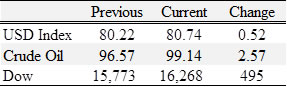

Corn and soybeans were up; cotton was mixed; and wheat was down for the week. As the Christmas season quickly approaches trading volume has reduced substantially with the exception of soybeans which have high volumes when accounting for seasonality. Corn and soybeans rallied this week rebounding from fear of potential Chinese import cancelations from last week. Cotton continues to have strong nearby futures prices while 2014 harvest prices continue to hover just above 75 cents. Wheat continues its downward spiral as low export demand and high world supply continue to provide downward pressure on price.

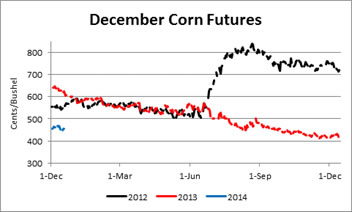

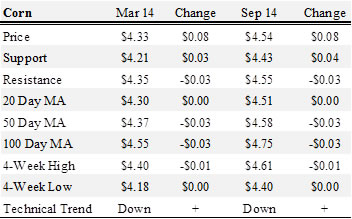

Corn

March 2014 corn futures closed at $4.33 up 8 cents from last week with support at $4.21 and resistance at $4.35. Across Tennessee basis (cash price- nearby future price) strengthened in Northwest, Upper-Middle, and Lower-Middle Tennessee while basis weakened at Northwest barge points and in Memphis. Overall basis for the week ranged between 10 under and 29 over the March futures contract. Corn net sales reported by exporters for the 2013/14 marketing year from December 6th to 12th were 32.6 million bushels, primarily to Mexico, China, Taiwan, South Korea, and the Dominican Republic. Net sales reported by exporters for the 2014/15 marketing year for the week were 1.8 million bushels to Japan. Exports for the same time period were 27.3 million bushels primarily to China, Mexico, Columbia, South Korea, Japan, and Peru. Corn export sales and commitments are 75% of the USDA estimated total annual exports for the 2013/14 marketing year (September 1 to August 31) compared to a 5-year average of 53%. Ethanol production for the week ending December 13th was 928,000 barrels per day down 16,000 barrels per day. Ending ethanol stocks were 15.625 million barrels up 177,000 barrels. May 2014 corn futures were trading at $4.41 up 8 cents from last week. Mar/May and Mar/Sep future spreads were 8 cents and 21 cents.

September 2014 corn futures closed at $4.54 up 8 cents from last week with support at $4.43 and resistance at $4.55. This week September and December 2014 corn futures prices traded between $4.41 and $4.61/bu. Look for this trading range to persist until new information is released in January. The January WASDE will most likely produce some changes in production and exports that could result in a shift out of this trading range. Protecting against the potential for dramatic price declines for harvest 2014 is strongly encouraged for all producers. Downside price protection could be obtained by purchasing a $4.60 September 2014 Put Option costing 39 cents establishing a $4.21 futures floor.

Soybeans

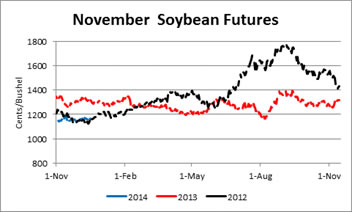

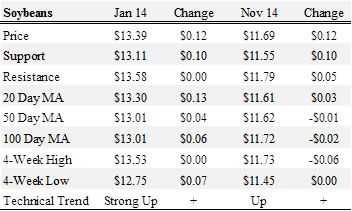

January 2014 soybean futures closed at $13.39 up 12 cents for the week with support at $13.11 and resistance at $13.58. Soybean to corn price ratio was 3.09 at the end of the week. For the week, soybean basis weakened at barge points and Memphis and strengthened in Upper-Middle, Lower-Middle, and Northwest Tennessee. In Tennessee, soybean basis at the end of the week was between 15 under and 62 over the January futures contract at elevators and barge points. Average basis at the end of the week was 26 over the January futures contract. Net sales reported by exporters for the 2013/14 marketing year from December 6th to 12th were 15.3 million bushels, primarily to China, the Netherlands, Spain, Indonesia, and Mexico. Net sales reported by exporters for the 2014/15 marketing year were 2.9 million bushels, primarily to China, Japan, and Hong Kong. Exports for the same period were 57.7 million bushels primarily to China, the Netherlands, Spain, Indonesia, Egypt, and Mexico. Soybean export sales and commitments are 97% of the USDA estimated total annual exports for the 2013/14 marketing year (September 1 to August 31), compared to a 5-year average of 73%. March 2014 soybean futures were trading at $13.31. Jan/Mar and Jan/Nov future spreads were -8 cents and -170 cents.

