You remember the iPod.The iPod created jobs,but a majority of those jobs were overseas.Electronics manufacturing jobs are mostly overseas,which helps to keep one million workers at China's Foxconn plants busy.

In contrast,the majority of wind energy jobs are in the U.S.,say researchers in a study by the Personal Computing Industry Center(PCIC),an Alfred P.Sloan Foundation Center.

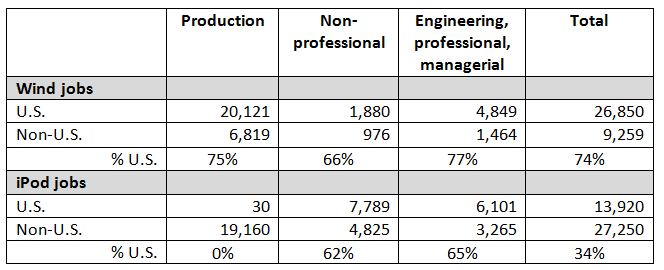

In the study,the PCIC researchers applied a methodology similar to what they used to measure the job impact of the iPod.A working paper by PCIC found that the wind industry creates a larger share of total employment in the U.S.than the iPod did in 2006,74%versus 34%.

But as many as half of the wind energy jobs may disappear if a tax credit is allowed to expire at year-end,say the PCIC paper and the American Wind Energy Association(AWEA).

It has become an election issue.President Barack Obama has favored extending the credit,and Republican nominee Mitt Romney is opposing its extension.The tax credit costs about$1 billion a year.

The wind industry is already seeing layoffs in expectation that Congress will fail to renew the credit.That is happening even as Google,for instance,announced today its plans to buy 48 MW of wind power to help supply its data center in Mayes County,Okla.

The PCIC researchers found that the U.S.wind industry has created nearly 27,000 direct jobs,and 9,250 non-U.S.jobs.

By contrast,the iPod,the PCIC researchers found,created nearly 14,000 U.S.jobs and 27,250 non-U.S.jobs in 2006.

High-tech manufacturing employment has declined by 28%since 2000,or about 687,000 jobs,the National Science Foundation said in a report this year.

This wind energy job count number for the U.S.may grow to as much as 30,000 to 35,000 as research continues,said Jason Dedrick,an associate professor at the School of Information Studies at Syracuse University,and one of the people on the project.The other authors are Kenneth L.Kraemer,a research professor at the University of California,Irvine,and Greg Linden,a research associate at the University of California,Berkeley.

Source:From working paper,"Should the U.S.Support the Wind Energy Industry?"by the Personal Computing Industry Center.

There are differing estimates on the wind industry's impact on job creation.

The American Wind Energy Association has put the number of wind jobs at 75,000.Its methodology is based on its database of nearly 500 facilities in all aspects of manufacturing.They estimate at least 30,000 jobs in manufacturing alone.

The balance of jobs in AWEA's estimate is made up of people who develop wind projects,maintain and run them.It includes anyone involved with the project,including wind financing specialist at banks,and people who prepare environmental studies,said Elizabeth Salerno,AWEA's Director of Industry Data&Analysis.

In developing its labor estimate,the PCIC researchers applied a methodology similar to what they used in measuring electronics production.Their estimates"are based primarily on detailed interviews with at least two companies at each stage of the wind energy value chain,from site development to maintenance,"the paper said.

Regardless difference in these labor force estimates,wind energy jobs aren't easily moved offshore because they involve on-site work,and the transportation cost of moving systems that can weigh many tons make it more efficient for manufactures to build the system here,said the PCIC paper.

Dedrick believes the tax credit is a worthwhile investment.Infant industries"need to get up and running"and build the capacity before they can stand on their own,he said.

There are other considerations for keeping the tax credit.The researchers,who are also from the University of California at Irvine and Berkeley,argued that the quality of the wind jobs is relatively high and support many highly paid engineers,managers,lawyers and other professionals.

The tax credit runs for 10 years,and provides 2.2 cents credit for every kWh produced.The credit goes to the wind farm operator,giving them a guarantee that whatever happens to energy markets,they know that at least part of their investment is assured,Dedrick said.

The tax credit helps to offset the pricing difference with fossil fuel sources.

The paper argues the offset is needed."Wind energy does not currently compete on a level playing field.Fossil fuels benefit from billions of dollars each year in tax preferences that,by law,will never expire,"it said."The collapse in natural gas prices that has made wind relatively unattractive for now may not last as producers rein in production.And the environmental costs of other fuels such as acid rain,greenhouse gas emissions and nuclear waste are not priced in the market in accord with any economic logic."

Wayne Pfisterer,president of Pfister Energy,which builds alternative energy,solar,wind,geothermal and other system on-site for businesses,said he expects a failure to extend the tax credit will hurt wind sales."We don't expect as an industry that the credit will be extended,"he said."The outlook is not good as we sit here today."