The good news for car buyers: Credit is loosening up, giving more consumers access to financing for buying a new or used car. The bad news? As car prices rise, the terms of the credit are getting worse.

That's the conclusion of the latest State of the Automotive Finance Market by Experian, a credit reporting company. While average interest rates are falling, the report shows the length of time people are borrowing for new cars has steadily risen since 2009. In 2009, loan terms averaged 62 months, climbing to 63 months in 2011, and edging higher to 64 months this year. That reflects an increase in six- and (gasp!) even seven-year loans.

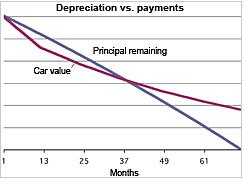

An analysis in a recent Consumer Reports Money Adviser newsletter shows that such long-term loans are riskier for consumers, because they leave you "upside down" in your car for a longer period of time. That means if you lose your job or encounter other unexpected financial hardships and can't make your car payments, you're more likely not to be able to sell the vehicle for as much as you owe on the loan. Of course, it also increases the amount paid in finance charges, over a shorter loan.

The Experian study shows the same trend in used-car purchases, where the average term has risen from 57 to 60 months. That reflects an increase in five-year loans over three- and four-year terms. Such longer terms are particularly risky with used cars, which have will have long-since outlived their warranties, leaving owners to cover unexpected repair bills and pricier maintenance costs on top of their car payments. To compound the hazard for those consumers, the report shows an increase in loans for cars older than five-years old.

So, who's signing up for these long-term loans on older vehicles that may be developing problems? You guessed it: Borrowers who have lower-than-average credit scores. The percentage of subprime borrowers among used car loans has increased from just over 35 percent to nearly 38 percent. On new-car loans, it has increased from just under 10 percent to almost 13 percent. And these buyers are paying extremely high interest rates, ranging from 9.7 percent for sub-prime buyers on new cars, to 17.7 percent for used-car buyers with "deep sub-prime" credit scores.

The average credit score of a new car buyer has dropped from 775 in 2009 to 755 this year, according to Experian data. Used car buyers' credit scores have dropped from an average of 684 to 668.

Even at low interest rates, and with a 10-percent down payment, our analysis shows that it can take two years or more to begin building equity in a new car. With less money down, or at a higher interest rate, it could take much longer.

At the same time, as the economy has recovered, the number of high-credit consumers borrowing money to buy new and used cars has fallen by about 3 percent, perhaps as more of these buyers pay cash for their cars.

Meanwhile, Experian shows that more buyers are financing more of their purchases. According to the company's third-quarter report, most buyers are borrowing more than the purchase price of the car, with new car buyers borrowing an average of 110 percent of the purchase price, and used-car buyers borrowing an average of 130 percent. The average new-car loan now amounts to $25,963, while used-car loans average $17,577.

If you're wondering where you fall on the scale, the average new-car payment is $452, while the average used car buyer pays $350 a month.

For the record, we recommend not buying more car than you can afford. With the average new-car going out the door for more than $30,000 this year, that means keeping up with the Jones is becoming quite expensive.

Buying a car should be a strategic, financial decision. Incurring debt for longer than a child is in elementary school may not be the best long-term investment. Consider buying used, or down-sizing your expectations, to keep your budget in check.

And to help avoid unexpected, potentially expensive surprises, be sure to factor in our reliability ratings into your purchase decision.