, but increasingly affordable slow pressure models continuing to gain share of this category.

Another consistently strong performer, food preparation, recorded another strong quarter of value growth. With the exception of kitchen machines, where demand increased for lower-priced models, all food preparation segments have seen a further rise in average price, as the mix of sales has shifted to the higher end.

Despite this strength in the appliance side of electrical stores, Major Domestic Appliances slowed down in Q4, experiencing their first quarter of sales revenue decline for 2013:

Refrigeration, the largest value segment within MDA, was particularly badly hit, while washing machines and cooking also experienced modest declines. For all segments, the value declines disguised an even stronger decline in volume, due in part to the knock-on effect of the strong, promotionally-driven demand seen earlier in the year.

Thankfully, average prices continued to climb, as Australian consumers continued to trade-up to higher-end products. Large capacity and frontloading washing machines, and bottom mount and French door refrigerators, all saw further share gains.

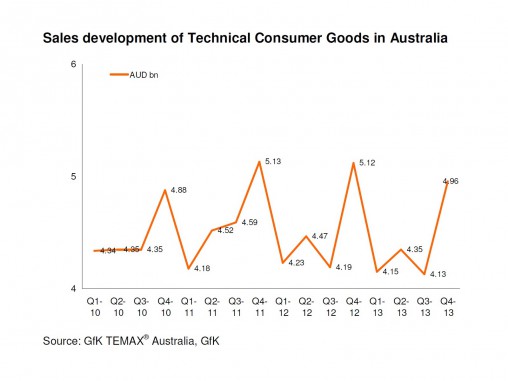

The below graph shows the general electrical retailing trend, tracking sales of Technical Consumer Goods in Australia over the last three years (click for a larger view):

GfK results show seasonal peaks in electrical retailing revenues, but sales have trended down in recent years.