Falling LNG costs and rising domestic gas prices in China have made opportunistic purchases increasingly attractive for non-traditional LNG buyers, which are now putting pressure on state-owned terminal operators to gain access to their import infrastructure.

Several private and state-owned companies -- which currently do not have access to receiving terminals or an established credit rating -- have stepped up discussions with the operators of China's terminals, requesting them to import LNG on their behalf, share cargoes or even grant direct access to their import facilities.

A state-owned importer said: "We are getting a lot of inquiries from partners, private companies and some smaller state-owned companies... A lot of them have approached us to share a cargo or buy one on their behalf."

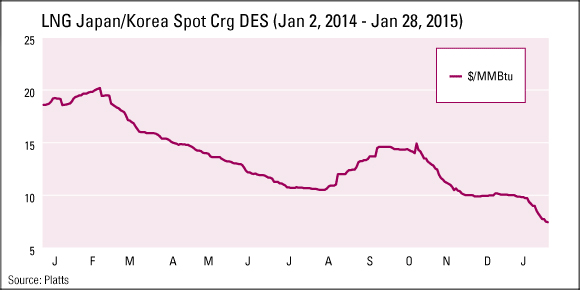

In recent months, plunging LNG spot prices, coupled with rising domestic gas values, have created an incentive for smaller players looking to import LNG.

With the JKM for March delivery at $7.75/MMBtu Monday, LNG spot prices are now soft enough for non-traditional buyers to cover the import, storage, regasification and leasing costs at a third-party terminal.

By comparison, pipeline gas prices were at $9.76/MMBtu at the Chinese border for December.

The Chinese government has twice raised non-residential gas prices since 2013, in line with its broader aim to reform the country's energy markets.

Residential users are also being moved to a three-tier pricing system segmented by consumption volume, which has seen hefty increases.

On January 14, China's National Development and Reform Commission also announced plans to link electricity tariffs for natural-gas-fired power plants with gas prices, in a bid to help operators cope with fuel costs.

"Domestic gas prices are so high that there is a great margin available," said Tony Regan, Principal Consultant with Singapore-based business consultancy Tri-Zen.

"A lot of the supply up to recently was coming from the onshore liquefaction plants, but from mid-last year, that supply is looking expensive... It is cheaper to import LNG than buy it from domestic producers."

CHINA'S IMPORT INFRASTRUCTURE UNDERUTILIZED

The logistics also seem favorable to the accommodation of third-party cargoes, as the majority of China's 12 LNG terminals are running at low operating rates.

According to import data released Monday, the average utilization rate at China's terminals was 55.24% in 2014. Only three of the country's terminals showed rates above 60% -- PetroChina's Rudong, and state-owned CNOOC's Guangdong Dapeng and Shanghai.

The low utilization is mainly due to slow downstream consumption, driven by rising prices, mild temperatures and sluggish economic growth.

The LNG market share has been further eroded by abundant pipeline imports from Myanmar and central Asia, record-high hydroelectric power production and plunging prices of alternative fuels such as crude oil and LPG.

So far, only Rudong appears to have been opened to third-party deliveries, with state-owned Shenergy receiving term volumes from Malaysia in August 2014.

The buyer normally imports LNG into the CNOOC-operated Shanghai LNG terminal, where it holds a 55% stake.

Private gas distributor ENN also took delivery of the Sonangol Benguela at Rudong in December, marking the first time a Chinese private buyer received a cargo through third-party access.

Market sources said Excelerate Energy had sold the cargo at a slight premium to the December JKM because of the uncertainty over availability of delivery slots for third-party cargoes at state-owned terminals.

Sellers are unwilling to take the risk of having a delivery canceled or postponed, which is why they may ask for premiums of at least 50 cents/MMBtu for third-party deliveries, a Singapore-based trader explained.

The trend looks set to continue, with PetroChina reported to have bought two January-delivery cargoes on behalf of two downstream buyers, and signed more than 10 Memorandum of Understanding agreements to facilitate third-party access to Rudong, market sources said.

STATE IMPORTERS SHOW MARKET SHARE CONCERNS

However, it is unclear whether all of these MOUs will materialize. While state-owned buyers are open to import LNG on behalf of third parties, they remain reluctant to widen direct access to their terminals.

Just as falling spot prices have created an attractive environment for newcomers, state-owned importers -- which are tied to high-cost, long-term contracts -- have grown increasingly concerned about losing market share in their downstream markets.

Their concerns are well founded.

Supplier Qatargas sold a 24,300 mt spot cargo to gas distributor Jovo Group in November 2014 at a price of approximately $13.50/MMBtu CIF.

This was more than 20% cheaper than the average price of $17.63/MMBtu CIF Chinese buyers paid for Qatari cargoes in the same month. Both PetroChina and CNOOC have significant term contracts with Qatar.

"There is room for cooperation, but not for leasing tolling capacity from state-owned terminals," a state-owned importer said.

Another said that no slots were available at its terminals in Q1, as LNG was needed in tank for winter peak shaving purposes.

However, as the government continues the push to increase the share of gas in the country's energy mix, state-owned companies are under mounting pressure to free up infrastructure to more end-users.

"The reality is that they are not fully utilizing those facilities... Some new terminals are running at very low operating rates, so they could lease capacity if they wanted to," said Regan.

"They will resist because it is a strategic asset for them... But that may change and the government is leaning towards that," he added.