November 2014 soybean futures closed at $11.69 up 12 cents for the week with support at $11.55 and resistance at $11.79. This week November 2014 soybean futures traded between $11.53 and $11.73/bu. Strong export sales continue to support nearby soybean future contracts and while weather in South America has been good to excellent this far into their growing season some dry weather concerns are starting to creep into southern production regions. Pricing some 2014 production prior to planting is strongly encouraged. Downside price protection could be achieved by purchasing an $11.80 November 2014 Put Option which would cost 76 cents and set a $11.04 futures floor.

Cotton

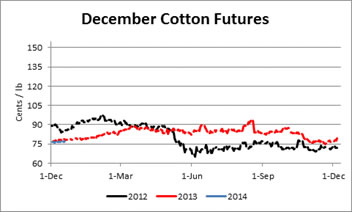

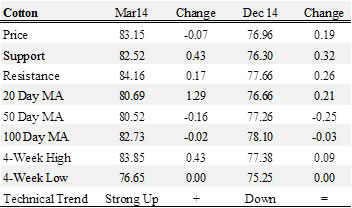

March 2014 cotton futures closed at 83.15 down 0.07 cents for the week with support at 82.52 and resistance at 84.16. Nearby cotton futures continue to trade at 82 to 84 cents. Cotton adjusted world price (AWP) increased 1.67 cents to 67.59 cents. Net sales reported by exporters for the 2013/14 marketing year from December 6th to 12th were up from last week at 236,000 bales of upland cotton, primarily to Turkey, China, South Korea, and Columbia. Net sales reported by exporters for the 2014/15 marketing year were 6,600 bales to Turkey. Exports for the same period were 150,400 bales primarily to China, Turkey, Mexico, Vietnam, and Indonesia. Cotton export sales and commitments are 70% of the USDA estimated total annual exports for the 2013/14 marketing year (August 1 to July 31), compared to a 5-year average of 73%. Upside price is still limited by the large reserves that are held in China. May 2014 cotton futures are trading at 82.91 up 0.01 cents from last week. Mar/May and Mar/Dec future spreads were -0.24 cents and -6.19 cents.

December 2014 cotton futures closed at 76.96 up 0.19 cents for the week with support at 76.3 and resistance at 77.66. This week the December 2014 futures contract traded between 76.40 and 77.40 cents. It is unlikely this trading range will change until the New Year. Any rallies in the market near 80 cents should be viewed as an opportunity to start establishing a price on 2014 production. Downside price protection could be obtained by purchasing a 77 cent December 2014 Put Option costing 5.23 cents establishing a 71.77 cent futures floor.

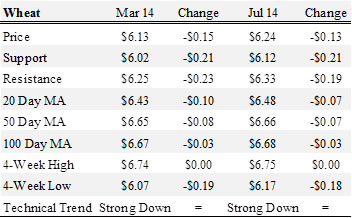

Wheat

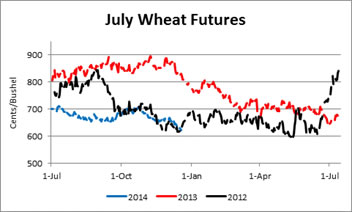

March 2014 wheat futures closed at $6.13 down 15 cents for the week with support at $6.02 and resistance at $6.25. Since December 4th wheat prices are down 59 cents per bushel and have established new lows the past 7 trading days. Argentina revised wheat production estimates up 6% but have yet to remove export restrictions. Net sales reported by exporters for the 2013/14 marketing year from December 6th to 12th were 24.1 million bushels, primarily to Japan, Nigeria, Mexico, Brazil, and South Korea. Net sales reported by exporters for the 2014/15 marketing year were 0.1 million bushels to Mexico. Exports for the same period were 13.8 million bushels primarily to Japan, Brazil, China, Israel, and Mexico. Wheat export sales are 79% of the USDA estimated total annual exports for the 2013/14 marketing year (June 1 to May 31), above the 5-year average of 73%. May 2014 wheat futures are trading at $6.20 down 14 cents from last week. Mar/May and Mar/Jul future spreads were 7 cents and 11 cents.

July 2014 wheat futures closed at $6.24 down 13 cents for the week with support at $6.12 and resistance at $6.33. In Tennessee, June/July cash forward contracts averaged $6.02/bu with a range of $5.51/bu to $6.27/bu at elevators and barge points. Prices have declined substantially from late October highs. Competition for exports and near record production in many countries have drug prices down over the past couple months. Downside price protection could be obtained by purchasing a $6.30 July 2014 Put Option costing 40 cents establishing a $5.90 futures floor.