Market statistics released today at Toy Fair by NPD show that the UK toy industry stood firm in 2012 - in the face of poor retail performance overall and in comparison with like for like industry sectors.

NPD figures show that UK toy sales dropped by just one per cent in value throughout 2012.

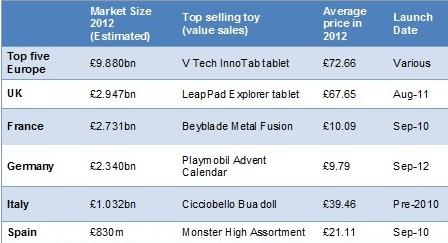

The UK toy market is now valued at £2.94 billion. It remains the largest toy industry in Europe and the fourth largest in the world.

The figures compare favourably with overall entertainment industry sales, which declined by 12 per cent.

Key categories included building sets and dolls, which both saw growth of 11 per cent.

Meanwhile, combined value sales in the top five European markets dropped two per cent in 2012 - the first time there has been a drop in eight years. The NPD Group’s analysis relates this decline specifically back to the lower contribution made by new toy launches last year. In the UK, Europe’s largest toy market, 31 per cent of value sales were generated by new products in 2012 – down three per cent over the previous year.

That is not to say new products didn’t sell well in 2012. LEGO Friends was 'a huge hit' - rated by NPD as the best new property last year in the UK, as well as in Germany, France, Italy and the United States.

Furby was the number one seller in the UK in December. However, overall, the trend is the same in the top five European markets, with a smaller contribution being made to market value by new products than in the previous year.

The analysis also highlights the huge variety in the European toy market, with each of the top five countries having a different top seller in 2012. Overall InnoTab’s VTech tablet took the top sales slot across Europe for 2012 as the biggest selling product thanks to a broad distribution in most countries, with over half a million units sold.

Frederique Tutt, Global Toy Industry Analyst with The NPD Group, said of the pre-school tablets’ success: “Introduced in the UK in 2011 and to continental Europe in 2012, pre-school tablets have a relatively high price point and as such their strong sales performance shows that when the product is appealing, parents are prepared to pay more money despite the current challenging economic climate. In the case of tablets they strike a chord with parents and kids alike, all equally fascinated by their new technology, which is both entertaining and educational.”

Tutt concluded: “Kids love new products, and that appetite is certainly fuelled by manufacturers with new product launches. This analysis shows the vital role innovation has in maintaining and growing the toy market.”