Highlighting the Plenary session at the Strategies in Light conference, Ella Shum and Vrinda Bhandarkar of Strategies Unlimited reported on the 2012 market for packaged LEDs and SSL products.

For the first time in 2012, general lighting became the largest market for packaged LEDs globally at $3.1 B (billion), according to new data presented by Strategies Unlimited in the Plenary session of the Strategies in Light (SIL) Conference. Meanwhile, global solid-state lighting (SSL) revenue grew from $9.4 B in 2011 to $11.8 B in 2012, including replacement lamps and luminaires.

First Ella Shum, director of the LED practice at Strategies Unlimited, covered the market for packaged LEDs. The talk was entitled "The art of war," and Shum opened saying, "We have had a bloodbath in the last few years in the LED industry."

Shum reported that the global market for packaged LEDs in 2012 totaled $13.7 B. The number does not include the sale of bare die or modular lighting products but solely package LEDs whether the product in question is a single-emitter LED or a chip-on-board (COB) LED array.

Package LED market by segment

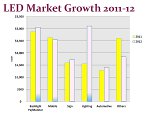

Strategies Unlimited segments the market six ways with 2012 sales broken down by SSL at 23%, backlights for TVs and monitors at 22%, mobile at 19%, signage at 13%, automotive at 10%, and other at 13%. The lighting segment experienced tremendous growth from just over $1.5 B in 2011. There was moderate growth or declines in the other segments that are largely are fully saturated at this point (see nearby chart).

Shum also presented a ranking of LED suppliers with growth/decline rates that are summarized in a nearby table. Samsung was a major mover as it increased its production of LEDs for use in Samsung consumer products such as TVs, and Korean company Lumens Co Ltd also enjoyed growth due to a close tie with Samsung according to Shum. Toyoda Gosei's growth came thanks to Apple mobile products according to Shum. Cree and Philips Lumileds were the most prominent beneficiaries of the ramp in general lighting.

Rank Manufacturer 2012 Growth/Decline 1 Nichia 5% 2 Samsung 22% 3 Osram Opto 5% 4 LG Innotek -1% 5 tie Seoul Semi 14% 5 tie Philips Lumileds 21% 7 Cree 18% 8 Toyoda Gosei 37% 9 Sharp 14% 10 tie Everlight -1 % 10 tie Lumens 32%

Shum also presented a ranking of LED suppliers with growth/decline rates that are summarized in a nearby table. Samsung was a major mover as it increased its production of LEDs for use in consumer products, and Korean company Lumens Co Ltd also enjoyed growth due to a close tie with Samsung according to Shum. Toyoda Gosei's growth came thanks to Apple mobile products according to Shum. Cree and Philips Lumileds were the most prominent beneficiaries of the ramp in general lighting.

Looking forward, Shum projects that the packaged LED market will grow to $15 B by 2017 with SSL being the largest driver. That reflects a compound annual growth rate (CAGR) of 1.8%. LED unit growth is much steeper, about the unit price will decline. Moreover, Shum said the fact that the research includes everything from single-die packages to ones with many die in an array makes an analysis of unit numbers mostly meaningless.

SSL market 2012

In the SSL market, Bhandarkar said replacement lamp revenue grew from $2.1 B in 2011 to $$2.58 B in 2012. The largest jump came in Japan where energy concerns caused by the earthquake and tsunami that occurred in 2011 knocking out major energy-generation facilities.

In the luminaire sector, revenue grew from $7.2 B in 2011 to $9.2 B in 2012. The commercial market segment is leading the adoption of SSL, representing 23% of the market. Growth in luminaires is fairly consistent across the globe. For the first time, Bhandarkar also reported on an other category that includes products such as flexible strings, furniture lighting, airplane lighting, toys and others that totaled $2.75 B bring the overall market total to $14.5 B.

Bhandarkar also addressed some specific types of products. She said "LED downlights became a commodity market in 2012 - more than 50% of products sold in Japan were LEDs." Looking forward, she said "Troffers will be the next major wave of SSL deployment starting this year." She expects the troffer market to be strong in 2014 and going into 2015.

Overall, the SSL market will enjoy a CAGR of 12% through 2017. Bhandarkar projects that SSL luminaire revenue will exceed $20 B in 2017.