After experiencing a boon in 2010, the weak LED market reaction in 2011 did not allow the global LED manufacturing production to grow as expected. Capacity utilization reached a low due to the fast capacity expansion and slower market demand, and this triggered a fall in prices of LED chips, equipment and materials. Compared with the substantial growth in 2010, the output of global LED manufacturing industry merely saw a slight rise of less than 5 percent in 2011.

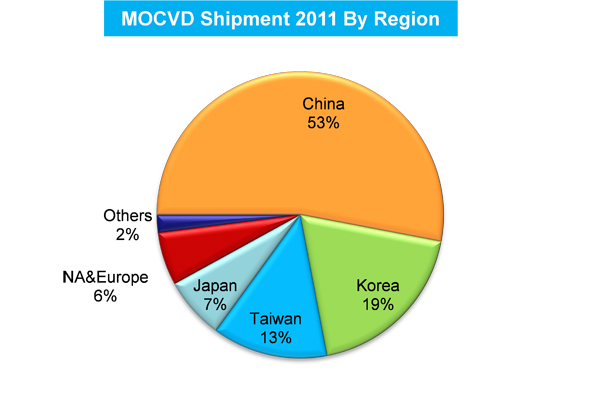

Although the LED backlight and lighting markets did not grow to expectations in 2011 and the outside world worried about the slowing demand for MOCVD equipment, China's MOCVD tool installations continued to grow at a rapid pace. Increased volume of China's MOCVD installation ranked first globally, and occupied over 50 percent of the total global volume in 2011. According to estimates by SEMI China, in 2010-2012 China saw the actual monthly output of LED gallium nitride epitaxial chips grow 300 percent to around 1.3 million chips (based on 2 inches wafers).

Figure 1: MOCVD Shipment by Region 2011

Source: SEMI China, 2012

In 2011, the global LED manufacturing industry was pressured by overcapacity and pricing, and this market pressure was particularly high for local Chinese LED manufacturers. While focusing on middle- and low-end application markets, local Chinese LED epitaxial chips manufacturers faced extraordinarily fierce competition on pricing and many were confronted with falling fab utilization and high inventories. With declining fab utilization and challenging price environment, many local Chinese LED epitaxial chips manufacturers suffered. In contrast, leading international LED manufacturers were able to maintain continuous growth, with gross margins of 30 to 40 percent.

In China, most new LED epitaxial and chip projects focus on the Gallium Nitride blue-green LEDs, with a majority of the capacity currently targeting the crowded medium and small die-sized LED applications. The LED products in China that require large die-size and high-power LED chips with high luminous efficacy for the high-end lighting field rely on imports as domestic manufacturers occupy only a small market share for these applications.

If the Chinese LED upstream manufacturers only target products with low technological requirements and fail to enter the general lighting market, the issue of overcapacity in the Chinese LED manufacturing industry will only deteriorate. Many Chinese local LED manufacturers, however, realize that technological innovation, product transformation, and manufacturing upgrades are their best option for future growth; these manufacturers have increased their efforts to develop new technologies and many have made significant progress.

From Common Sapphire Substrate to PSS, the "Leap Forward" of the Chinese Sapphire Substrate Industry

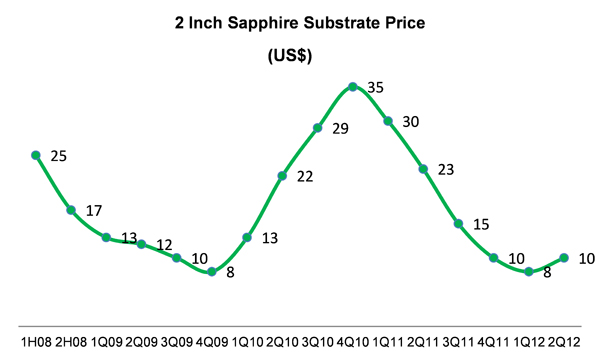

In 2010, the production expansion of the global LED manufacturing industry resulted in a growing demand for sapphire substrates, followed by a rise in sapphire substrate prices. The price of the common 2-inch sapphire substrates, for example, rose from $8 in the fourth quarter of 2009 to $35 one year later. This vast increase drew considerable attention to the relatively calm sapphire substrate field.

Figure 3: 2 inch Sapphire Substrate Price Trend

Source: SEMI China (compiled from company data and press releases)

Driven by the fast growing LED epitaxy capacities in China, investment activity quickly spread upstream to the sapphire substrate market. More and more Chinese enterprises are starting to engage in manufacturing of sapphire ingots and substrates. In 2011, over 20 new sapphire ingot and substrate projects began production and work; the majority of investments were privately funded; however, many domestic sapphire substrate manufacturers did not expect the softening of the global LED manufacturing industry in 2011. This market downturn led to a steep fall sapphire substrate for substrate pricing. The price of 2-inch sapphire substrates plunged back to its previous low of $8 from its high of $35.

While the Chinese local sapphire substrate manufacturing industry faced severe pricing pressures as they invested in capacity, domestic LED epitaxial chips manufacturers quickly began to introduce PSS (Patterned Sapphire Substrate) to improve the luminance of LED chips. This situation resulted in a disconnect between some sapphire substrate manufacturers and LED epitaxy customers. A number of sapphire suppliers had to make new investments for PSS processing to keep up with customer requirement, while failing to profit from initial investments to produce flat sapphire substrate.

New Market Opportunities: SEMI China Establishes the Industry Platform

Undeniably, the Chinese LED manufacturing industry has entered a transformation period, and the situation gives way to larger growth opportunities going forward. Sapphire substrate, LED epitaxial chip, and LED packaging manufacturers in China will need to adapt to the transformation or struggle to remain relevant players in the market. Companies that will move forward will have to adopt newer, more efficient technologies and equipment so they can produce higher quality products with better yields and lower costs. In doing so, this companies can gain market share and initiative for future growth. Without this transformation, the market will eradicate number Chinese LED manufacturing companies within three years. This industry change also creates many market opportunities for material and equipment suppliers with innovative solutions.