The results of the quarterly Manufacturers Alliance for Productivity and Innovation (MAPI) Business Outlook point to a degree of renewed momentum in manufacturing activity over the next three to six months.

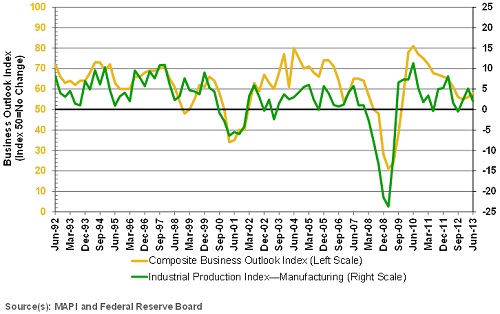

The survey's composite index is a leading indicator for the manufacturing sector. The June 2013 composite index advanced to 58 from 56 in the March survey, the second straight quarterly advance after 10 consecutive quarterly declines. For the past 15 quarters, the index has remained above the threshold of 50, the dividing line separating contraction and expansion.

"The improvements in the composite index and a number of individual indexes, though modest, are encouraging given that manufacturing sector activity in the late winter and early spring had slowed from its pace at the end of 2012 and early 2013," said Donald A. Norman, Ph.D., MAPI senior economist and survey coordinator in a recent interview. "I was really pleased to see some hopeful signs. There is some cause for optimism and I'm starting to feel more hopeful this year than I was last year."

Things are picking up, said Norman, and although expansion will likely continue to be modest it also seems to be less volatile. Last year, industrial production jumped up 9.8% in the first quarter. Since GDP was much smaller, it was not surprising to see a sharp drop in the second and third quarters. The production simply wasn't sustainable, Norman said. This year, industrial production is up 5% in the first quarter. "Some of this volatility in the industrial production index has been quite an up and down pattern over the last year and a half," Norman said. "We may be seeing a smoother pattern, and I certainly hope so since it's hard to make business plans with that sort of up and down."

Norman also noted that the non-U.S. Investment Index fell rather sharply, but this was not a surprise to members. "All of us are concerned about what's happening globally because U.S. manufacturers are so connected to what's going on in other markets."

Domestically, Norman said many employers remain uncertain over the impact of the Affordable Care Act. Those manufacturers tempted to cut healthcare costs might not remain competitive in terms of attracting and retaining talent, yet those who do cut costs might gain a competitive advantage as well. "The whole industry is watching one another to see which choice is made," Norman said.

The Composite Business Outlook Index is based on a weighted sum of the Prospective U.S. Shipments, Backlog Orders, Inventory, and Profit Margin Indexes. In addition to the composite index, which in this survey reflects the views of 54 senior financial executives representing a broad range of manufacturing industries, the report includes 13 individual indexes that are split between current business conditions and forward looking prospects. Of those 13 indexes, 9 individual indexes increased and one remained flat.

Current Business Condition Indexes:

The Backlog Orders Index, which compares the second quarter 2013 backlog of orders with that of one year earlier, jumped to 54 in June from 43 in the March report.

The Current Orders Index, a comparison of expected orders in the second quarter of 2013 with those in the same quarter one year ago, improved to 53 from 47.

The Inventory Index, based on a comparison of inventory levels in the second quarter of 2013 with those in the second quarter of 2012, advanced to 51 in June from 48 in March.

The Capacity Utilization Index, which measures the percentage of firms operating above 85% of capacity, rose marginally to 21.2% in June from 20.7% in March. It is still below the long-term average of 32%.

The Export Orders Index, which compares exports in the second quarter of 2013 with those in the same quarter in 2012, remained flat at 45.

The lone decrease among current indicators was in the Profit Margin Index, which fell to 56 in June from 62 in March.

Forward Looking Indexes:

There were increases in five of the seven forward looking indexes.

The Interest Rate Expectations Index climbed to 81 from 58, indicating that a growing majority of respondents believe that longer-term interest rates will rise by the end of the third quarter of 2013.

The Prospective U.S. Shipments Index, which reflects expectations for third quarter 2013 shipments compared with those in the third quarter of 2012, rose to 67 in June from 61 in March. The Prospective Non-U.S. Shipments Index, which measures expectations for shipments abroad by foreign affiliates of U.S. firms for the same time frame, advanced to 60 in the current report from 53 in the March survey.

The Research and Development Spending Index was 73 in the June report, an increase from 68 in March, and compared spending for the years 2012 and 2013.

The two investment indexes were split. The U.S. Investment Index is based on executives' expectations regarding domestic capital investment for 2013 compared to 2012. The index was 65 in June, a slight increase from 64 in the March survey. The Non-U.S. Investment Index declined to 53 in the current report from 62 in March.

A minor area of concern was the Annual Orders Index, which is based on a comparison of expected orders for all of 2013 with orders in 2012; it decreased to 64 in June from 74 in March but remains at a relatively high level.

In a supplemental section, participants were queried on issues concerning healthcare reform.

Current sentiment seems to favor the status quo, with only 9% of the respondent firms indicating they are considering eliminating healthcare plans and directing employees to exchanges. Approximately one-third reported considering eliminating higher-cost ("Cadillac") healthcare options.

Close to one-fourth of the companies have considered or are considering plans in which premiums paid by employees vary with their level of compensation.

MAPI's Composite Business Outlook Index (see chart below) is a historically accurate near-term preview of business prospects for the manufacturing sector and is a leading indicator of the Federal Reserve's industrial production index.