Mainly driven by surging rates for insuring property against natural disasters, Taiwan’s overall written premiums for non-life insurances for the first 10 months grew 7.03% from a year ago, with the growth doubling insiders’ forecast early this year, according to statistics issued by the Non-life Insurance Association of the R.O.C.

The statistics show that property insurance against natural disasters amounted to NT$9.3 billion in written premiums for the first 10 months, up 42% or nearly NT$2.8 billion over a year ago.

The written insurance premium growth is the strongest among those of other insurance policies and exceeds insiders’ expectations of between 20% and 30% after the Insurance Bureau adjusted upward rates on commercial property insurance against fire with additional coverage of natural disasters last July, a move that likely compromised sales to commercial customers.

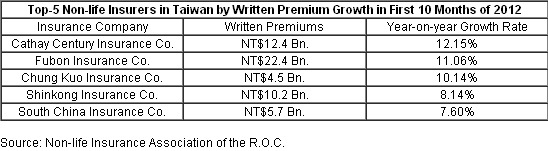

Among Taiwanese non-life insurers, Cathay Century Insurance Co. enjoyed the highest growth of 12.15% in written premiums of NT$12.4 billion for the past 10 months. Fubon Insurance Co. reported an 11.06% growth in written premiums of NT$22.4 billion during the period, while Chung Kuo Insurance Co. scored a 10.14% increase in NT$4.5 billion. Shinkong Insurance Co. and South China Insurance Co. raked in written premiums of NT$10.2 billion and NT$5.7 billion, respectively, for an 8.14% and 7.60% growth.