Genesco Inc. said lower than planned sales and gross margin pressures at its Lids segment in the third quarter and expected continued margin pressure at the segment in the fourth quarter would cause it to lower its guidance for the full year.

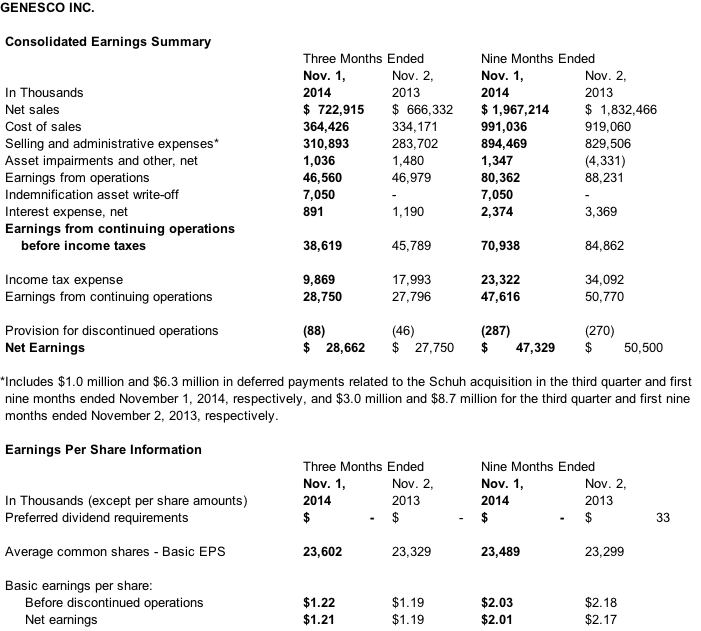

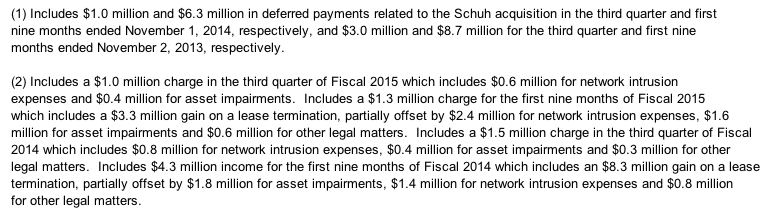

In the third quarter, earnings from continuing operations for the third quarter of Fiscal 2015 were $28.8 million, or $1.21 per diluted share, compared to earnings from continuing operations of $27.8 million, or $1.18 per diluted share, for the third quarter ended November 2, 2013. Fiscal 2015 third quarter results reflect pretax items of $2.0 million, or $0.07 per diluted share after tax, including $1.0 million related to deferred purchase price payments in connection with the acquisition of Schuh Group Limited; and $1.0 million in network intrusion expenses and asset impairment charges. They also reflect the favorable resolution of formerly uncertain tax positions taken by Schuh at the time of the acquisition, resulting in the write-off of an indemnification asset of $7.1 million and the reversal of a corresponding FIN 48 provision, with essentially no net after-tax effect on earnings for the quarter. Fiscal 2014 third quarter results reflect pretax items of $8.5 million, or $0.25 per diluted share after tax, including $4.0 million of expenses related to the change in accounting for deferred bonuses, $3.0 million related to deferred purchase price payments in connection with the acquisition of Schuh Group Limited; and $1.5 million for network intrusion expenses, asset impairment charges and other legal matters.

Adjusted for the items described above in both periods, earnings from continuing operations were $30.3 million, or $1.28 per diluted share, for the third quarter of Fiscal 2015, compared to earnings from continuing operations of $33.8 million, or $1.43 per diluted share, for the third quarter of Fiscal 2014. For consistency with Fiscal 2015's previously announced earnings expectations and with previously reported adjusted results for the prior year period, the company believes that the disclosure of the results from continuing operations adjusted for these items will be useful to investors. A reconciliation of earnings and earnings per share from continuing operations in accordance with U.S. Generally Accepted Accounting Principles with the adjusted earnings and earnings per share numbers presented in this paragraph is set forth on Schedule B to this press release.

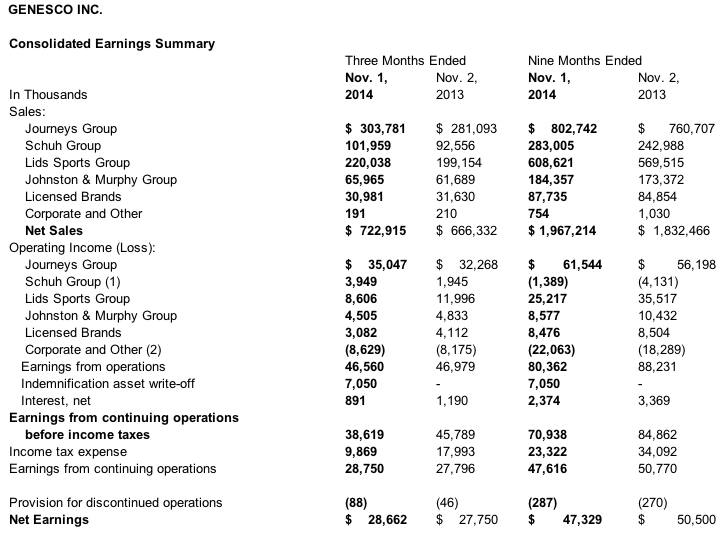

Net sales for the third quarter of Fiscal 2015 increased 8 percent to $723 million from $666 million in the third quarter of Fiscal 2014. Consolidated third quarter 2015 comparable sales, including same store sales and comparable e-commerce and catalog sales, increased 3 percent, with a 6 percent increase in the Journeys Group, a 1 percent increase in the Lids Sports Group, and flat comparable sales in the Schuh and Johnston & Murphy Groups.

Robert J. Dennis, chairman, president and chief executive officer of Genesco, said, "We delivered solid top-line growth in the third quarter, driven by better than expected sales in the Journeys Group. Sales in our other divisions, except for the Lids Sports Group, were essentially on plan. At the Lids Sports Group, lower than planned sales caused negative expense leverage and lower gross margins, resulting in a shortfall in earnings that was not offset by the other divisions' performance.

"The fourth quarter has started off well, with consolidated comparable sales up 9 percent through December 2, 2014."

Dennis also discussed the company's updated outlook. "Based on our third quarter performance and expectations for additional margin pressure in the Lids Sports Group in the fourth quarter, we are revising our full year outlook. We now expect adjusted diluted earnings per share to be in the range of $4.75 to $4.85, compared to Fiscal 2014's adjusted earnings per share of $5.09, down from our previously issued guidance of $5.10 to $5.20. Consistent with our previous guidance, these expectations do not include non-cash asset impairments and other charges, partially offset by a gain on a lease termination in the first quarter this year, which we estimate will be in the range of $2.9 million to $3.4 million pretax, or $0.08 to $0.09 per share, after tax, in Fiscal 2015. These expectations also do not reflect a $5.7 million, or $0.15 per diluted share, change in the first quarter related to the change in accounting for bonus awards. Finally, the expected earnings per share do not reflect compensation expense associated with the Schuh deferred purchase price as described above, which is currently estimated at approximately $7.3 million, or $0.31 per diluted share, for the full year. This guidance assumes a comparable sales increase in the low single digit range for the full fiscal year."

Dennis concluded, "We continue to be confident in the long-term outlook for our company and believe the actions we are taking to improve our earnings power will begin to yield positive results next year."