AUSTRALIAN stocks are expected to start the last full trading week before Christmas on a cautious note amid ongoing negotiations over the looming US budget deadline.

Futures trading was pointing to a weak start on the local market today, after Wall Street closed lower as investors fretted over the likelihood of US President Barack Obama and congress reaching a deal over the so-called fiscal cliff.

CommSec chief economist Craig James said despite some encouraging US manufacturing, inflation and industrial production data, and BHP Billiton and Rio Tinto being well-supported in London trade, the fiscal cliff was dominating sentiment. "If we could solve the fiscal cliff problem then everything would be all right," Mr James said yesterday. "That's the only issue out there at the moment."

A series of US tax hikes and government spending cuts, referred to as the fiscal cliff, are due at the start of the new year. Unless an agreement is reached, these measures are expected to push the US economy back into recession, which would have a significant knock-on impact on the global economy.

In New York, the Dow Jones Industrial Average slumped 0.27 per cent, the S&P 500 eased 0.41 per cent and the NASDAQ Composite tumbled 0.7 per cent.

"Progress in resolving the US fiscal cliff remains slow," AMP Capital Markets chief economist Shane Oliver said in a research note on Friday. "An agreement before year end would be a good outcome for equity markets."

In economic news, the minutes of this month's Reserve Bank board meeting are due tomorrow, while the Westpac-Melbourne Institute leading index of economic activity report will be released on Wednesday.

The RBA cut the cash rate by 25 basis points to 3 per cent at its most recent meeting.

In company news, ANZ, DuluxGroup and Incitec Pivot will hold their annual general meetings this week.

Meanwhile, the Australian Competition & Consumer Commission is expected to issue determinations on Qantas's proposed alliance with Dubai-headquartered Emirates, and Carsales.com's deal with the Telstra-owned Trading Post.

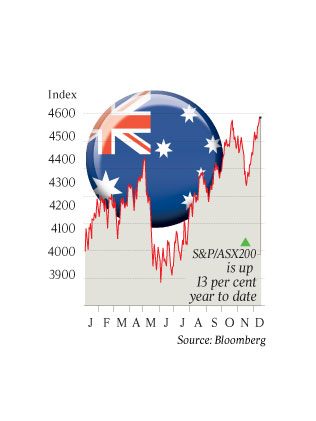

The Australian dollar finished weekend trading at $US1.0572, up from $US1.0544 at Friday's local close. Local stocks closed flat on Friday -- the benchmark S&P/ASX 200 edged up 0.01 per cent and the broader All Ordinaries index rose 0.04 per cent.

Australian stocks have risen about 2 per cent this month.