Global mining deals picked up in the first half of 2014 and are likely to continue that way for the rest of the year, a SNL Metals & Mining study released Friday shows.

Both the averages of price paid and value of acquired commodities per deal, however, were lower than in the same period last year, the report reveals.

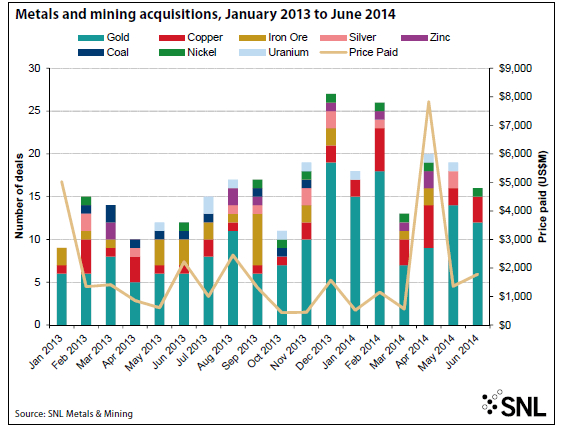

About 117 transactions totalling US$13.21 billion were announced from January to June, a 56% increase on the 75 deals worth around US$11.47 billion completed in the same period last year

However, the total price paid in the first half of 2014 was only 15% higher than a year earlier, and the value of all commodities acquired was 21% lower. The average price paid per transaction was US$113 million, compared with US$153 million in the first half of 2013, while the average value acquired per deal sank to US$4.55 billion from US$8.99 billion year over year.

There were four deals with prices of at least US$1 billion in the half year, compared with three in the 2013 half, and 12 deals with values between US$100 million and US$999 million, compared with 14 in the prior year half.

SNL Metals & Mining’s upbeat forecast echoes the latest predictions by major research groups including PwC, E&Y and Business Monitor, which had called for a significant increase in mining deals this year.

The firm’s analysts warn, however, that the much-anticipated influx of capital from new mining-focused private funds is taking longer than expected.

Main target: gold assets

When it comes to the type of commodities acquired so far this year, the biggest change detected by SNL was in early-stage gold deals. There were 32 early-stage gold deals between January and June compared with only two project purchases without resources or reserves in the first half of 2013. In total, SNL’s report says, there were 75 gold deals in the first half, up from 37 a year ago.

This suggests that companies have been shedding their noncore gold projects at a high rate, and that companies with sufficient capital are snapping them up — buyers are taking advantage of low project valuations to enhance their long-term pipelines or to acquire properties near their existing mines and projects.

The report also notes that while copper purchases rebounded, the number of iron ore deals went down, and there were no coal-related transactions at all.

![[Ruoteng] F/M Thread Mini Ball Valve with BSPT Thread & Metal Handle -China Valve Manufacturer [Ruoteng] F/M Thread Mini Ball Valve with BSPT Thread & Metal Handle -China Valve Manufacturer](https://image.made-in-china.com/3f2j00kvsVIimzrhYS/-Ruoteng-F-M-Thread-Mini-Ball-Valve-with-BSPT-Thread-Metal-Handle-China-Valve-Manufacturer.jpg)