Taiwanese LED packager Edison Opto’s 3Q13 financial results showed the company’s consolidated revenue reached NT$ 826 million (US$ 27.99 million) and underwent a Year-on-Year (YoY) growth rate of 44.89 percent and Quarter-on-Quarter (QoQ) of 1.6 percent. Under market cutthroat price competition in 2Q, consolidated profit margin was up 7.7 percent compared to 2Q13 to 19.97 percent. Consolidated operation profit margin turned to a positive growth of 3.79 percent and had grown at a 2.95 percent YoY. Although, net profit increased at an exponential rate in 3Q13 of 6.9 times YoY compared to the previous year, it still experienced a 31.92 percent QoQ decline. The company’s EPS reached NT$ 0.23 this quarter.

Company officials pointed out, the rebounding gross profit margin was due to less price competition pressure in 3Q13, compared to excessive price cut strategy the company implemented in 2Q13 to enter the market. However,operation profit margin growth has been sluggish with only an incremental increase of 3.79 percent since the addition of consolidated revenue from subsidiary LumenMax in June 2013. On top of this, the company’s recognized currency exchange loss, company’s convertible bond interest costs, and accumulated LumenMax equipment loss, net profit was down to NT$ 15.73 million. Still, net profits returned to the parent company reached NT$ 26.46 million and achieved two consecutive quarters of profits.

Edison Opto consolidated revenue in the first three quarters of 2013 climbed up at 16.38 YoY percent to about NT$ 2.10 billion, a decrease of 2.11 percent compared to the same period in 2012. Consolidated operation loss was 0.68 percent, a positive growth compared to 3Q12. Net loss reached NT$ 2.05 million in 3Q13, but net profits from the company’s main operations decreased 85.19 percent to NT$ 11.14 million with EPS at NT$ 0.1.

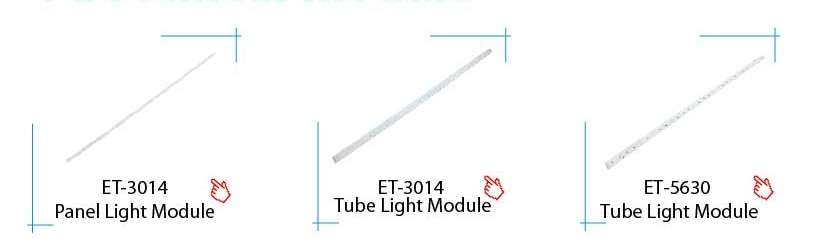

Edison Opto's linear PLCC modules. (LEDinside/ Edison Opto)

The company's 3Q13 Plastic Leaded Chip Carrier (PLCC) monthly production capacity expanded to 300 kk, while Chip On Board (COB) production increased from 500k to 1.5 kk. Although, 4Q13 is traditionally the industry’s low season, it utilization rates are expected to be maintained at 70 percent.